Take note: The 20 funds listed here outperformed even those impressive benchmarks.

The results show that Asia was the place to be in 2017. Twelve of the 20 funds listed focus on China, Japan, India or South Korea. That did not preclude broader “global opportunities” or “international growth” funds from finding investments in the Far East, as well. The average return of these 20 funds for the year was 48.5%.

As is typically the case when investing in actively managed international funds, expense ratios are slightly higher compared with domestic funds, due in part to additional research by fund managers of companies that have fewer analysts following them and less robust regulatory oversight. These funds averaged 1.43% in expense ratios — with a high of more than 2%.

Scroll through to see the 20 top 2017 international fund returns among those with at least $100 million in assets. Three-year returns, expense ratios and total assets are also included for each fund. All data from Morningstar Direct.

20. Vanguard International Growth Inv (VWIGX)

3-Yr. return: 15.18%

Expense Ratio: 0.45%

Total Assets (millions): $34,084.57

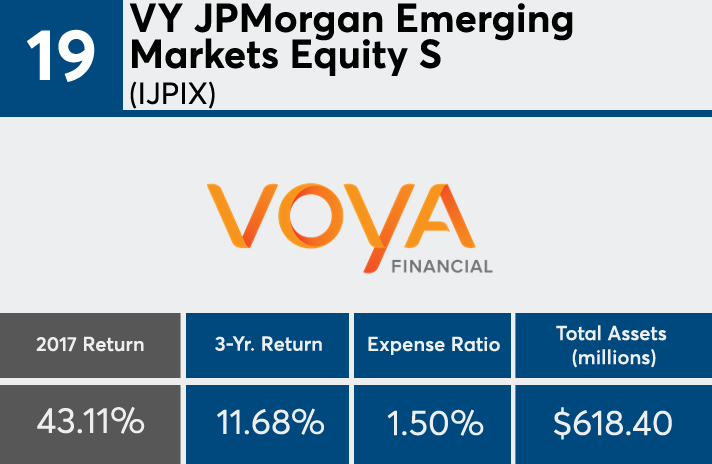

19. VY JPMorgan Emerging Markets Equity S (IJPIX)

3-Yr. return: 11.68%

Expense Ratio: 1.50%

Total Assets (millions): $618.40

18. City National Rochdale Emerg Mkts N (RIMIX)

3-Yr. return: 13.29%

Expense Ratio: 1.63%

Total Assets (millions): $1,735.13

17. Matthews Korea Investor (MAKOX)

3-Yr. return: 16.18%

Expense Ratio: 1.15%

Total Assets (millions): $221.42

16. Eaton Vance Greater India A (ETGIX)

3-Yr. return: 12.61%

Expense Ratio: 1.72%

Total Assets (millions): $273.19

15. American Century International Opps Inv (AIOIX)

3-Yr. return: 16.30%

Expense Ratio: 1.54%

Total Assets (millions): $209.44

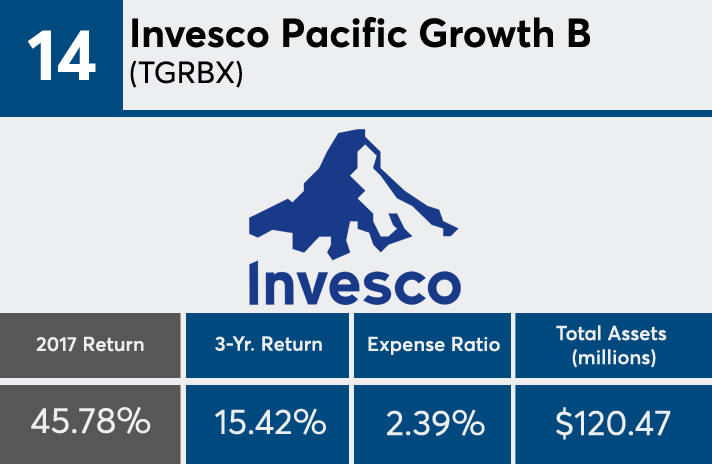

14. Invesco Pacific Growth B (TGRBX)

3-Yr. return: 15.42%

Expense Ratio: 2.39%

Total Assets (millions): $120.47

13. American Century Emerging Markets Inv (TWMIX)

3-Yr. return: 14.02%

Expense Ratio: 1.29%

Total Assets (millions): $1,866.29

12. Fidelity Emerging Asia (FSEAX)

3-Yr. return: 12.99%

Expense Ratio: 1.10%

Total Assets (millions): $1,252.34

11. Fidelity Advisor Emerging Asia A (FEAAX)

3-Yr. return: 12.89%

Expense Ratio: 1.38%

Total Assets (millions): $323.73

10. Fidelity Emerging Markets (FEMKX)

3-Yr. return: 12.41%

Expense Ratio: 0.97%

Total Assets (millions): $5,288.54

9. Eaton Vance Greater China Growth A (EVCGX)

3-Yr. return: 13.68%

Expense Ratio: 1.85%

Total Assets (millions): $101.23

8. Hennessy Japan Small Cap Investor (HJPSX)

3-Yr. return: 22.31%

Expense Ratio: 1.84%

Total Assets (millions): $171.50

7. VanEck Emerging Markets A (GBFAX)

3-Yr. return: 10.24%

Expense Ratio: 1.53%

Total Assets (millions): $2,115.65

6. Fidelity China Region (FHKCX)

3-Yr. return: 12.02%

Expense Ratio: 1.00%

Total Assets (millions): $1,483.71

5. Oppenheimer Global Opportunities A (OPGIX)

3-Yr. return: 25.75%

Expense Ratio: 1.17%

Total Assets (millions): $7,449.62

4. Matthews Asia Innovators Investor (MATFX)

3-Yr. return: 14.36%

Expense Ratio: 1.24%

Total Assets (millions): $219.12

3. Wasatch Emerging India Investor (WAINX)

3-Yr. return: 16.97%

Expense Ratio: 1.75%

Total Assets (millions): $276.66

2. Oberweis China Opportunities (OBCHX)

3-Yr. return: 11.69%

Expense Ratio: 1.99%

Total Assets (millions): $127.53

1. Matthews China Investor (MCHFX)

3-Yr. return: 17.17%

Expense Ratio: 1.18%

Total Assets (millions): $986.24