With all due respect to small-cap enthusiasts, high-yield fanatics or gold bugs, large caps have dominated a rollicking good ride from the late 1970s to today. These funds powered through good times and bad: sky-high inflation, bull markets, crashes and irrational exuberance. There were low points along the way, of course. That’s why we added both the best, and worst, annual performances for each fund, in addition to the 40-year annualized average.

Spoiler alert, the worst year for each one was 2008, the year of the financial crisis. The best year for 11 of 20 of these funds was either 1979 or 1980. But before you get too envious of the days of disco, bear in mind that the 30-year mortgage rate reached 16% in 1980, according to numbers from FreddieMac.

To be sure, a lot of funds aren’t eligible for this list. Any fund launched in the past 40 years obviously won’t be here, impressive gains notwithstanding. The biggest case in point: There are no ETFs on this list because they’re too new for our time frame in this analysis. The first ETFs made their appearance on the scene in the early 1990s.

So which funds have posted the best performance for the past 40 years? Scroll through to see the top 20. All data is from Morningstar.

20. American Century Select Inv

Best Year: 1980

Best Year Return: 45.76%

Worst Year: 2008

Worst Year Return: -39.67%

Fund assets (millions): $2,433

Expense Ratio: 0.99%

19. Fidelity Contrafund

Best Year: 1991

Best Year Return: 54.92%

Worst Year: 2008

Worst Year Return: -37.16%

Fund assets (millions): $102,722

Expense Ratio: 0.70%

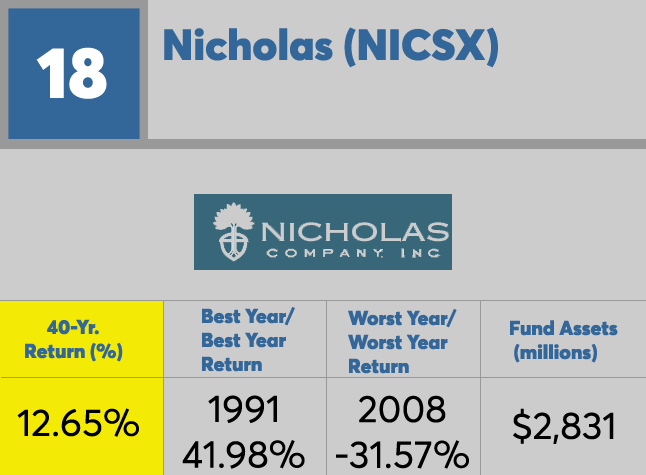

18. Nicholas

Best Year: 1991

Best Year Return: 41.98%

Worst Year: 2008

Worst Year Return: -31.57%

Fund assets (millions): $2,831

Expense Ratio: 0.72%

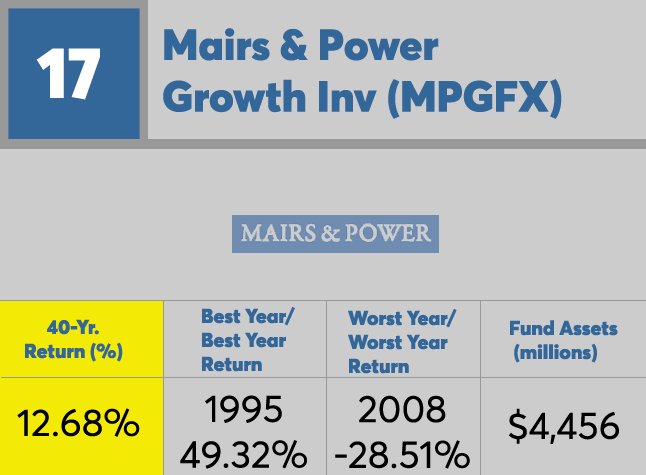

17. Mairs & Power Growth Inv

Best Year: 1995

Best Year Return: 49.32%

Worst Year: 2008

Worst Year Return: -28.51%

Fund assets (millions): $4,456

Expense Ratio: 0.65%

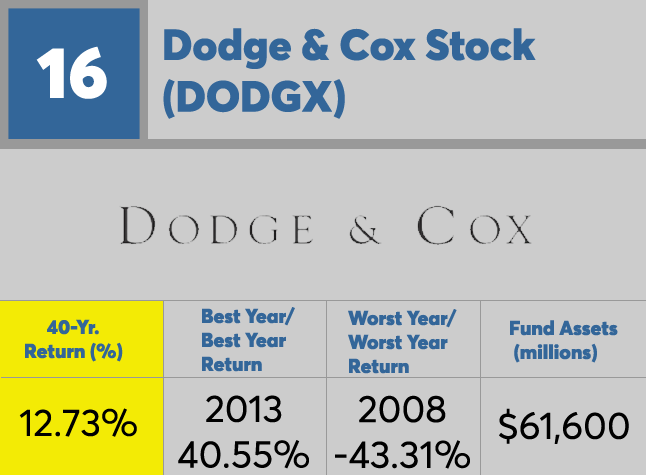

16. Dodge & Cox Stock

Best Year: 2013

Best Year Return: 40.55%

Worst Year: 2008

Worst Year Return: -43.41%

Fund assets (millions): $61,600

Expense Ratio: 0.52%

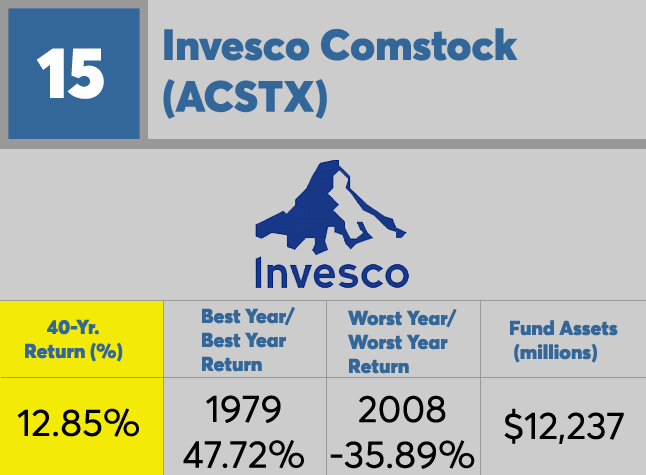

15. Invesco Comstock

Best Year: 1979

Best Year Return: 47.72%

Worst Year: 2008

Worst Year Return: -35.89%

Fund assets (millions): $12,237

Expense Ratio: 0.84%

14. First Eagle Global

Best Year: 2003

Best Year Return: 37.64%

Worst Year: 2008

Worst Year Return: -21.06%

Fund assets (millions): $51,151

Expense Ratio: 1.10%

13. T. Rowe Price New Horizons

Best Year: 1980

Best Year Return: 57.56%

Worst Year: 2008

Worst Year Return: -38.78%

Fund assets (millions): $16,742

Expense Ratio: 0.79%

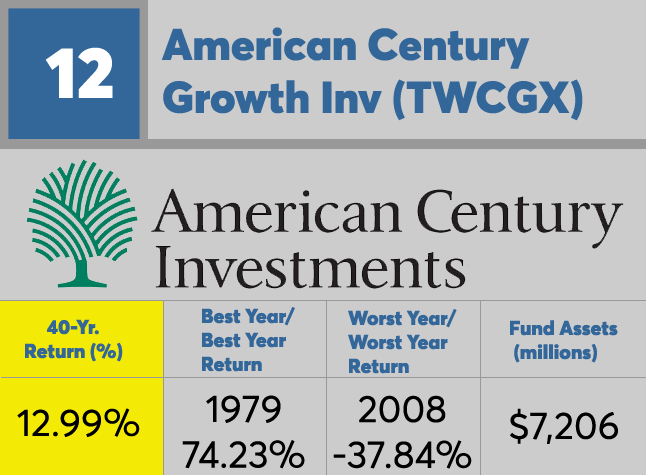

12. American Century Growth Inv

Best Year: 1979

Best Year Return: 74.23%

Worst Year: 2008

Worst Year Return: -37.84

Fund assets (millions): $7,206

Expense Ratio: 0.98%

11. American Funds AMCAP

Best Year: 1979

Best Year Return: 51.93%

Worst Year: 2008

Worst Year Return: -37.68%

Fund assets (millions): $51,302

Expense Ratio: 0.67%

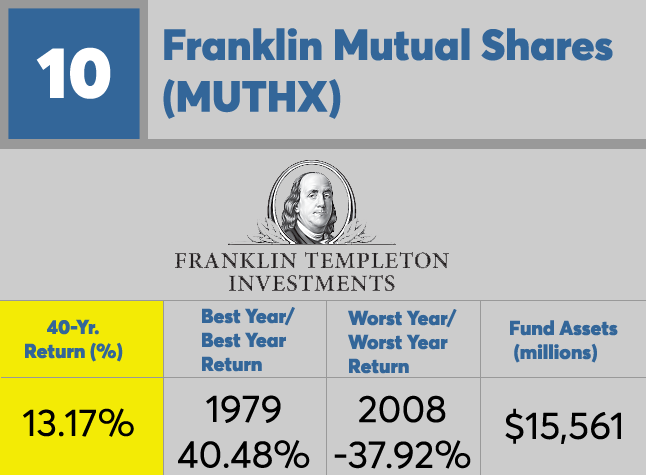

10. Franklin Mutual Shares

Best Year: 1979

Best Year Return: 40.48%

Worst Year: 2008

Worst Year Return: -37.92%

Fund assets (millions): $15,461

Expense Ratio: 0.79%

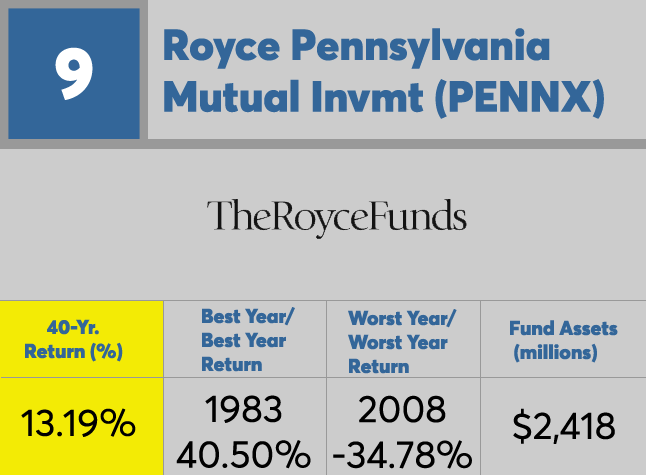

9. Royce Pennsylvania Mutual Invmt

Best Year: 1983

Best Year Return: 40.50%

Worst Year: 2008

Worst Year Return: -34.78

Fund assets (millions): $2,418

Expense Ratio: 0.92%

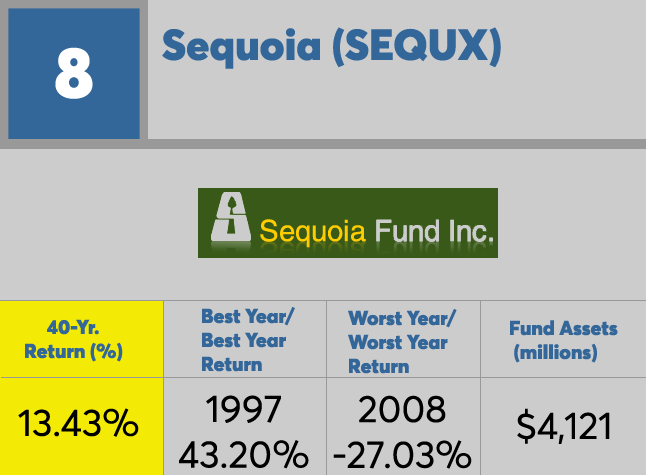

8. Sequoia

Best Year: 1997

Best Year Return: 43.20%

Worst Year: 2008

Worst Year Return: -27.03%

Fund assets (millions): $4,121

Expense Ratio: 1%

7. T. Rowe Price Small-Cap Stock

Best Year: 1979

Best Year Return: 54.57%

Worst Year: 2008

Worst Year Return: -33.35%

Fund assets (millions): $9,432

Expense Ratio: 0.90%

6. Davis NY Venture

Best Year: 1980

Best Year Return: 43.91%

Worst Year: 2008

Worst Year Return: -40.03

Fund assets (millions): $11,806

Expense Ratio: 0.89%

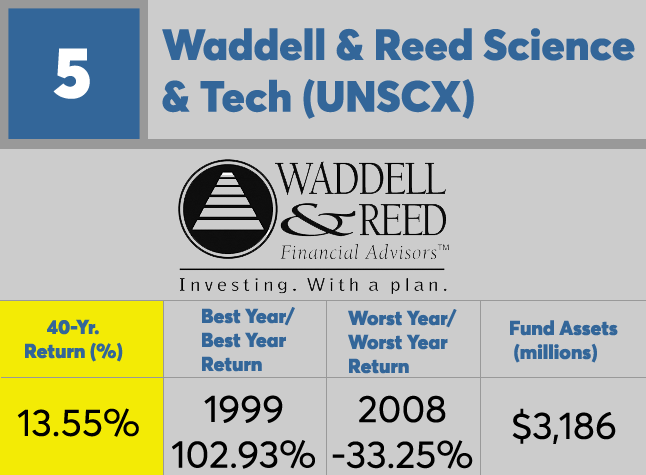

5. Waddell & Reed Science & Tech

Best Year: 1999

Best Year Return: 102.93%

Worst Year: 2008

Worst Year Return: -33.25%

Fund assets (millions): $3,186

Expense Ratio: 1.27%

4. American Funds Growth Fund of Amer

Best Year: 1979

Best Year Return: 45.72%

Worst Year: 2008

Worst Year Return: -39.07%

Fund assets (millions): $149,719

Expense Ratio: 0.66%

3. Columbia Acorn

Best Year: 1979

Best Year Return: 50.25%

Worst Year: 2008

Worst Year Return: -38.55%

Fund assets (millions): $4,813

Expense Ratio: 0.80%

2. Alger Spectra

Best Year: 1999

Best Year Return: 72.01%

Worst Year: 2008

Worst Year Return: -42.19%

Fund assets (millions): $5,104

Expense Ratio: 1.21%

1. Fidelity Magellan

Best Year: 1980

Best Year Return: 69.94%

Worst Year: 2008

Worst Year Return: -49.40%

Fund assets (millions): $14,797

Expense Ratio: 0.83%