The woman who runs the nation's largest RIA firm, Maria Elena Lagomasino, doesn't have much faith in the non-fiduciary side of her industry. In fact, she says an unfortunate number of planners at large banks and brokerage houses run their businesses to benefit themselves as much – or more than – their clients.

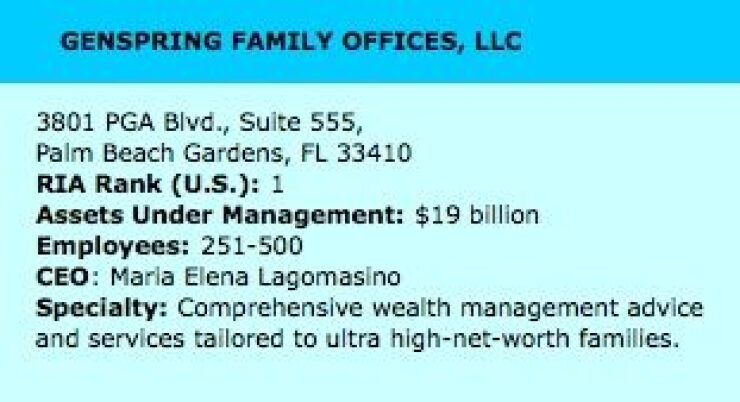

Over the past three decades, a tremendous amount of wealth nationwide has been transferred from families to the advisors who were supposed to be helping them, says Lagomasino, CEO of the country’s largest RIA, Palm Beach Gardens, Fla.-based GenSpring Family Offices.

“This is one of the core issues that I worry about,” Lagomasino says. “The families can make some make some pretty big mistakes. I’ve seen some pretty important wealth destruction.”

Lagomasino should know.

The financial exec, who prefers to be called Mel, spent a total of 22 years at Chase Manhattan and J.P. Morgan. In her last position as CEO of J.P. Morgan Private Bank, she oversaw an organization with $300 billion in client assets. Back when she first joined J.P. Morgan, Lagomasino described the culture there as fundamentally fiduciary, but says it gradually became oriented around sales, along with the rest of the industry.

That put families in the hands of brokers and advisors who often had incentives to sell risky investments that generated high commissions.

“People were sold all kinds of things they didn’t understand and that they didn’t need,” Lagomasino says. “It was solving for the person who was selling, but not for the families.”

Lagomasino intended to start her own firm. Along the way, however, she was recruited to join the company that came to be known as GenSpring in 2005. In her six-plus years at the helm, the firm has tripled its total assets under management to nearly $17 billion, and the number of client families has grown to 700 from 200. GenSpring also has a separate international division with $2 billion in AUM.

Lagomasino has taken on an active role advocating for her passion: the broad adoption of a fiduciary standard throughout the financial industry. She and five co-founders created the Institute for the Fiduciary Standard, which conducts research, education and advocacy. Within the industry, she says, the need for a greater understanding of the fiduciary standard is important because “about 90% of the investors out there think they are talking with somebody who is an advisor, and instead they are really talking to a broker who is not working under that standard.”

She contends the prevailing suitability standard goes against the principles upon which the country was founded. The institute traces the roots of the fiduciary standard – which puts clients’ interest ahead of their brokers or advisors – back to the founding fathers. “Washington and Madison were among those who used fiduciary language to describe government officials as the peoples‚ agents, guardians or trustees who derive their authority from the consent of people,” according to the group’s website.

“The soul of our business comes from this fiduciary mindset,” she continues, yet “this is still really, really rare.”

Lagomasino is quick to admit that putting clients’ interests first can present challenges. For example, GenSpring’s fundamentally bearish view of the markets of late has lead some of her colleagues to fear clients might fire them because they want to hear a more optimistic outlook. “We can’t have a view that’s influenced by what’s right for us financially,” Lagomasino says she tells them. “If they are firing us because we tell them what we think, that comes with the territory.”

A passion for freedom of choice and transparency runs deep in Lagomasino’s personal history. She was 11 when her parents left her father’s air conditioning company and everything else they owned in Cuba shortly before Fidel Castro nationalized all privately owned industry.

Thanks to one of her father’s business contacts, the family moved to West Hartford, Conn., where he found work.

“Was it hard? Yes. And everyone was wonderful to us,” she says.

Lagomasino’s career in financial services was no foregone conclusion. She majored in French literature for her undergraduate degree and then earned a master’s degree in library science. While working as a librarian at the United Nations in New York, she took an aptitude test which revealed she would do well in finance and marketing. She was 27 when she took a job at Citibank.

More than 30 years later, Lagomasino was sitting at her desk at J.P. Morgan one day when she realized that she needed to leave the bank she had called home for so long. At that moment, she turned to a colleague and said, “You know, I watched my parents do this. This one is a piece of cake.”

-- Third of a three-part, web-exclusive series examining the people and strategies behind the Top 3 RIAs and how they're racing to scale and differentiating themselves from the competition.

Also see:

Ann Marsh writes for