Which Regional Broker-Dealers have the Most Advisors

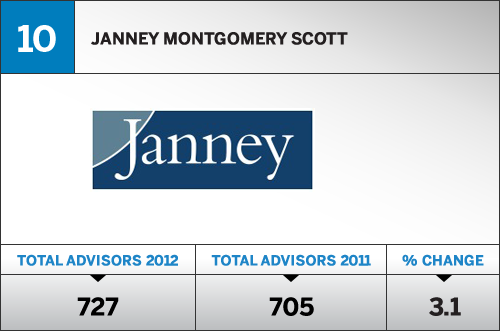

<b>10. Janney Montgomery Scott

<b>9. Raymond James & Associates

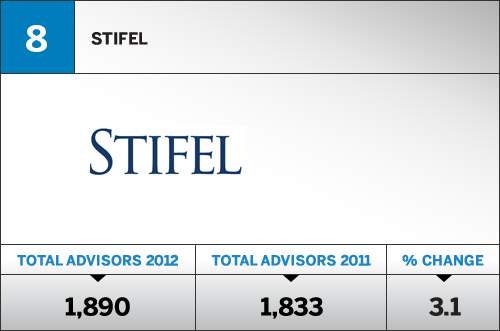

<b>8. Stifel

<b>7. RBC Wealth Management

<b>6. Ameriprise Financial

<b>5. UBS Wealth Management Americas

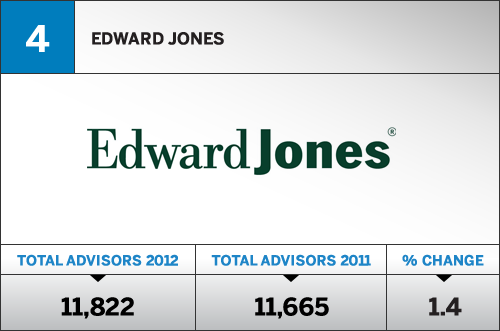

<b>4. Edward Jones

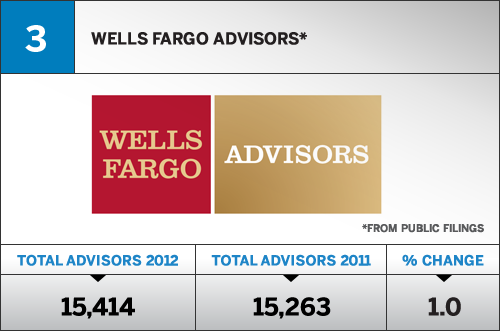

<b>3. Wells Fargo Advisors

<b>2. Bank of America Merrill Lynch