However, for that additional benefit, the funds typically generate lower yields, says Morningstar analyst Ken Oshodi. AMT-free funds underperformed the larger muni category over the past year, Oshodi notes, although they slightly outperformed over the longer-term, especially 10 years.

Scroll through to see the 20 best performing AMT-free touted funds over the past five years. All data from Morningstar.

20. BMO Intermediate Tax-Free Y (MITFX)

5-Yr. Return: 2.72%

Expense Ratio: 0.55%

Ttal Assets (millions): $1,588

19. JHancock Tax-Free Bond A (TAMBX)

5-Yr. Return: 2.79%

Expense Ratio: 0.81%

Total Assets (millions): $566

18. Elfun Tax-Exempt Income (ELFTX)

5-Yr. Return: 2.93%

Expense Ratio: 0.20%

Total Assets (millions): $1,486

17. JPMorgan Tax Free Bond A (PMBAX)

5-Yr. Return: 2.99%

Expense Ratio: 0.67%

Total Assets (millions): $325

16. First Investors Tax Exempt Opps A (EIITX)

5-Yr. Return: 3%

Expense Ratio: 1%

Total Assets (millions): $280

15. Franklin Federal Tax-Free Income A (FKTIX)

5-Yr. Return: 3.21%

Expense Ratio: 0.61%

Total Assets (millions): $12,479

14. Northern Tax-Exempt (NOTEX)

5-Yr. Return: 3.25%

Expense Ratio: 0.45%

Total Assets (millions): $1,081

13. Dreyfus AMT-Free Municipal Bond Z (DRMBX)

5-Yr. Return: 3.26%

Expense Ratio: 0.49%

Total Assets (millions): $984

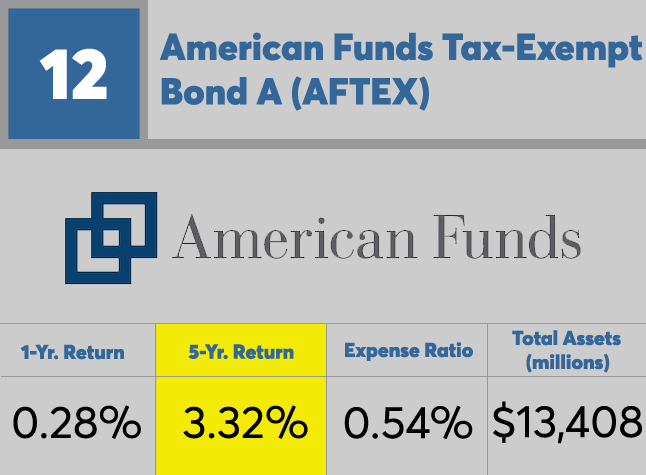

12. American Funds Tax-Exempt Bond A (AFTEX)

5-Yr. Return: 3.32%

Expense Ratio: 0.54%

Total Assets (millions): $13,408

11. Columbia Tax-Exempt A (COLTX)

5-Yr. Return: 3.38%

Expense Ratio: 0.76%

Total Assets (millions): $3,832

10. Delaware Tax-Free USA A (DMTFX)

5-Yr. Return: 3.42%

Expense Ratio: 0.81%

Total Assets (millions): $501

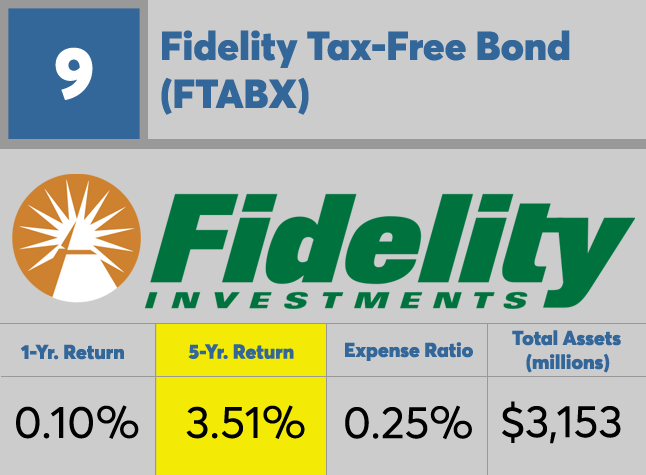

9. Fidelity Tax-Free Bond (FTABX)

5-Yr. Return: 3.51%

Expense Ratio: 0.25%

Total Assets (millions): $3,153

8. MainStay Tax-Free Bond B (MKTBX)

5-Yr. Return: 3.56%

Expense Ratio: 1.04%

Total Assets (millions): $2,452

7. Lord Abbett AMT Free Municipal Bond I (LMCIX)

5-Yr. Return: 3.58%

Expense Ratio: 0.40%

Total Assets (millions): $203

6. USAA Tax Exempt Long-Term (USTEX)

5-Yr. Return: 3.64%

Expense Ratio: 0.51%

Total Assets (millions): $2,352

5. Vanguard Long-Term Tax-Exempt (VWLTX)

5-Yr. Return: 3.66%

Expense Ratio: 0.19%

Total Assets (millions): $9,959

4. Lord Abbett Natl Tax-Free Income A (LANSX)

5-Yr. Return: 3.85%

Expense Ratio: 0.74%

Total Assets (millions): $1,958

3. Eaton Vance AMT-Free Municipal Income I (EVMBX)

5-Yr. Return: 3.89%

Expense Ratio: 0.56%

Total Assets (millions): $346

2. Vanguard High-Yield Tax-Exempt (VWAHX)

5-Yr. Return: 4.01%

Expense Ratio: 0.19%

Total Assets (millions): $10,686

1. Pioneer AMT-Free Municipal A (PBMFX)

5-Yr. Return: 4.26%

Expense Ratio: 0.81%

Total Assets (millions): $1,237