These 20 funds are the top-performing actively managed funds over the past 10 years (with a minimum AUM of $500 million). The average fund posted an annualized gain of 13.3%, especially impressive since the beginning of that period included the financial crisis. Indeed, the S&P 500 posted a 7.6% gain in that period, as measured by SPY, the oldest ETF that tracks the index.

In addition to 10-year and three-year returns, we also show expense ratios of the funds, which averaged 88 basis points.

All funds benefit from being in the right place at the right time, and most of these funds are invested heavily in tech and health care.

To be sure, passive investing has gained in popularity in recent years as advisors and investors flock to low-cost options. Check back next week for the best passive funds.

Scroll through to see all 20 actively managed funds with the highest 10-year returns. All data from Morningstar Direct.

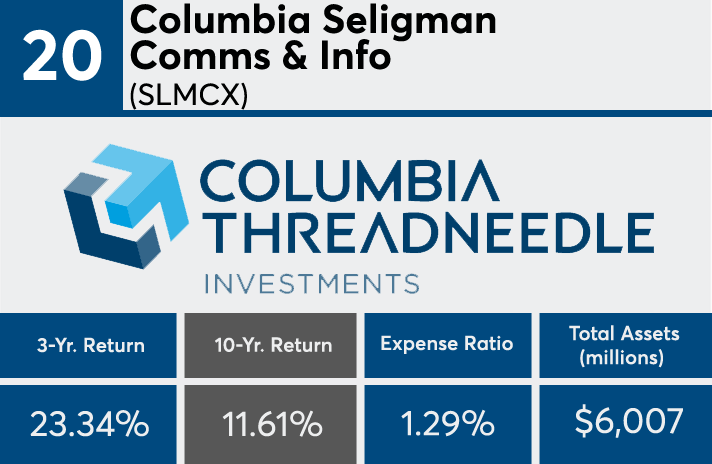

20. Columbia Seligman Comms & Info (SLMCX)

10-Yr. Return: 11.61%

Expense Ratio: 1.29%

Total Assets (millions): $6,007

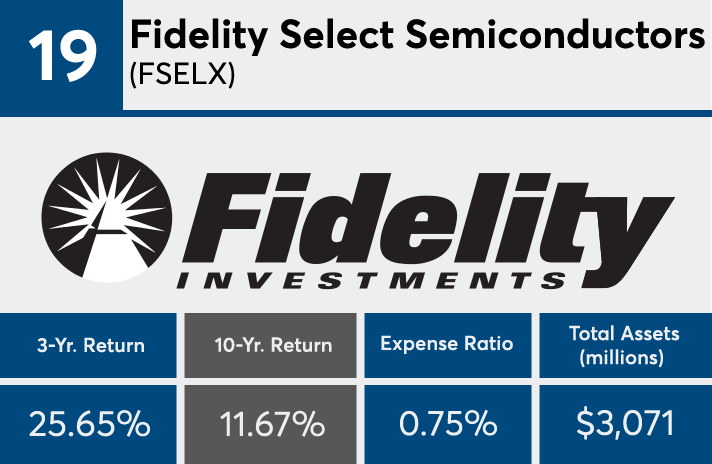

19. Fidelity Select Semiconductors (FSELX)

10-Yr. Return: 11.67%

Expense Ratio: 0.75%

Total Assets (millions): $3,071

18. T. Rowe Price Media & Telecomms (PRMTX)

10-Yr. Return: 11.71%

Expense Ratio: 0.79%

Total Assets (millions): $4,640

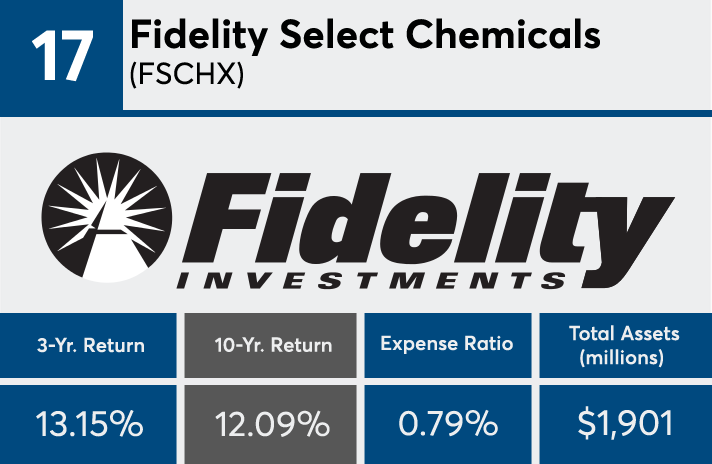

17. Fidelity Select Chemicals (FSCHX)

10-Yr. Return: 12.09%

Expense Ratio: 0.79%

Total Assets (millions): $1,901

16. T. Rowe Price New Horizons (PRNHX)

10-Yr. Return: 12.11%

Expense Ratio: 0.79%

Total Assets (millions): $21,385

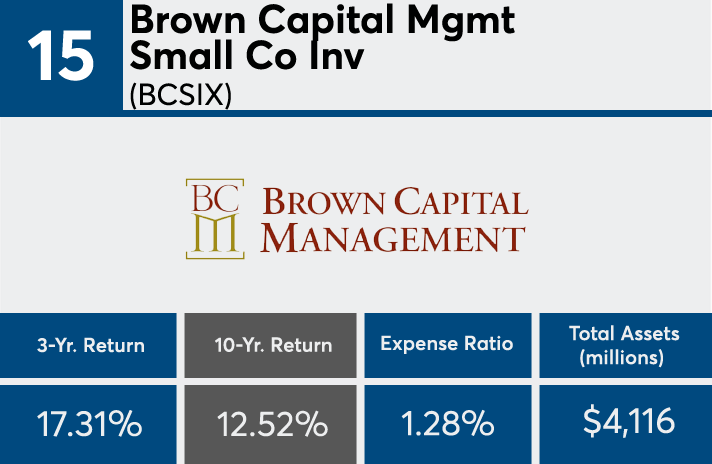

15. Brown Capital Mgmt Small Co Inv (BCSIX)

10-Yr. Return: 12.52%

Expense Ratio: 1.28%

Total Assets (millions): $4,116

14. Janus Henderson Global Life Sciences (JNGLX)

10-Yr. Return: 12.52%

Expense Ratio: 0.84%

Total Assets (millions): $3,746

13. PRIMECAP Odyssey Aggressive Growth (POAGX)

10-Yr. Return: 12.71%

Expense Ratio: 0.63%

Total Assets (millions): $8,814

12. Parnassus Endeavor Investor (PARWX)

10-Yr. Return: 12.75%

Expense Ratio: 0.95%

Total Assets (millions): $4,927

11. Fidelity Select Health Care (FSPHX)

10-Yr. Return: 12.94%

Expense Ratio: 0.73%

Total Assets (millions): $7,009

10. BlackRock Health Sciences Opps Inv (SHSAX)

10-Yr. Return: 13.06%

Expense Ratio: 1.18%

Total Assets (millions): $6,083

9. Fidelity Select Medical Equip & Systems (FSMEX)

10-Yr. Return: 13.20%

Expense Ratio: 0.76%

Total Assets (millions): $4,048

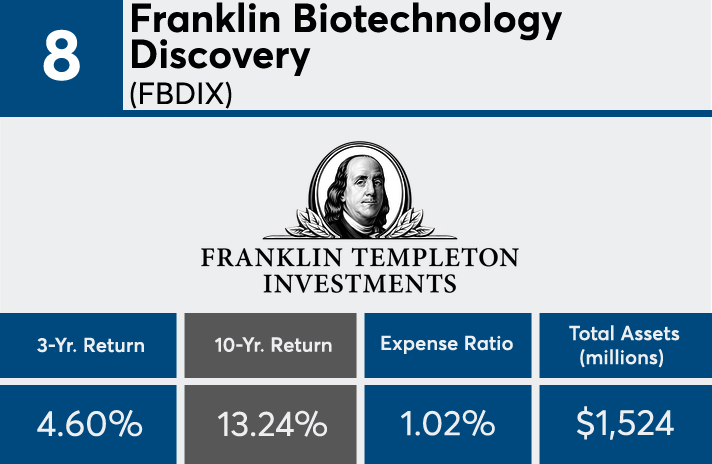

8. Franklin Biotechnology Discovery (FBDIX)

10-Yr. Return: 13.24%

Expense Ratio: 1.02%

Total Assets (millions): $1,524

7. Fidelity Select Software & IT Svcs Port (FSCSX)

10-Yr. Return: 13.57%

Expense Ratio: 0.75%

Total Assets (millions): $4,569

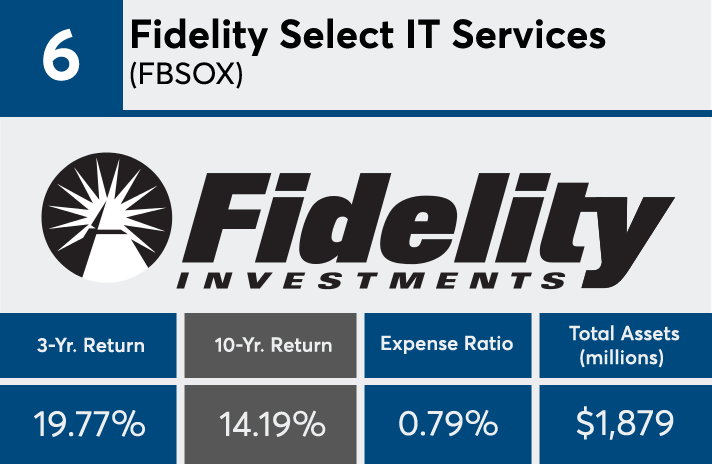

6. Fidelity Select IT Services (FBSOX)

10-Yr. Return: 14.11%

Expense Ratio: 0.79%

Total Assets (millions): $1,879

5. Fidelity Select Retailing (FSRPX)

10-Yr. Return: 14.40%

Expense Ratio: 0.78%

Total Assets (millions): $1,776

4. VALIC Company I Health Sciences (VCHSX)

10-Yr. Return: 14.83%

Expense Ratio: 1.07%

Total Assets (millions): $758

3. Fidelity Select Biotechnology (FBIOX)

10-Yr. Return: 15.09%

Expense Ratio: 0.74%

Total Assets (millions): $9,969

2. T. Rowe Price Health Sciences (PRHSX)

10-Yr. Return: 15.31%

Expense Ratio: 0.77%

Total Assets (millions): $11,818

1. T. Rowe Price Global Technology (PRGTX)

10-Yr. Return: 15.64%

Expense Ratio: 0.90%

Total Assets (millions): $5,696