FP50 2017: Which IBDs made the most in annuity sales?

Still, the No. 1 firm took in more than $915 million last year from annuities, more than twice as much as its nearest competitor. Together, the top 10 firms raked in nearly $2.8 billion in revenue. To get the full list, please click through our slideshow.

For a deep dive into the key issues shaping all types of revenue at IBDs, please see

The companies provided their annual revenue effective Dec. 31, 2016 for FP's survey.

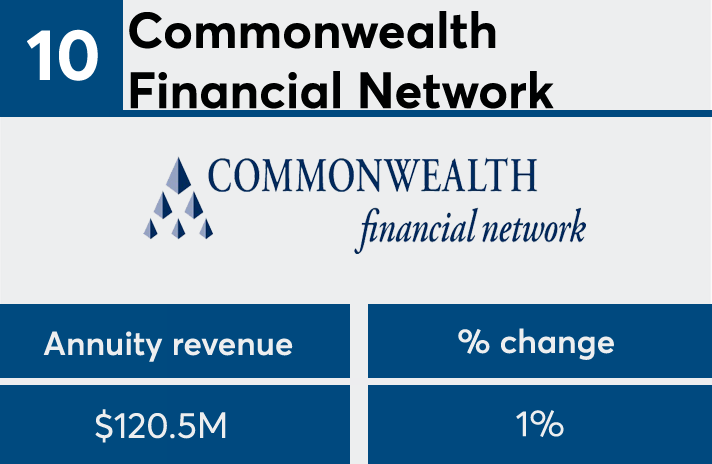

10. Commonwealth Financial Network

% change from 2015: 1%

9. Cambridge Investment Research

% change from 2015: 7%

8. MML Investors Services

% change from 2015: (10%)

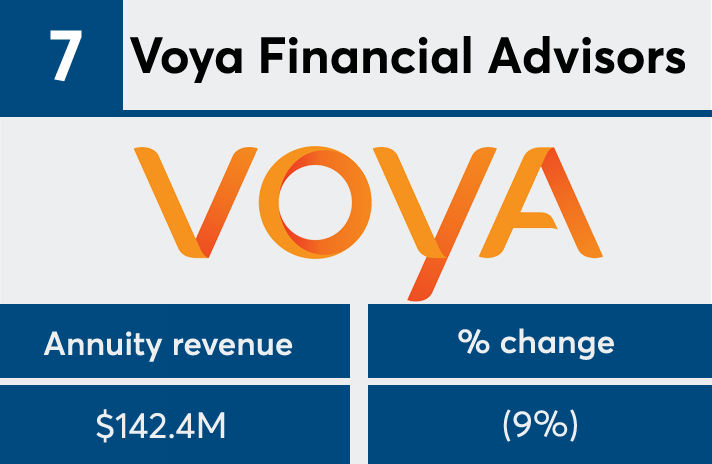

7. Voya Financial Advisors

% change from 2015: (9%)

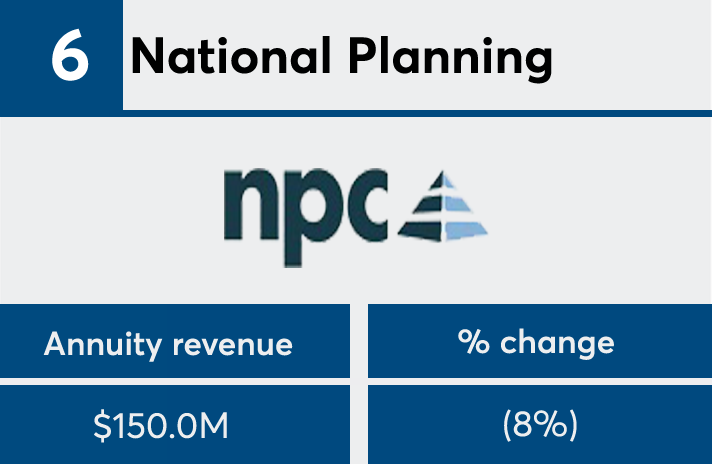

6. National Planning

% change from 2015: (8%)

5. Raymond James Financial Services

% change from 2015: (1%)

4. Lincoln Financial Network

% change from 2015: (4%)

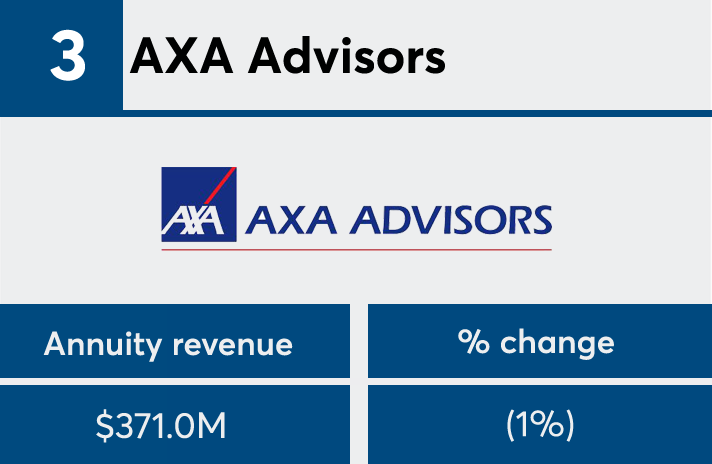

3. AXA Advisors

% change from 2015: (1%)

2. Ameriprise Financial

% change from 2015: (5%)

1. LPL Financial

% change from 2015: (7%)