The spring media buy for the CFP Board's ad push to increase public trust in and visibility of certified financial planners will cost $14.6 million and run to May 17.

-

The latest study by The Kitces Report of advisors' well-being found five key drivers of their happiness with work — and many firms are falling short.

-

From reducing cognitive load to rethinking meeting formats, small changes can lead to big improvements for some clients.

-

New data from J.P. Morgan reveals how retirement expectations diverge from reality, and what that means for advisors helping clients navigate life after work.

-

Nearly two-thirds of advisors surveyed this month said that internal training programs or workshops were offered by their firms.

-

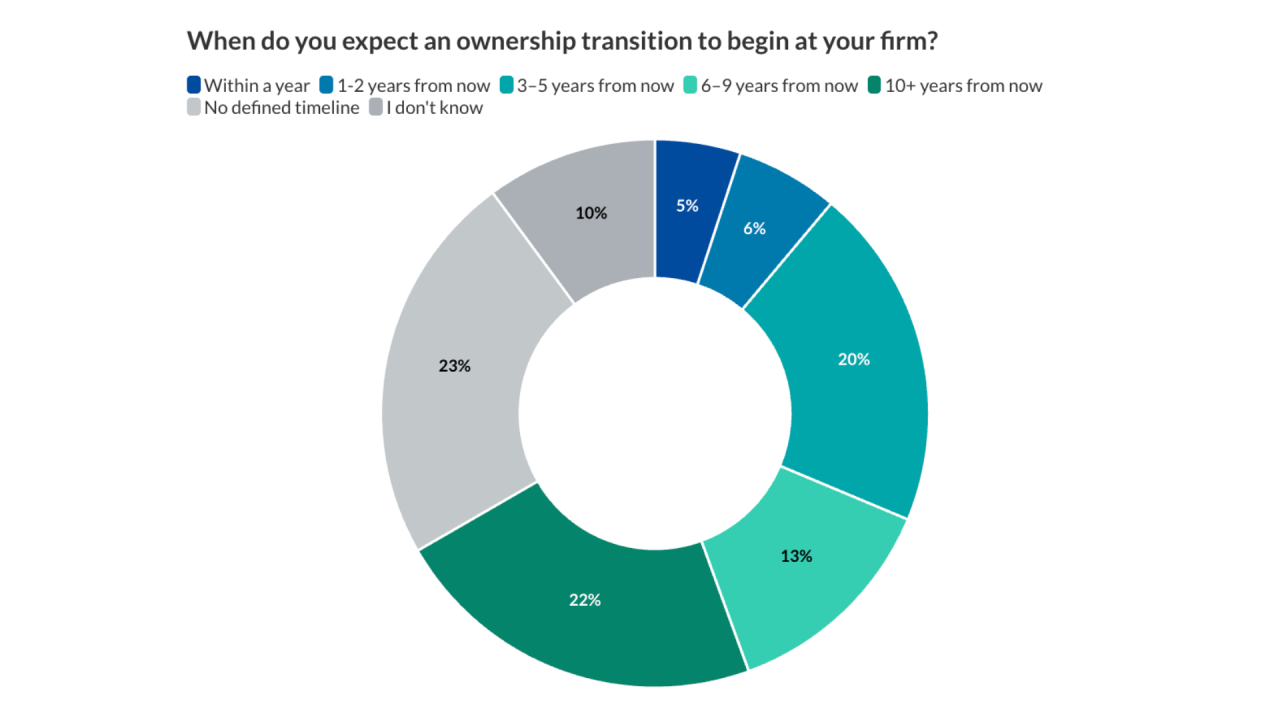

Many advisors haven't yet begun putting together an exit plan. Experts say there are common features and defined timelines that can help make it work.

-

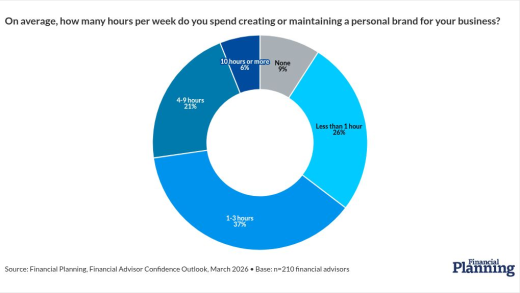

A Financial Planning survey found that advisors believe AI will continue to transform wealth management. But experts say human oversight is still essential.

-

Across the industry, financial advisors are anticipating a busy 2026. From consumer protection cuts to AI regulation, wealth management could look very different a year from now.

-

- Tax TuesdayEvery TuesdayActionable ideas and savvy strategies advisors can use to guide their clients on tax matters. Delivered every Tuesday.

- RetirementEvery WednesdayAnalysis and strategies for all phases of retirement planning, including Social Security.

- DaybreakDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Best of the WeekWeeklyThe most popular stories of the week.

-

RIA leaders are debating "digital employees" but expect service models to expand to meet growing HNW needs, says industry observer Ric Edelman.

-

Wealthy clients and the firms that serve them should cultivate a "zero-trust" mindset to repel hackers and their increasingly sophisticated digital scams.

-

Showing up for clients is still crucial, but using AI to deliver on financial goals matters more, says Altruist's CEO.

-

For a newly launched RIA, its website is one area in which less can be more — but only if the firm's online HQ puts the right visitors on the path to conversion.

-

As a subscriber to Financial-Planning.com, you can earn up to 12 hours of CE credit from the CFP Board and the Investments & Wealth Institute.

-

Many express frustration with either real or perceived doubts about clients' concerns, but experts say they're missing an opportunity to address them up front.

-

Financial Planning announces its 2026 class of the top 40 most productive employee wealth management brokers under the age of 40.

-

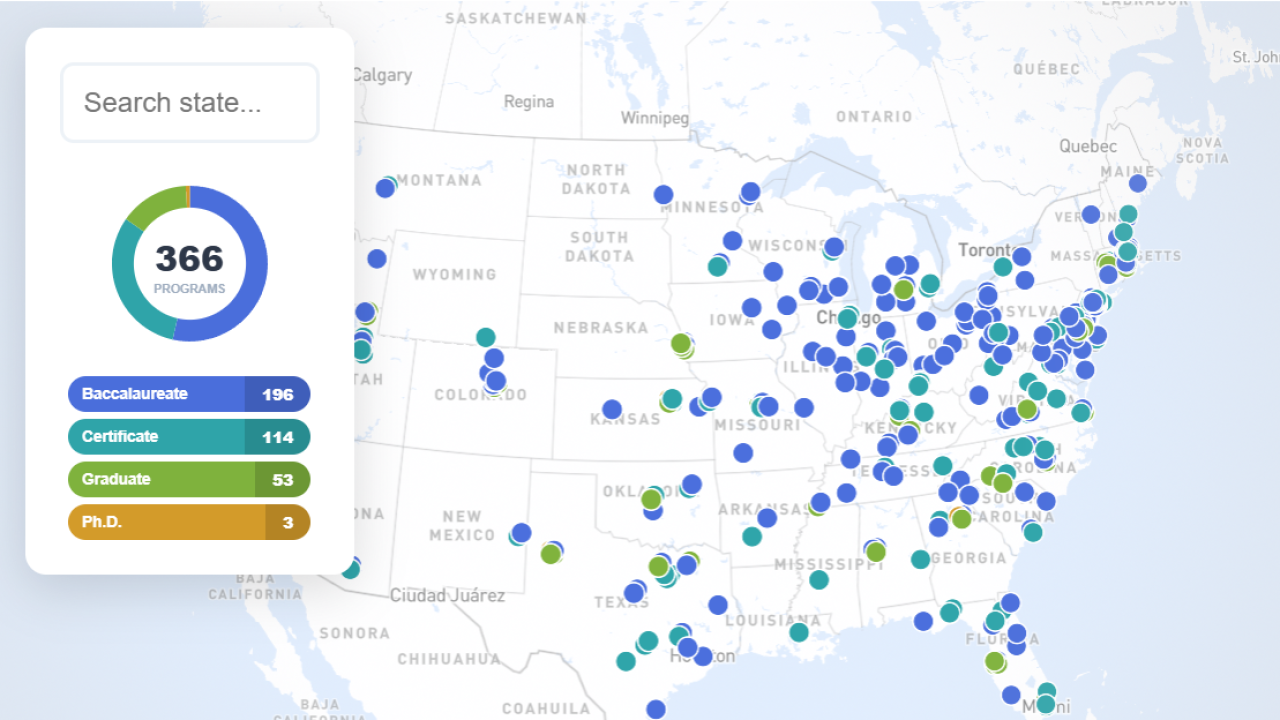

The growth of CFP Board-registered programs, from certificates to doctoral programs, reflects the industry's shift away from commission-based models.

-

The annual ranking of the fee-only RIAs with the most assets under management — see the top firms.

-

- Partner Insights from Cetera Financial Group

-

-