Investors have propelled stocks at a torrid pace in response to President Trump's hopes to cut taxes and boost infrastructure spending, analysts say.

Morningstar Senior Analyst Alina Lamy reports that long-only equity mutual funds gained $177.62 million in inflows during the second week of February, the first time equity mutual funds saw net-positive weekly flows since last March when they experienced inflows of $1.45 billion.

“Optimism right after the election in November sparked U.S. equity funds and ETFs, overall, as both saw significant inflows. There was a clear reversal,” Lamy says. “Before that, outflows from the more expensive funds were larger than the inflows into the lower cost funds, so the overall flows were negative; however, the strong inflows into index funds were positive.”

The S&P 500 has continued to set records and stands nearly 12.8% higher than it was on Election Day.

Lamy notes that a majority of recent mutual fund flows have gone to fixed-income and international equity funds.

Vanguard and Fidelity have a combined 12 funds in this ranking of 20. Scroll through to see the long-only equity mutual funds that attracted the most new money over the last year. All data from Morningstar.

20. Wells Fargo Special Mid Cap Value Inst (WFMIX)

1-Yr. Return: 31.69%

5-Yr. Reutrn: 15.71%

Expense Ratio: 0.87%

Total Assets (millions): $6,386.46

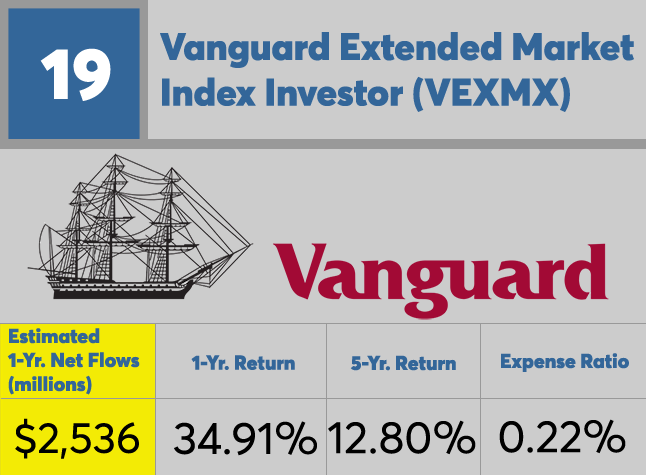

19. Vanguard Extended Market Index Investor (VEXMX)

1-Yr. Return: 34.91%

5-Yr. Reutrn: 12.80%

Expense Ratio: 0.22%

Total Assets (millions): $51,148.60

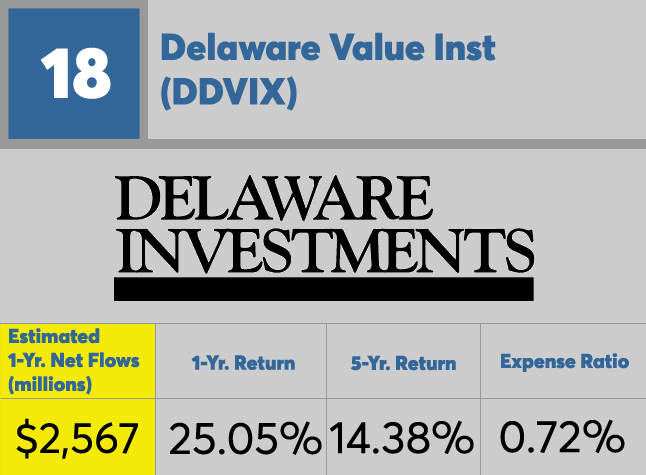

18. Delaware Value Inst (DDVIX)

1-Yr. Return: 25.05%

5-Yr. Reutrn: 14.38%

Expense Ratio: 0.72%

Total Assets (millions): $14,882.05

17. Fidelity Total Market Index Investor (FSTMX)

1-Yr. Return: 26.96%

5-Yr. Reutrn: 13.72%

Expense Ratio: 0.09%

Total Assets (millions): $38,241.07

16. Loomis Sayles Growth Y (LSGRX)

1-Yr. Return: 21.40%

5-Yr. Reutrn: 15.61%

Expense Ratio: 0.66%

Total Assets (millions): $5,215.13

15. ClearBridge Large Cap Growth A (SBLGX)

1-Yr. Return: 21.47%

5-Yr. Reutrn: 15.68%

Expense Ratio: 1.11%

Total Assets (millions): $6,083.51

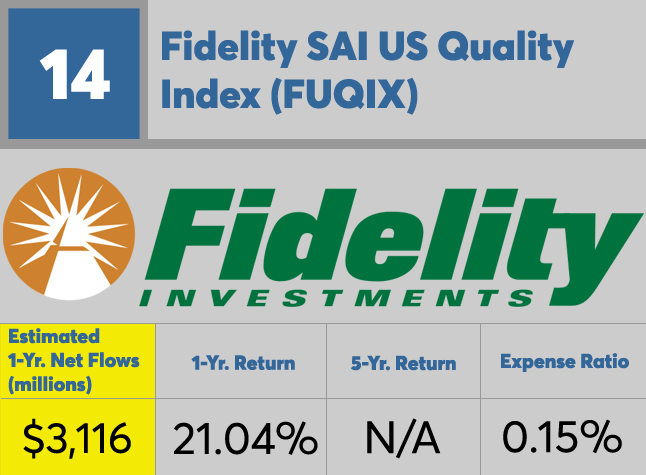

14. Fidelity SAI US Quality Index (FUQIX)

1-Yr. Return: 21.04%

5-Yr. Reutrn: N/A

Expense Ratio: 0.15%

Total Assets (millions): $4,331.19

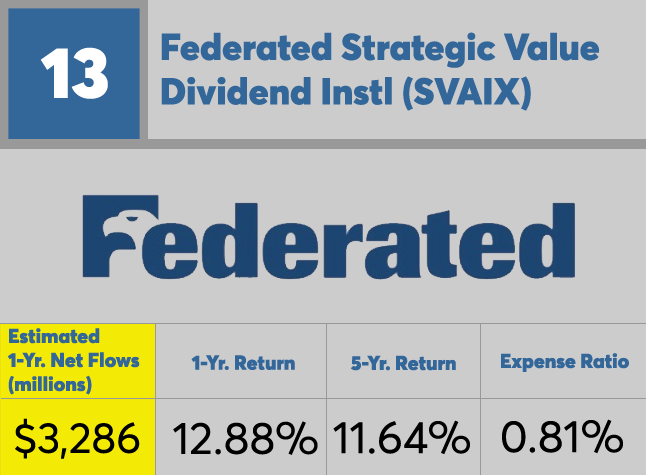

13. Federated Strategic Value Dividend Instl (SVAIX)

1-Yr. Return: 12.88%

5-Yr. Reutrn: 11.64%

Expense Ratio: 0.81%

Total Assets (millions): $14,348.32

12. Vanguard Equity-Income Inv (VEIPX)

1-Yr. Return: 23.64%

5-Yr. Reutrn: 13.54%

Expense Ratio: 0.26%

Total Assets (millions): $25,874.14

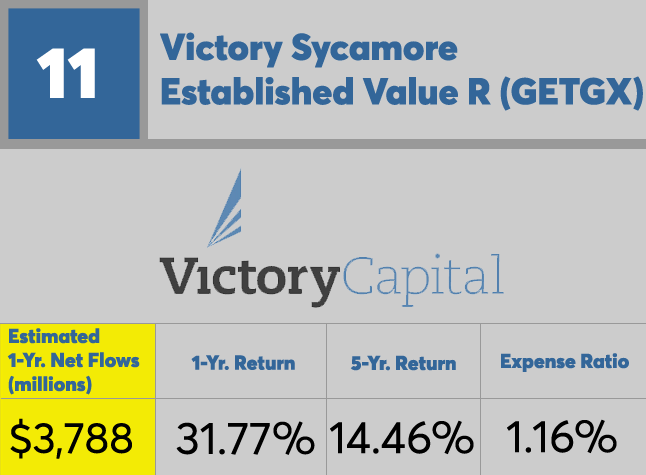

11. Victory Sycamore Established Value R (GETGX)

1-Yr. Return: 31.77%

5-Yr. Reutrn: 14.46%

Expense Ratio: 1.16%

Total Assets (millions): $8,132.10

10. Janus Enterprise D (JANEX)

1-Yr. Return: 26.34%

5-Yr. Reutrn: 13.65%

Expense Ratio: 0.84%

Total Assets (millions): $11,968.54

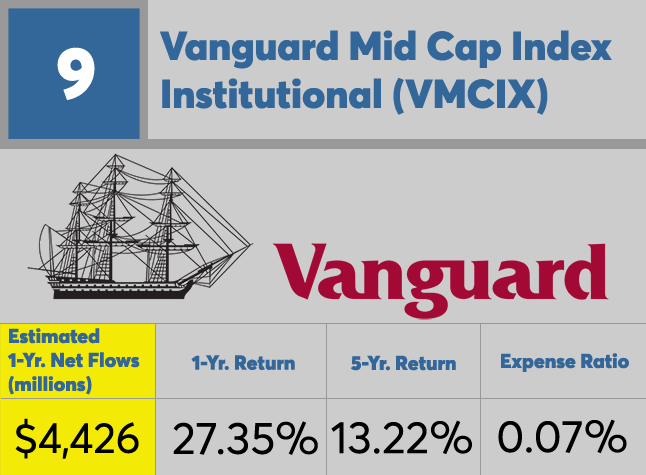

9. Vanguard Mid Cap Index Institutional (VMCIX)

1-Yr. Return: 27.35%

5-Yr. Reutrn: 13.22%

Expense Ratio: 0.07%

Total Assets (millions): $79,891.73

8. Vanguard Small Cap Value Index Inv (VISVX)

1-Yr. Return: 37.12%

5-Yr. Reutrn: 14.47%

Expense Ratio: 0.20%

Total Assets (millions): $25,772.39

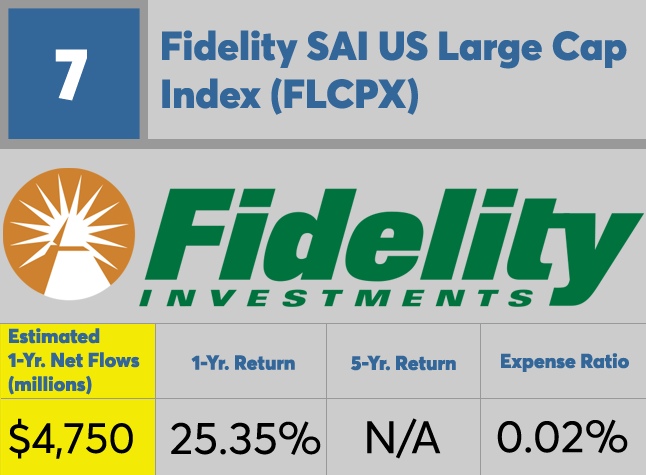

7. Fidelity SAI US Large Cap Index (FLCPX)

1-Yr. Return: 25.35%

5-Yr. Reutrn: N/A

Expense Ratio: 0.02%

Total Assets (millions): $5,002.27

6. Vanguard Small Cap Index Inv (NAESX)

1-Yr. Return: 34.20%

5-Yr. Reutrn: 13.05%

Expense Ratio: 0.20%

Total Assets (millions): $71,907.21

5. Invesco Diversified Dividend A (LCEAX)

1-Yr. Return: 19.46%

5-Yr. Reutrn: 13.89%

Expense Ratio: 0.83%

Total Assets (millions): $22,239.49

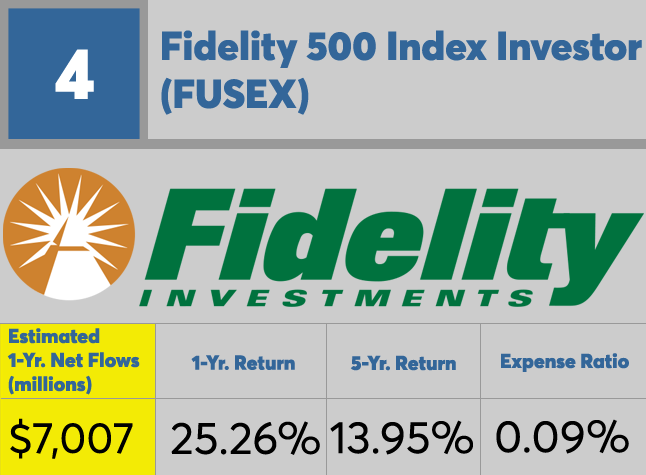

4. Fidelity 500 Index Investor (FUSEX)

1-Yr. Return: 25.26%

5-Yr. Reutrn: 13.95%

Expense Ratio: 0.09%

Total Assets (millions): $111,429.52

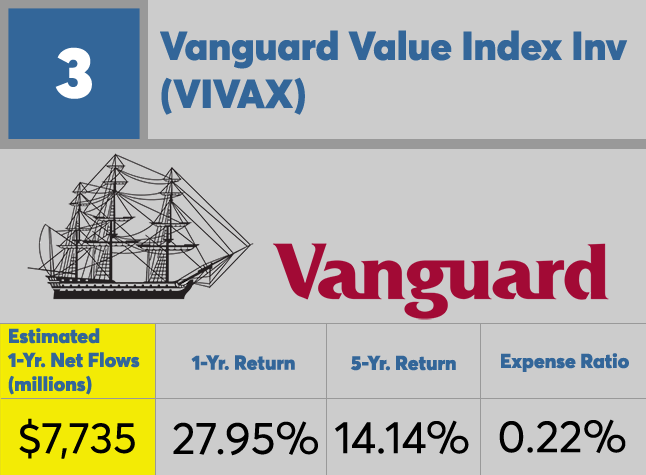

3. Vanguard Value Index Inv (VIVAX)

1-Yr. Return: 27.95%

5-Yr. Reutrn: 14.14%

Expense Ratio: 0.22%

Total Assets (millions): $52,231.47

2. Vanguard 500 Index Investor (VFINX)

1-Yr. Return: 25.20%

5-Yr. Reutrn: 13.88%

Expense Ratio: 0.16%

Total Assets (millions): $292,354.58

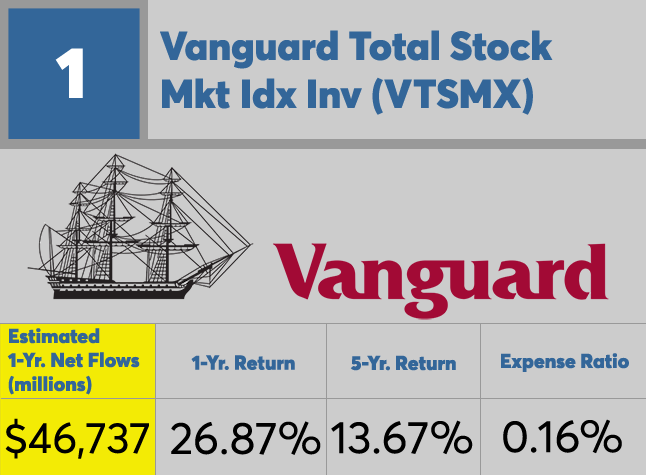

1. Vanguard Total Stock Mkt Idx Inv (VTSMX)

1-Yr. Return: 26.87%

5-Yr. Reutrn: 13.67%

Expense Ratio: 0.16%

Total Assets (millions): $517,957.76