Fidelity stayed in second place after sharing that space in a tie with Edward Jones last year, and Schwab kept its place atop the list, which J.D. Power released last week. The industry-wide average jumped 15 points on J.D. Power’s 1,000-point scale to 819.

“It’s the highest score that we’ve seen,” says J.D. Power wealth management practice director Mike Foy.

The 14-year record came amid

Indeed, the investment performance measurement drew the highest increase among the seven key factors of the survey, at 35 points.

Yet advisory service makes up the most important piece of the weighted index, and the ratings for the top three firms show that they “recognize the need to be successful across the board,” Foy says.

“Schwab, Fidelity and Edward Jones are in many ways different,” he says. “There’s not just a single model that works.”

LPL Financial, Morgan Stanley and Wells Fargo displayed “meaningful progress” in investor satisfaction, according to the study. At 44 points, Stifel achieved the highest year-over-year improvement of any of the 20 firms.

“Stifel has gone through a number of acquisitions and sales as well in the past few years,” Foy says of the firm’s high marks. “Some of it likely has to do with some of the changes related to those acquisitions.”

All but one of the companies covered in the survey, AXA Advisors, received higher marks than in the 2016 survey. AXA dipped by a modest five points, and both Merrill Lynch and Ameriprise saw increases in customer satisfaction while falling below the industry average.

“We didn’t see anything negative there, they were just overtaken by the other firms,” Foy says, noting positive reviews this year for retail bank brokerages such as U.S. Bank, PNC, Chase and Citigroup.

The retail banks “began to pay more attention to wealth management in recent years” amid low interest rates, according to Foy. “We are beginning to see the benefits of an improved wealth management performance at those firms.”

While the annual report covers many trends, the company rankings remain the most closely-watched aspect of the survey among J.D. Power’s many advisory industry clients, he notes.

“We’re never going to get away from, nor do we want to get away from, the fact that we’re ranking firms based on what their customers say about their experience,” Foy says. “Everything that we do is really based on what the customers say.”

20. AXA Advisors

2016 Ranking: 13

19. Northwestern Mutual

2016 Ranking: 16

18. Lincoln Financial Network

2016 Ranking: 19

17. Voya Financial

2016 Ranking: 20

16. Morgan Stanley Wealth Management

2016 Ranking: 15

15. Citigroup (CitiCorp)

2016 Ranking: 14

14. Chase

2016 Ranking: 12

13. LPL Financial

2016 Ranking: 17

12. PNC Wealth Management

2016 Ranking: 18

11. RBC Wealth Management

2016 Ranking: 10

10. Ameriprise Financial

2016 Ranking: 5

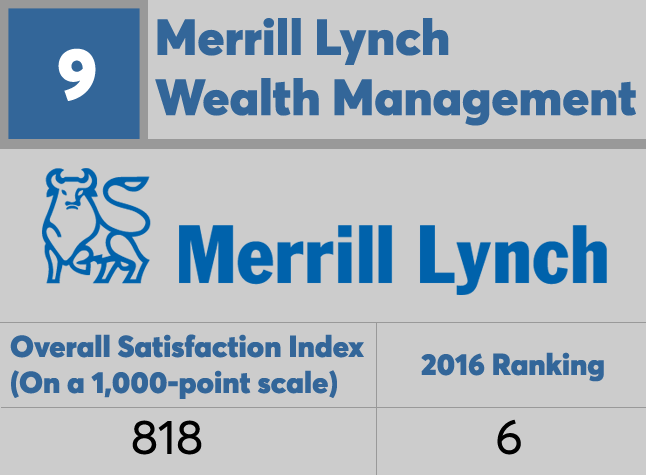

9. Merrill Lynch Wealth Management

2016 Ranking: 6

8. Raymond James

2016 Ranking: 7

7. Wells Fargo Advisors

2016 Ranking: 8

6. Stifel, Nicolaus & Company

2016 Ranking: 11

5. UBS Financial Services

2016 Ranking: 4

4. U.S. Bank

2016 Ranking: 9

3. Edward Jones

2016 Ranking: 2

2. Fidelity Investments

2016 Ranking: 3

1. Charles Schwab

2016 Ranking: 1