15 recruiting trends to watch next year

To say the least, 2017 was eventful when it comes to recruiting advisors. The Broker Protocol began to unravel, and the Department of Labor’s fiduciary rule was partially implemented. Plenty of questions loom over both these issues in 2018.

Meanwhile, a massive acquisition may cement a new leading firm’s headcount atop all others’ next year, while the changes in another part of the industry could also upset the traditional balance of power between regional firms and wirehouses.

For a detailed listing of recent hires, check the latest edition of

Additional reporting by Lee Conrad, Charles Paikert, Ann Marsh and Andrew Welsch

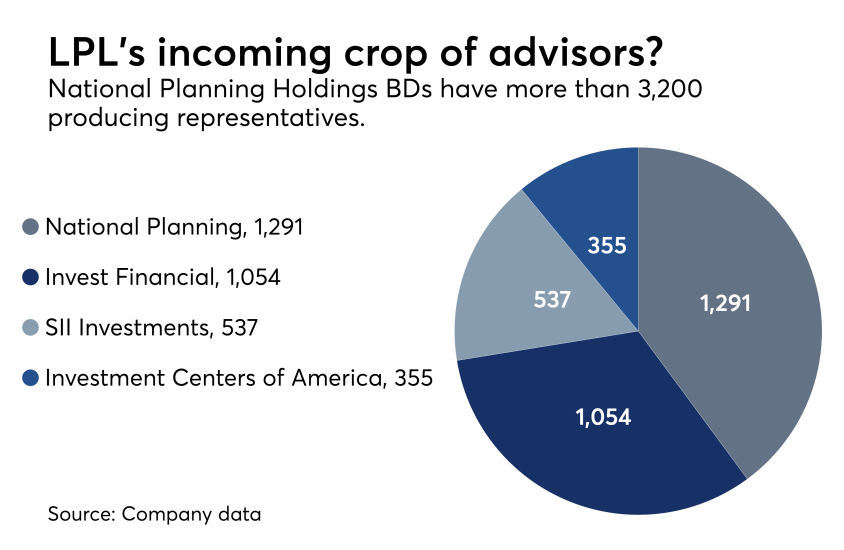

1. LPL’s massive acquisition touches off a recruiting fight

The deal

LPL has planned the transition of NPH’s assets and advisors to its platform

To read more,

2. Will the Broker Protocol collapse in 2018?

"My personal prediction is that protocol will unravel,” Stifel CEO Ron Kruszewski

To read more,

3. Will the fiduciary disruption spill into 2018?

Morgan Stanley

In the IBD space, LPL CEO Dan Arnold called the DoL rule

Firms in all parts of the industry

To read more,

4. Can Wells Fargo’s recruiting efforts overcome its scandal-plagued brand issues?

Though the firm reported in October that it snapped a three-quarter

The wirehouse’s ability to recruit aggressively will be complicated by

To read more,

5. Will the industry’s diversity improve in 2018?

The CFP Board and FPA

The longstanding lack of diversity in wealth management is a “grave” threat, Pershing Advisor Solutions CEO Mark Tibergien said in

“Our talent doesn’t reflect the face of our community, nor does it reflect what I think is important for the continuation of the independent financial advisor movement to address as a crisis,” Tibergien said.

To read more,

6. Will RIAs meet the succession challenge?

Many firms are finding that the quality of hires they attract depends on whether or not they have a succession plan in place, and on the quality of that plan.

On the other side of the same coin, subpar hires can suppress a firm's value and dim its succession prospects decades down the line.

To read more,

7. A missing component in the bank channel

There are a few exceptions. U.S. Bank

But as a group, the bank channel still lags in this respect.

To read more,

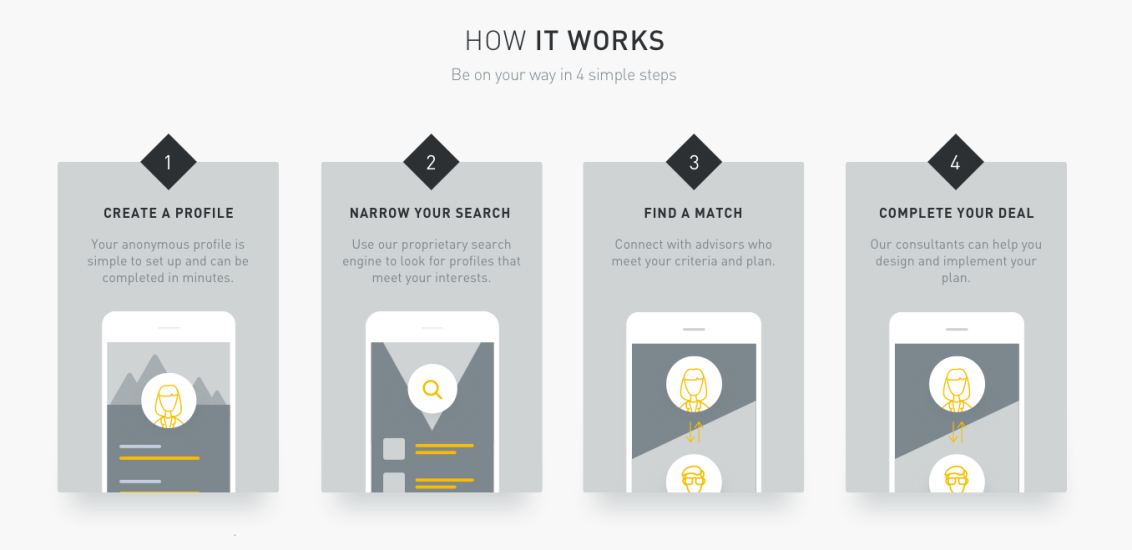

8. How tech will help recruiting while reducing the number of advisors

The number of advisors has dropped to roughly 301,000, down 11% from its peak in 2005, according

Firms like Morgan Stanley and Cetera Financial Group have unveiled such innovations, including Cetera’s

To read more,

9. Which breakaway brokers will the platforms add next?

HighTower's

To read more,

10. Can IBDs win and retain breakaway RIA advisors?

Major IBD players like LPL and Cetera are betting that tech and compliance support will help them retain so-called hybrid advisors, according

LPL recently

“These changes make the administrative and compliance services LPL provides through our corporate RIA platform more valuable than ever,” LPL Managing Director for National Sales and Consulting Andy Kalbaugh told advisors.

To read more,

11. Coming off a banner year for recruiting, can the regional BDs keep up the momentum in 2018?

RBC said it

While advisor moves to regionals hit new highs this year, the factors driving that momentum are not likely to dissipate any time soon.

“Regional firms have become very attractive places for advisors,” says headhunter Mark Elzweig. “Their environments are smaller and more flexible. And most every wirehouse advisor knows someone at a regional firm that is happy.”

To read more,

12. How will the industry leverage college planning programs?

The question remains whether the industry is doing enough to tap this incoming crop, however.

To read more,

13. What will be the next IBD consolidation?

Advisor Group’s Royal Alliance Associates ushered in

Both firms also grew this year

To read more,

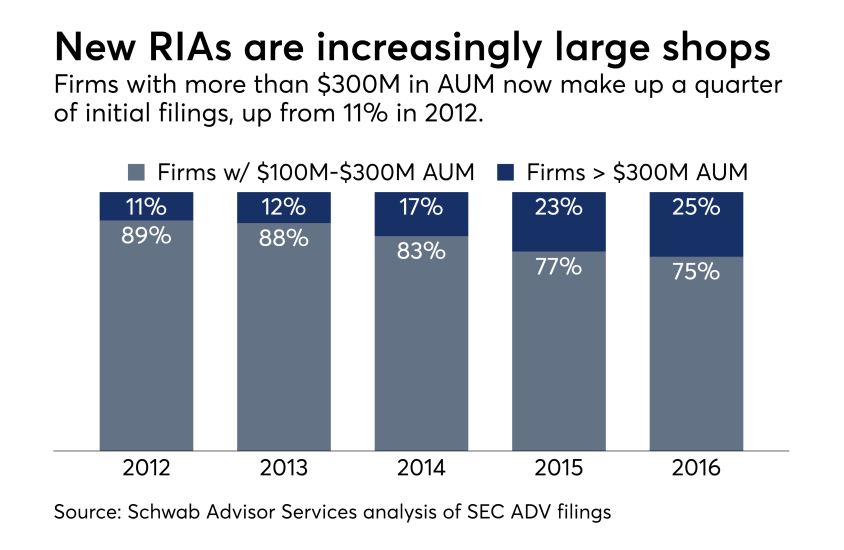

14. Which way will RIA M&A deal flow go?

"Acquisitions allow me to partner with top advisor talent and hire more qualified people because now I have greater resources," says Brent Brodeski, CEO of Rockford, Ill.-based Savant Capital Management. "For the same amount of time and energy that it takes to open a new office, I come out ahead if I buy one."

It should come as no surprise then, that 2017 is on track to

To read more,

15. Musical chairs in the bank channel

And that’s not likely to stop anytime soon. To be sure, the TPMs also spent a number of years on a consolidation spree, but two industry consultants say that pathway to growth

To read more,