Vanguard rose to first after placing third a year ago, while Scottrade and Charles Schwab fell from Nos. 1 and 2 to Nos. 4 and 6, respectively, the consulting firm reported last week. Capital One Investing improved the most of any firm in overall client satisfaction year-over-year, with a 24-point gain.

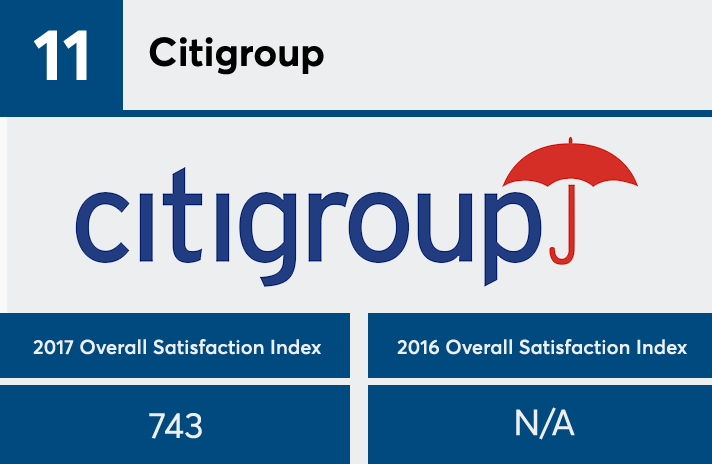

Fellow retail bank Citigroup joined the rankings for the first time, a product of what J.D. Power calls the “significant growth potential” of such firms. Mobile trading, which outpaced desktop trades for the first time in 2015, now comprises 63% of all self-directed trades, compared to 31% for desktop.

Self-directed trading describes clients who make investments without a personal adviser. J.D. Power emailed the survey questions in January to more than 4,600 such investors, a group that is not mutually exclusive of robo-advice clients.

“[Self-directed] firms are not simply providing a platform for trading,” says J.D. Power wealth management practice director Mike Foy.

Peeling clients off from among the ranks of self-directed investors will prove more difficult for advisers in coming years, he adds.

Respondents rated companies on a 1,000-point scale based on their interactions, fees, products and other criteria. The clients gave an average score of 779, a slight uptick of four points from 2016.

The results show opportunities for retail banks, according to Foy.

“They’ve got an enormous base of retail banking customers. In a lot of ways, they have an inside track on extending those relationships into the investing world,” he says. In particular, he adds, younger investors make for good prospects. “Millennials don’t seem to have such a sharp distinction in their minds about what firms have the ability to provide these services.”

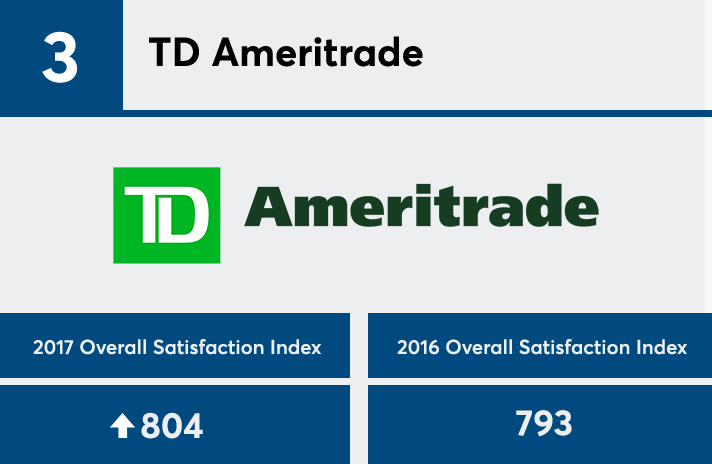

The banks generally performed worse on the survey than other firms, though Scottrade lost 14 points on its score of last year. TD Ameritrade’s

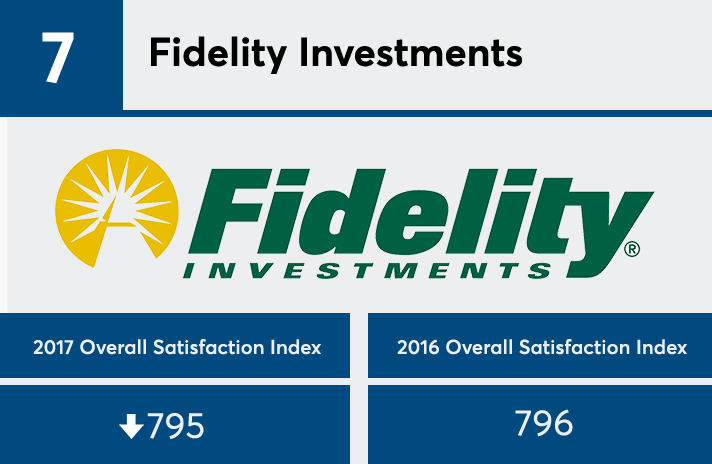

TD Ameritrade and two of its rivals — Fidelity Investments and Schwab — have been slashing their trading fees in a tight race for business. E-Trade and TD, which took second and third place, cater to active investments, while Vanguard is known for its passive philosophy, Foy notes.

“They have a different value proposition that’s well-aligned to what their target market is,” he says.

Yet the field remains wide open. Less than 100 points on the index separates Vanguard at the top of the ranking and Chase at the bottom, and Vanguard beat the average score by only 34 points.

“It is a very competitive space,” he says.

13. Chase

2016 ranking: 12

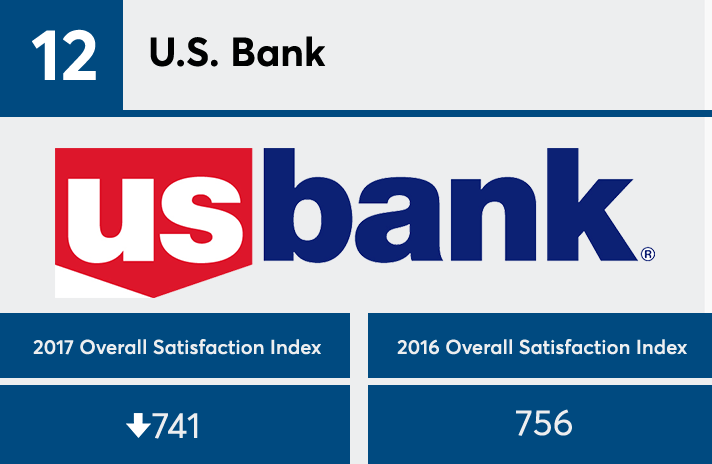

12. U.S. Bank

2016 ranking: 10

11. Citigroup

2016 ranking: N/A

10. WellsTrade

2016 ranking: 11

9. Merrill Edge

2016 ranking: 9

8. T. Rowe Price

2016 ranking: 7

7. Fidelity Investments

2016 ranking: 4

6. Scottrade

2016 ranking: 1

5. Capital One Investing

2016 ranking: 9

4. Charles Schwab

2016 ranking: 2

3. TD Ameritrade

2016 ranking: 6

2. E-Trade

2016 ranking: 5

1. Vanguard

2016 ranking: 3