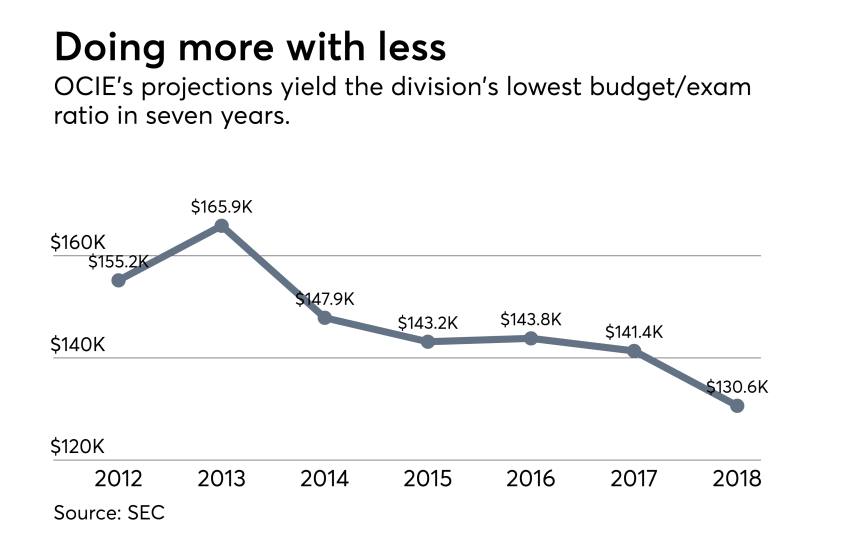

SEC OCIE exams to rise despite lower budget

The Office of Compliance Inspections and Examinations, which

Former SEC Chairwoman Mary Jo White led a shift in the division’s resources in her final year, according to the agency’s 2016

The SEC also moved some OCIE staff to FINRA’s new Securities Industry Oversight office, which is “focused on assessing FINRA’s fulfillment of its core mission to regulate member broker-dealers,” according to the annual report.

The budget request, which

OCIE predicts the number of BDs who will face exams in 2018 to tick up to 320, despite the lower funding request. The division also forecasts the number of advisers examined to grow to 1,850, a 6% increase from this year and a 28% jump from last year.

Representatives for the agency didn’t respond to a request for an explanation on how the lower funding would yield more adviser exams.

OCIE will manage the higher workload with a lower budget through “the introduction of efficiencies” and 100 reassigned staff members, Clayton told lawmakers last week. Assets managed by RIAs have more than tripled to $70 trillion since 2001, he noted.

“I expect that for at least the next several years we will need to do more each year to increase the agency’s examination coverage of investment advisers in light of continuing changes in the markets,” Clayton said.

Compliance experts, however, expect

Click through the slideshow for a full analysis of the budget request and its impact on advisers. Unless otherwise noted, data for 2017 is based on SEC’s continuing resolution and data for 2018 is based on the agency’s requests or estimates.

“The staff continued to enhance its risk assessment and surveillance capabilities to ensure that the program is spending its limited time and resources on those firms presenting the highest risk,” according to the budget request.

White, the former chairwoman, had noted the growth of staff examining RIAs in

“This level of coverage cannot be allowed to persist,” White said in remarks before the House Financial Services Committee. “Significantly more resources are needed to fulfill our responsibility to investors.”

The division did not provide any projections for this year or next year in the budgetary document. OCIE officials did explain the nature of exam findings during exams, though.

“Examiners find a wide range of deficiencies during examinations,” according to the document.

“Some of the deficiencies are more technical in nature, such as failing to include all information that is required to be in a record. However, other deficiencies may cause harm to customers or clients of a firm, have a high potential to cause harm, or reflect recidivist misconduct.”

All types of exams led to voluntary refunds of $60 million to investors in 2016, the annual report shows.

While FINRA will boost its enforcement and exams, OCIE merged its oversight of BDs and advisers registered with both regulators into the Broker-Dealer and Exchange office.

Examiners from the unit “will maintain a significant presence nationwide, including in market centers such as New York and Chicago,” according to the annual report.

Yet OCIE officials are seeking some $5 million less for the next fiscal year, along with $35 million less for the SEC overall. At the same time, however, the agency plans to conduct more probes of firms.

Examiners are on pace to carry out 2,449 exams overall this year, and OCIE forecasts the number to grow 6.5% to 2,609 in 2018, according to the SEC’s budget request.

By the end of 2018, however, the division would lose 19 employees from regional offices and six from headquarters, if lawmakers approve OCIE’s budget ask. Officials project the trimmed-down workforce to conduct even more exams.

Last year, though, the division’s funding fell short by only 0.1% of its proposed budget.

The SEC will “accelerate and expand our ongoing efforts to find efficiencies throughout our operations,” officials wrote in the agency’s requested budget.