With these parameters in mind – active management, low fees and strong performance – we started looking at the possibilities. We specifically looked at active funds with at least $500 million in assets and expense ratios of 25 basis points or less (we could have screened for 20 basis points because in the end, our most expensive fund on this list was just 19 basis points.).

Then, we ranked them by their year-to-date performance. The conclusion? It paid in 2017 to be a penny-pinching retiree. Why? Because 17 of the top 20 funds are target-date funds. Whether your client is planning to retire in 2035 or 2060, these funds have posted returns well into the double-digits year to date (the average is 20%) while costing an average of 15 basis points.

Reversion to the mean is a powerful force, though, as the three-year returns of these 20 funds averaged a more realistic 8.8%.

Scroll through to see the 20 top-performing active funds this year to date with the lowest expense ratios. All data from Morningstar.

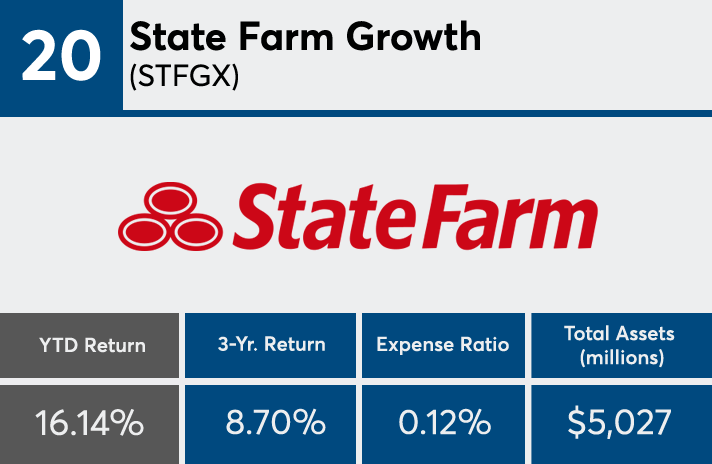

20. State Farm Growth (STFGX)

3-Yr. Return: 8.70%

Expense Ratio: 0.12%

Net Assets (millions): $5,027

19. Vanguard Target Retirement 2030 Inv (VTHRX)

3-Yr. Return: 7.62%

Expense Ratio: 0.15%

Net Assets (millions): $32,283

18. Fidelity Freedom 2030 Investor (FXIFX)

3-Yr. Return: 7.89%

Expense Ratio: 0.15%

Net Assets (millions): $4,182

17. State Street Target Retirement 2030 (SSBYX)

3-Yr. Return: 7.69%

Expense Ratio: 0.13%

Net Assets (millions): $774

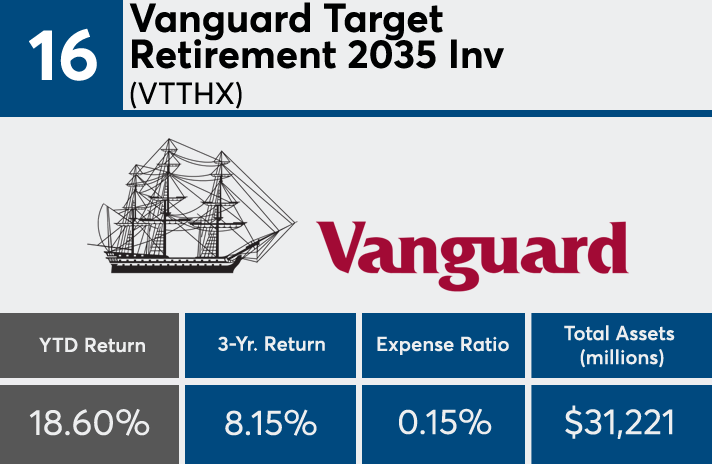

16. Vanguard Target Retirement 2035 Inv (VTTHX)

3-Yr. Return: 8.15%

Expense Ratio: 0.15%

Net Assets (millions): $31,221

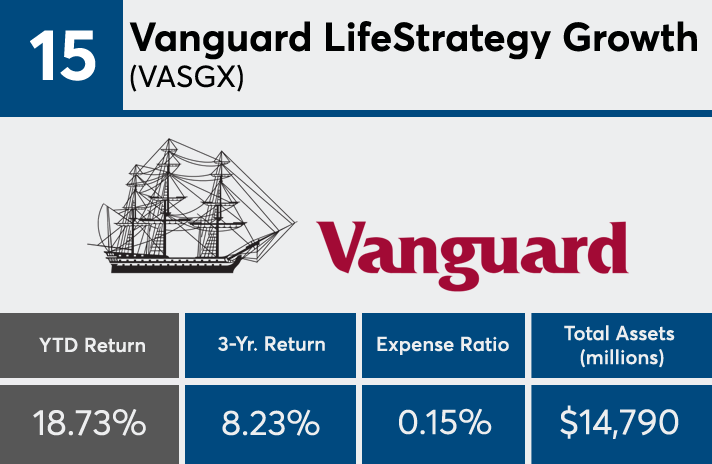

15. Vanguard LifeStrategy Growth Inv (VASGX)

3-Yr. Return: 8.23%

Expense Ratio: 0.15%

Net Assets (millions): $14,790

14. State Street Target Retirement 2035 (SSCKX)

3-Yr. Return: 8.20%

Expense Ratio: 0.13%

Net Assets (millions): $577

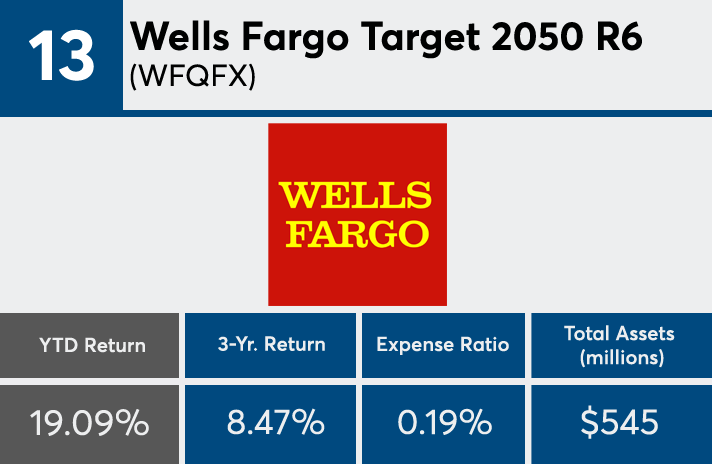

13. Wells Fargo Target 2050 R6 (WFQFX)

3-Yr. Return: 8.47%

Expense Ratio: 0.19%

Net Assets (millions): $545

12. Fidelity Freedom 2035 Investor (FIHFX)

3-Yr. Return: 8.78%

Expense Ratio: 0.15%

Net Assets (millions): $2,663

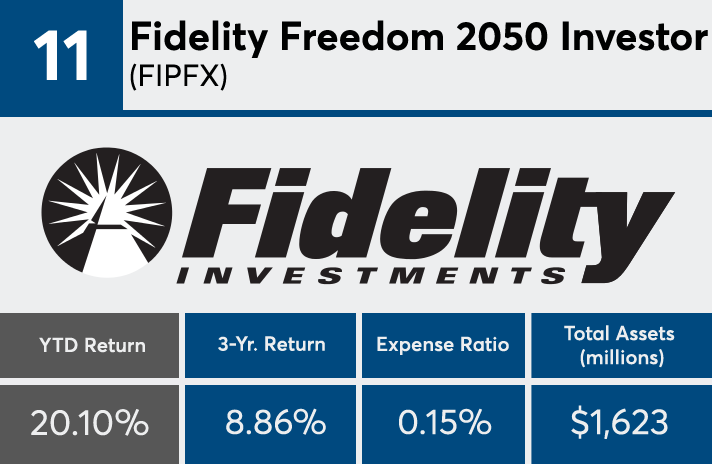

11. Fidelity Freedom 2050 Investor (FIPFX)

3-Yr. Return: 8.86%

Expense Ratio: 0.15%

Net Assets (millions): $1,623

10. Fidelity Freedom 2040 Investor (FBIFX)

3-Yr. Return: 8.86%

Expense Ratio: 0.15%

Net Assets (millions): $2,941

9. Fidelity Freedom 2045 Investor (FIOFX)

3-Yr. Return: 8.85%

Expense Ratio: 0.15%

Net Assets (millions): $1,748

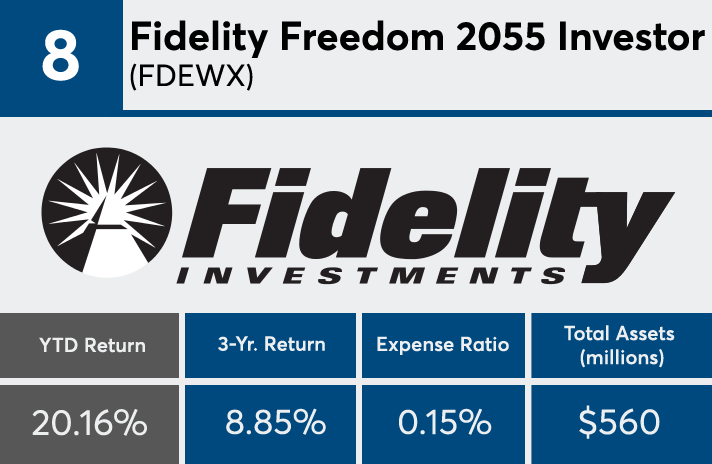

8. Fidelity Freedom 2055 Investor (FDEWX)

3-Yr. Return: 8.85%

Expense Ratio: 0.15%

Net Assets (millions): $560

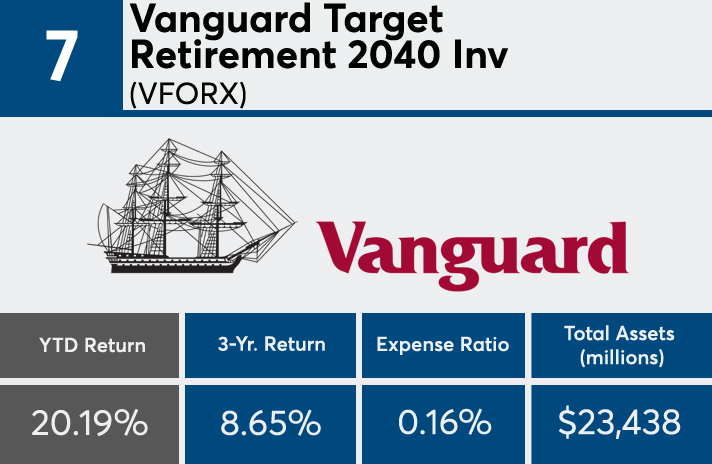

7. Vanguard Target Retirement 2040 Inv (VFORX)

3-Yr. Return: 8.65%

Expense Ratio: 0.16%

Net Assets (millions): $23,438

6. Vanguard Target Retirement 2055 Inv (VFFVX)

3-Yr. Return: 8.83%

Expense Ratio: 0.16%

Net Assets (millions): $6,095

5. Vanguard Target Retirement 2060 Inv (VTTSX)

3-Yr. Return: 8.84%

Expense Ratio: 0.16%

Net Assets (millions): $2,308

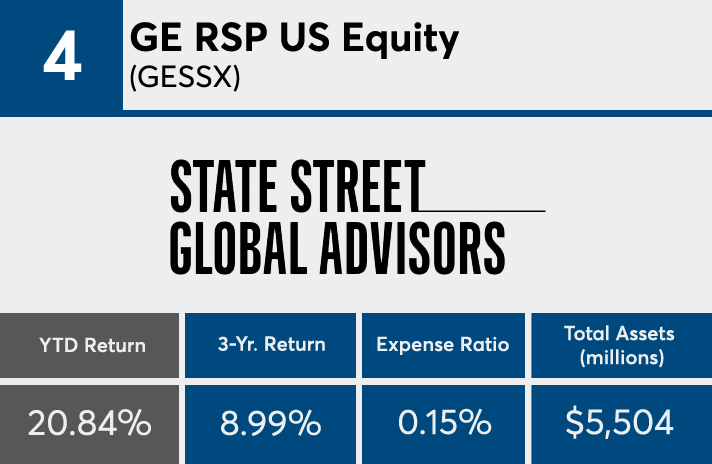

4. GE RSP US Equity (GESSX)

3-Yr. Return: 8.99%

Expense Ratio: 0.15%

Net Assets (millions): $5,504

3. Vanguard Target Retirement 2045 Inv (VTIVX)

3-Yr. Return: 8.89%

Expense Ratio: 0.16%

Net Assets (millions): $21,569

2. Vanguard Target Retirement 2050 Inv (VFIFX)

3-Yr. Return: 8.89%

Expense Ratio: 0.16%

Net Assets (millions): $14,237

1. Elfun Trusts Fund (ELFNX)

3-Yr. Return: 10.25%

Expense Ratio: 0.18%

Net Assets (millions): $2,795