More than half of the 20 biggest index funds achieved double-digit returns in 2016, too.

Leading the group is Franklin Income Fund, which gained 16.29% by the end of the year. Comparatively, the bond market, as gauged by the iShares Core US Aggregate Bond fund, remained flat in 2016. The large iShares fund had dividends, though, of about $2.40 per share.

Benefiting from investors seeking safe havens, bond funds added $274.4 billion in 2016, while $61.8 billion was withdrawn from stock funds, according to Lipper.

Dominating the list are offerings from American Funds. Its oldest fund — the Investment Company of America fund — is also its best performer.

Also from its growth and income category is its Washington Mutual Investors Fund. Funds from Vanguard, Fidelity and Metropolitan West round out the list.

Scroll through to see the best 2016 returns of the industry’s largest funds. All data from Morningstar.

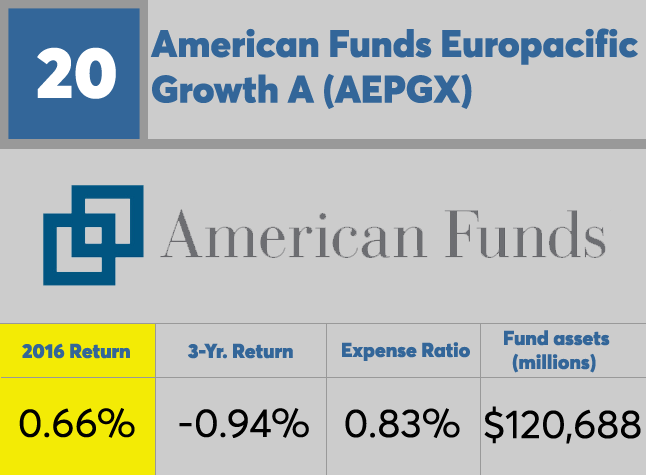

20. American Funds Europacific Growth A (AEPGX)

3-Yr. Return: -0.94%

Expense Ratio: 0.83%

Fund assets (millions): $120,688

19. Metropolitan West Total Return Bd M (MWTRX)

3-Yr. Return: 2.68%

Expense Ratio: 0.67%

Fund assets (millions): $78,572

18. Vanguard Total Bond Market II Idx Inv (VTBIX)

3-Yr. Return: 2.86%

Expense Ratio: 0.09%

Fund assets (millions): $108,962

17. Vanguard Total Bond Market Index Inv (VBMFX)

3-Yr. Return: 2.83%

Expense Ratio: 0.16%

Fund assets (millions): $171,724

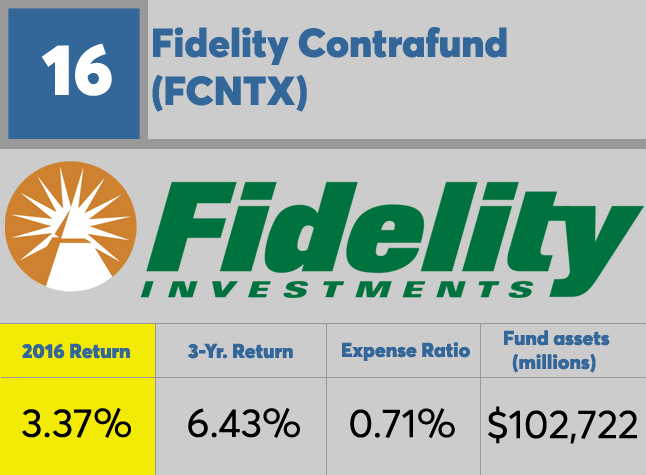

16. Fidelity Contrafund (FCNTX)

3-Yr. Return: 6.43%

Expense Ratio: 0.71%

Fund assets (millions): $102,722

15. Vanguard Total Intl Stock Index Inv (VGTSX)

3-Yr. Return: -1.41%

Expense Ratio: 0.19%

Fund assets (millions): $224,447

14. American Funds Capital World Gr & Inc A (CWGIX)

3-Yr. Return: 2.71%

Expense Ratio: 0.77%

Fund assets (millions): $81,840

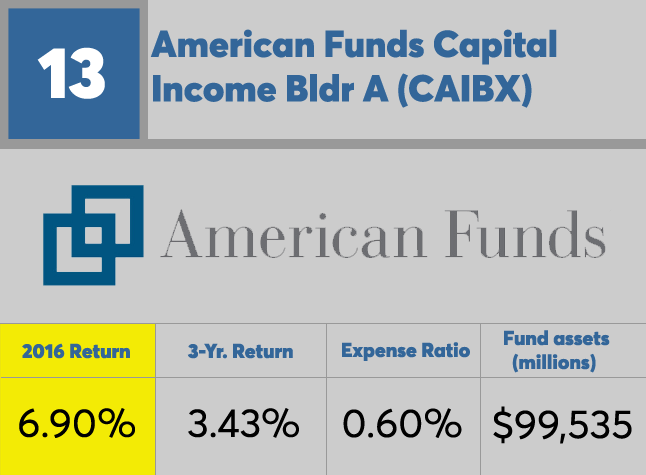

13. American Funds Capital Income Bldr A (CAIBX)

3-Yr. Return: 3.43%

Expense Ratio: 0.60%

Fund assets (millions): $99,535

12. American Funds Growth Fund of Amer A (AGTHX)

3-Yr. Return: 7.69%

Expense Ratio: 0.66%

Fund assets (millions): $146,038

11. American Funds American Balanced A (ABALX)

3-Yr. Return: 6.34%

Expense Ratio: 0.58%

Fund assets (millions): $101,238

10. American Funds Income Fund of Amer A (AMECX)

3-Yr. Return: 5.70%

Expense Ratio: 0.56%

Fund assets (millions): $101,822

9. Vanguard Wellington Inv (VWELX)

3-Yr. Return: 6.85%

Expense Ratio: 0.26%

Fund assets (millions): $92,973

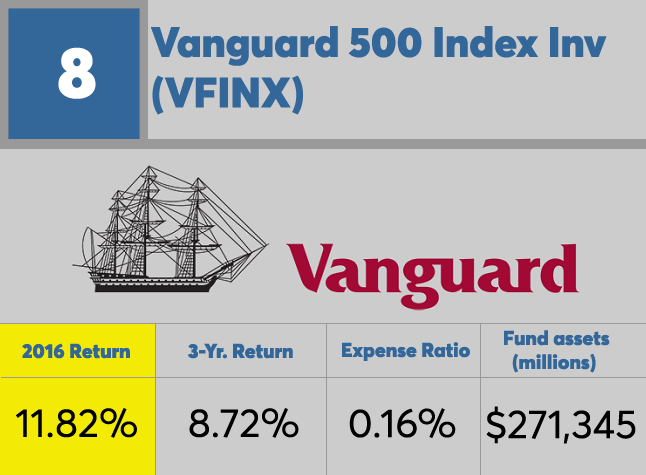

8. Vanguard 500 Index Inv (VFINX)

3-Yr. Return: 8.72%

Expense Ratio: 0.16%

Fund assets (millions): $271,345

7. Fidelity 500 Index Investor (FUSEX)

3-Yr. Return: 8.78%

Expense Ratio: 0.09%

Fund assets (millions): $109,233

6. Vanguard Institutional Index I (VINIX)

3-Yr. Return: 8.85%

Expense Ratio: 0.04%

Fund assets (millions): $210,941

5. Vanguard Total Stock Mkt Idx Inv (VTSMX)

3-Yr. Return: 8.26%

Expense Ratio: 0.16%

Fund assets (millions): $487,902

4. American Funds Fundamental Invs A (ANCFX)

3-Yr. Return: 8.23%

Expense Ratio: 0.60%

Fund assets (millions): $79,818

3. American Funds Washington Mutual A (AWSHX)

3-Yr. Return: 7.99%

Expense Ratio: 0.58%

Fund assets (millions): $85,926

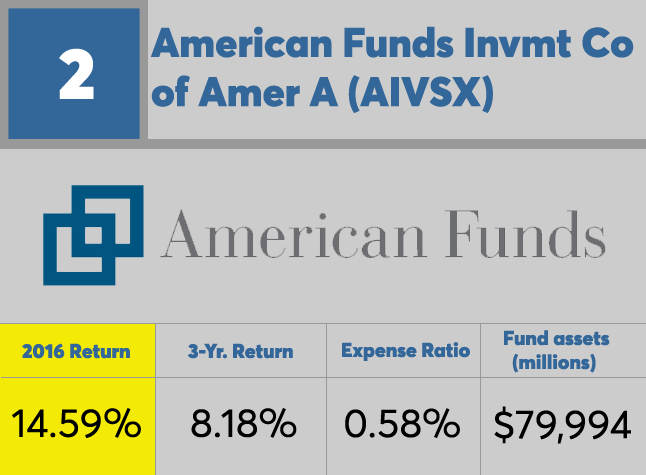

2. American Funds Invmt Co of Amer A (AIVSX)

3-Yr. Return: 8.18%

Expense Ratio: 0.58%

Fund assets (millions): $79,994

1. Franklin Income A (FKINX)

3-Yr. Return: 3.73%

Expense Ratio: 0.61%

Fund assets (millions): $79,293