Top performers: Target-date funds 2030 - 2035

"If you look over the past five years, you'll see that the S&P 500 posted a double-digit positive return, much higher than the returns of the Barclays Aggregate Bond Index," Holt says. "If you look more recently, it’s the reverse."

In addition to their skewed exposure to stocks, Holt says these funds have been heavily weighted with U.S. large-caps, which have seen better performance than in "other areas like emerging market stocks … and even U.S. small-cap stocks" over the last five years.

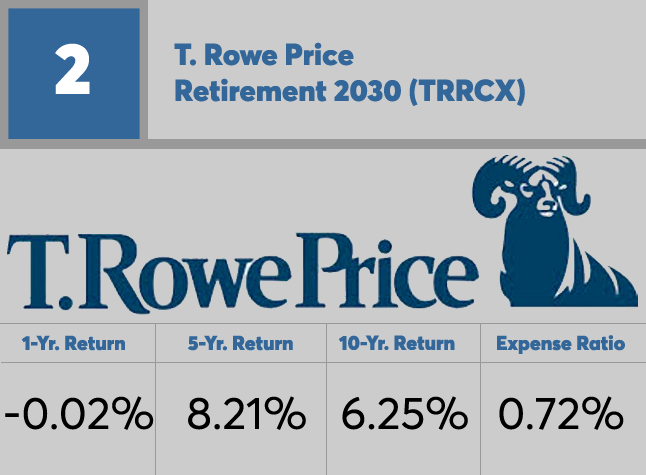

"In addition to its advantageous overweight in U.S. large-cap stocks, the American Funds Target Date Retirement series got an extra boost to performance from its underlying funds," he explains, adding that, "many of the funds held within the target-date funds ranked near the top of their respective peer groups over the past five years." The T. Rowe Price Retirement series and the Schwab Target series also "benefitted from holding strong-performing funds," he adds.

All this week, look for data on target-date fund performance for 2000 through 2055.

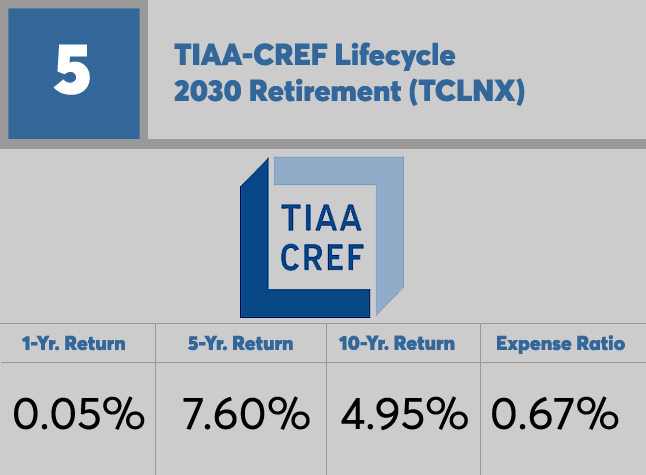

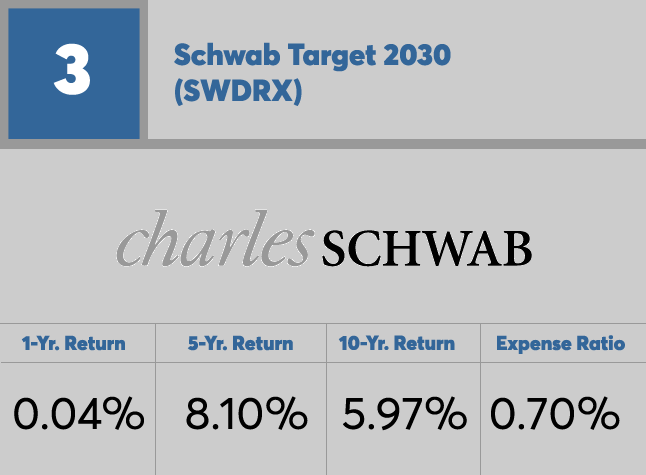

Top performers: Target-date funds 2030

Top performers: Target-date funds 2030

Top performers: Target-date funds 2030

Top performers: Target-date funds 2030

Top performers: Target-date funds 2030

Top performers: Target-date funds 2035

Top performers: Target-date funds 2035

Top performers: Target-date funds 2035

Top performers: Target-date funds 2035