Beyond ever-present concerns about the party ending abruptly, more recently, many advisors and clients fret that President Trump’s call for tariffs on steel and aluminum imports could lead to a trade war that will will depress global investing.

Indeed, the Vanguard FTSE EM ETF is up 3.3% year-to-date, but incurred a loss of 3.4% for the past week. Shorter timeframes are usually less meaningful, but in this case, could reflect a turning point in emerging markets.

The president’s threat to initiate a trade war could rein in, or even reverse, global growth, says Mark Hamrick, a senior economic analyst for Bankrate. It’s hard to construct a scenario that’s positive for the investment markets unless the threats evaporate and nothing actually happens, he adds.

Taking a longer view, Hamrick notes that emerging markets have had a good run in recent years after severe pullbacks a decade ago.

Scroll through to see the 20 best-performing emerging markets equity funds for the past year. There is also data on each fund’s three-year returns, expense ratios and total assets. Funds with less than $100 million in assets were excluded. All data from Morningstar Direct.

20. Fidelity SAI Emerging Markets Index (FERGX)

3-Yr. Return: N/A

Expense Ratio: 0.08%

Total Assets (millions): $3,654.63

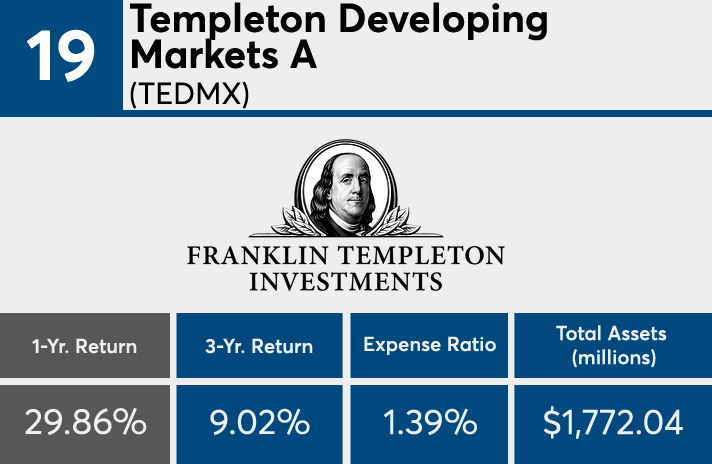

19. Templeton Developing Markets A (TEDMX)

3-Yr. Return: 9.02%

Expense Ratio: 1.39%

Total Assets (millions): $1,772.04

18. Deutsche Emerging Markets Equity S (SEMGX)

3-Yr. Return: 9.63%

Expense Ratio: 1.00%

Total Assets (millions): $114.93

17. Strategic Advisers Emerging Markets (FSAMX)

3-Yr. Return: 8.85%

Expense Ratio: 1.07%

Total Assets (millions): $5,070.61

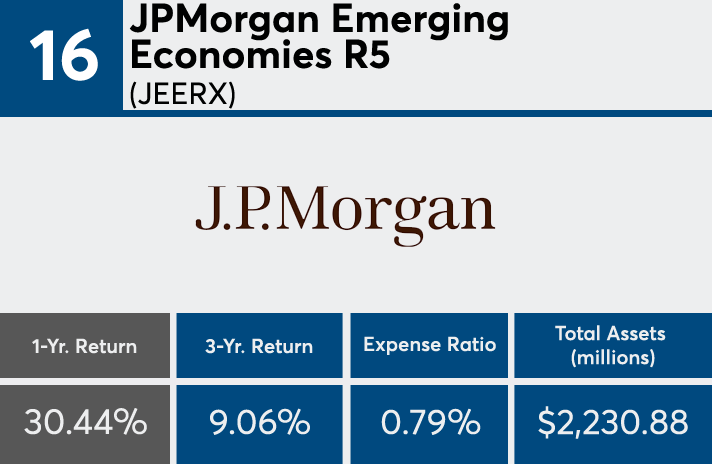

16. JPMorgan Emerging Economies R5 (JEERX)

3-Yr. Return: 9.06%

Expense Ratio: 0.79%

Total Assets (millions): $2,230.88

15. GuideMark Emerging Markets Service (GMLVX)

3-Yr. Return: 11.02%

Expense Ratio: 1.70%

Total Assets (millions): $109.12

14. City National Rochdale Emerg Mkts N (RIMIX)

3-Yr. Return: 10.66%

Expense Ratio: 1.62%

Total Assets (millions): $1,762.26

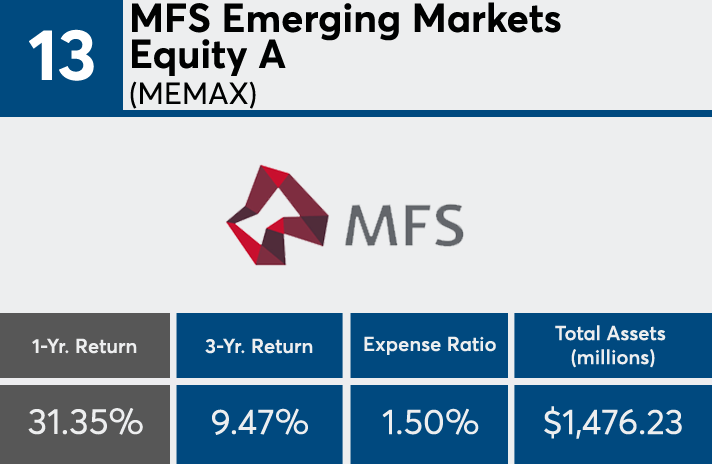

13. MFS Emerging Markets Equity A (MEMAX)

3-Yr. Return: 9.47%

Expense Ratio: 1.50%

Total Assets (millions): $1,476.23

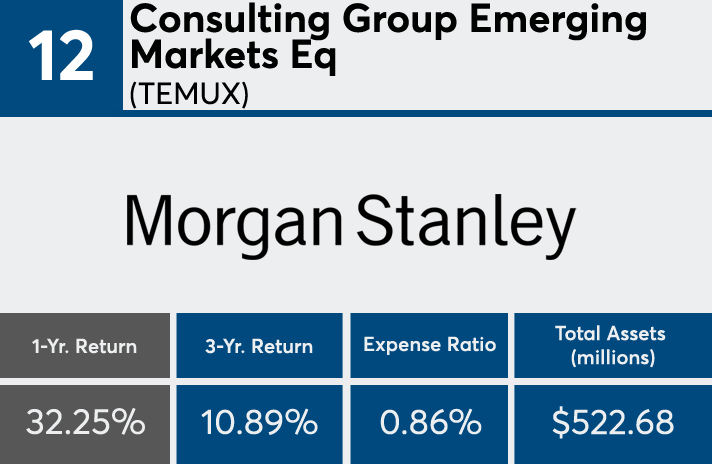

12. Consulting Group Emerging Markets Eq (TEMUX)

3-Yr. Return: 10.89%

Expense Ratio: 0.86%

Total Assets (millions): $522.68

11. Hartford Schroders Emerging Mkts Eq I (SEMNX)

3-Yr. Return: 10.17%

Expense Ratio: 1.27%

Total Assets (millions): $3,077.27

10. Ivy Emerging Markets Equity A (IPOAX)

3-Yr. Return: 11.75%

Expense Ratio: 1.58%

Total Assets (millions): $2,637.32

9. VALIC Company I Emerg Economies (VCGEX)

3-Yr. Return: 10.39%

Expense Ratio: 0.94%

Total Assets (millions): $891.67

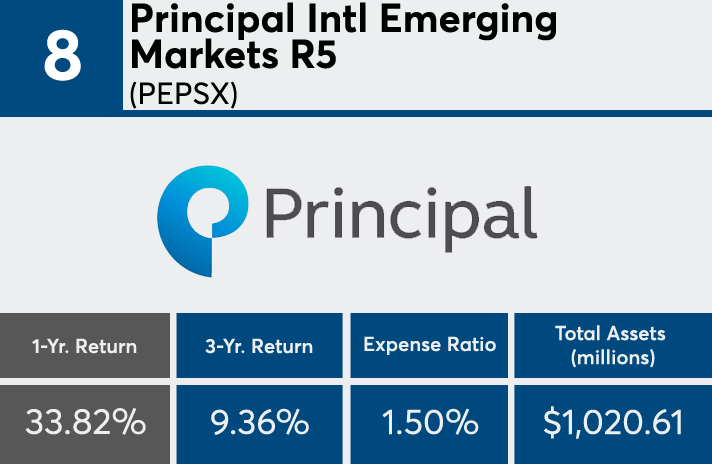

8. Principal Intl Emerging Markets R5 (PEPSX)

3-Yr. Return: 9.36%

Expense Ratio: 1.50%

Total Assets (millions): $1,020.61

7. VY JPMorgan Emerging Markets Equity S (IJPIX)

3-Yr. Return: 9.75%

Expense Ratio: 1.50%

Total Assets (millions): $610.21

6. Victory Sophus Emerging Markets A (GBEMX)

3-Yr. Return: 11.50%

Expense Ratio: 1.34%

Total Assets (millions): $277.12

5. T. Rowe Price Emerging Markets Stock (PRMSX)

3-Yr. Return: 11.92%

Expense Ratio: 1.26%

Total Assets (millions): $12,161.31

4. BNY Mellon Emerging Markets M (MEMKX)

3-Yr. Return: 9.91%

Expense Ratio: 1.42%

Total Assets (millions): $1,063.15

3. Fidelity Emerging Markets (FEMKX)

3-Yr. Return: 10.05%

Expense Ratio: 0.97%

Total Assets (millions): $5,540.47

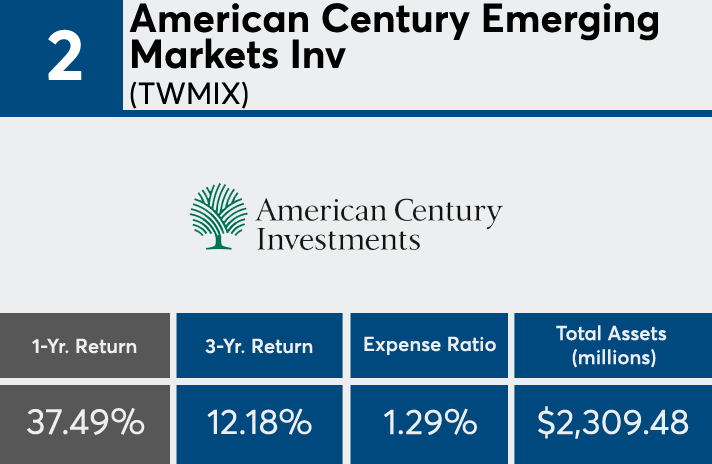

2. American Century Emerging Markets Inv (TWMIX)

3-Yr. Return: 12.18%

Expense Ratio: 1.29%

Total Assets (millions): $2,309.48

1. VanEck Emerging Markets A (GBFAX)

3-Yr. Return: 8.97%

Expense Ratio: 1.53%

Total Assets (millions): $2,200.48