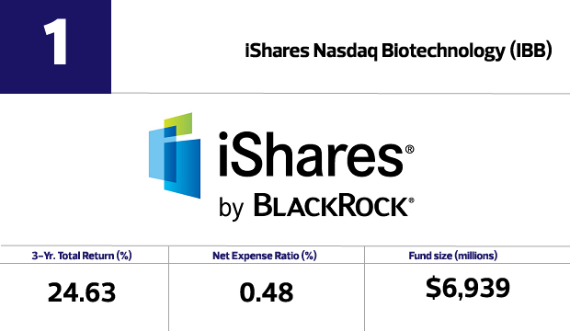

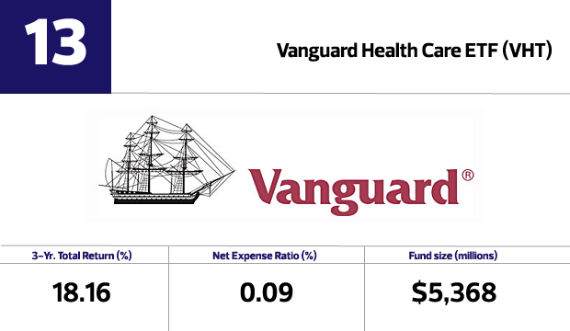

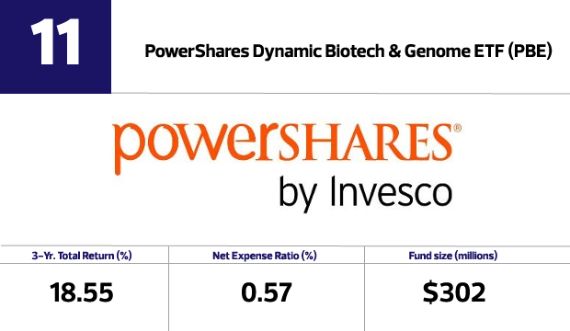

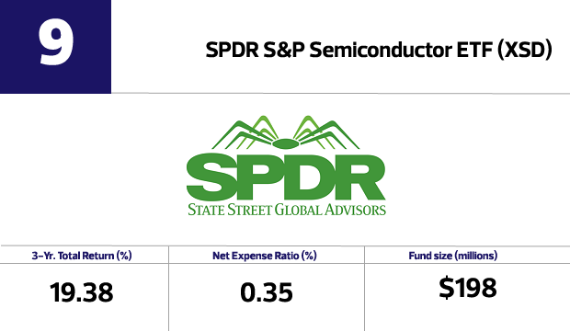

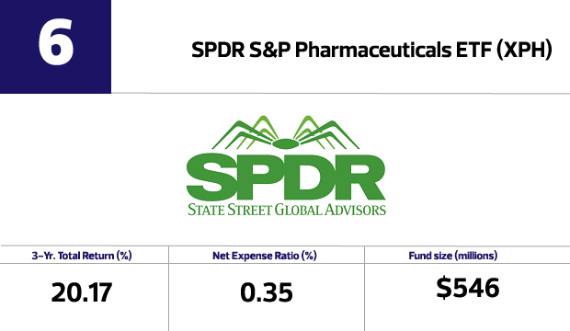

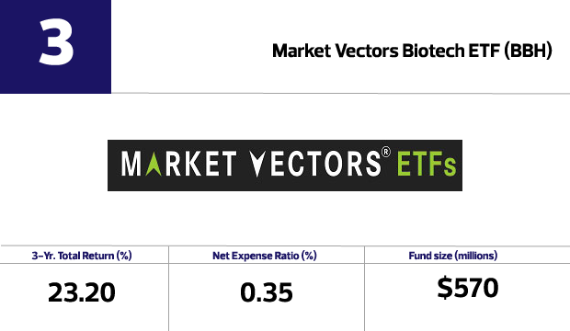

Top Funds by Total Returns

Of the top 20 funds with the highest total return over three years, 14 are in the health and pharmaceutical industries; and all 14 are ETFs, which typically carry low expenses. In fact, the Vanguard Health Care ETF carried an extremely low expense ratio of nine basis points. In total return, it's ranked 13th on this list.

Click through to see all 20 funds or view them as a

Image: iStock

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns

Top Funds by Total Returns