The Most Useful — and Neglected — Social Security Planning Strategies

Click through this handy cheat sheet to see some of the most useful and neglected Social Security planning strategies.

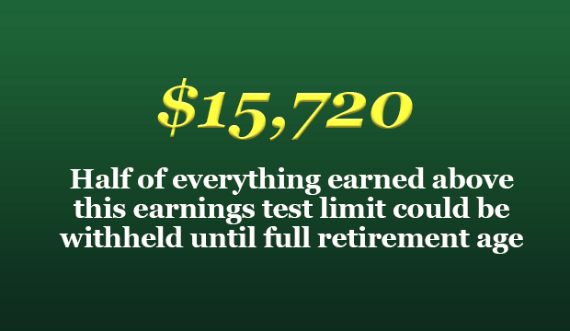

The Earnings Test Limit

There are several drawbacks to claiming Social Security benefits before full retirement age. For one, clients may receive a significantly reduced benefit for the rest of their lives. A lesser-known downside: Clients might also be subject to an earnings test if they claim early. That means that half of anything they earn above the earnings test limit of $15,720 could be withheld until they turned 66.

Social Security: The Youngest Beneficiary

Social Security: Parents as Beneficiaries

Dont Forget the Kids

Clients Should Delay Filing for Benefits

Investment Return

The investment returns clients might forgo by spending down some savings would be very hard pressed to match.

Tune Into the Survivors Program

Beneficiaries may include children under 19, or even dependent parents 62 or older. In 2013, roughly 6 million people relied upon the survivor program.

Benefits of the Disability Program

There is no minimum age to receive disability benefits. But a client must have worked a minimum number of years in order to be eligible. The minimum number of years worked increases with age from at least 2 years of work at age 30 to at least 9.5 years of work at age 60.

Clients Emotional Factors

Listen patiently to (and respect) these types of responses from clients. Consciously try not to judge, counter these concerns or respond in any way. Doing so can help a client relax, feel respected and finally, be more receptive to the rational facts you want to present.