Top performers: Target-date funds 2050 - 2055

"If you look at 2055, a lot of them are around 90% in equity," notes Jeff Holt, Morningstar’s associate director for multi-asset strategies, in regard to the product's five-year return data.

Performance leaders, like the American Funds Target Date Retirement 2050 and 2055 funds, for instance, each had over 83% of their asset allocation in stocks. "Strong performance from the underlying equity funds helped them rise to the top of those peer groups," Holt says.

"Where target-date managers are setting themselves apart in their philosophy and approach as investors approach retirement and are in the retirement phase, and not so much when they are younger," Holt adds. "At that point, too, their accounts are smaller so it won't have as much effect on the outcome. What will drive it will be [the period] right before retirement when their balances are large."

Click to see the rest of the series tracking the best-performing target-date funds for 2050 through 2055.

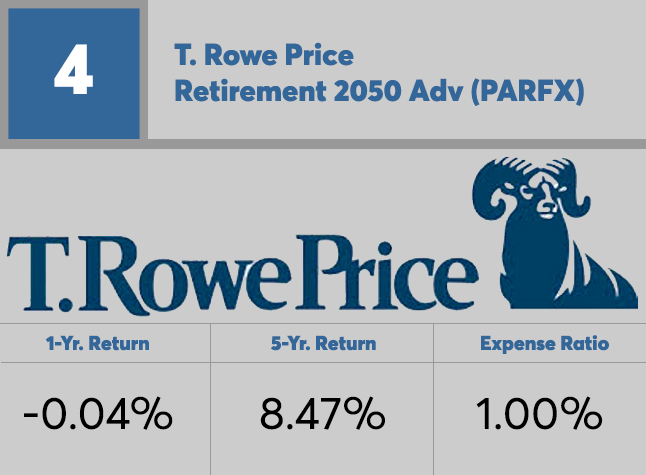

Top performers: Target-date funds 2050

Top performers: Target-date funds 2050

Top performers: Target-date funds 2050

Top performers: Target-date funds 2050

Top performers: Target-date funds 2055

Top performers: Target-date funds 2055

Top performers: Target-date funds 2055

Top performers: Target-date funds 2055

Top performers: Target-date funds 2055