Indeed, the entire volatility category, as defined by Morningstar, went haywire. There were 27 funds in that group, some pegged to volatility, others against it (either structured as an inverse fund, or shorting the VIX.) Of the 20 funds that have been in business at least one year, 17 posted a loss over the past 12 months. Of the 24 in business for at least six months, 21 posted losses. For one fund, it was even worse: Credit Suisse said it would be forced to liquidate an inverse ETP, effectively wiping out a fund whose market value topped $2 billion less than a month earlier.

The higher-returning funds in the volatility category were long the VIX, while the poorer-performing funds were short it, said Alex Bryan, Morningstar’s director of passive strategies research for North America.

“The short VIX products are extremely risky — people who buy them are betting against an increase in market volatility,” Bryan said via email. “When volatility spikes (and changes in volatility are tough to predict), you lose. The long VIX products are also risky, but a bit less so, since they pay off when volatility picks up, which often coincides with poor market performance,” he explained.

Despite the recent turbulence (and relatively high expense ratios), some of these funds still pulled in investor cash over the past year because they were profitable trades for a long time (when the market was calm and trending up). A lot of investors got lulled into sustained bull market complacency, Bryan said.

Scroll through to see the 20 worst-performing funds in the volatility category with more than $1 million in assets ranked by their one-year returns. We also show each fund’s three-year returns, one-year flows, expense ratios and total assets. Funds not old enough to have one-year return data were ranked by six-month returns. All data from Morningstar Direct.

20. VelocityShares Daily Inverse VIX MT ETN (ZIV)

3-Yr. Return: 18.83%

1-Yr. Flows (millions): $67.49

Expense Ratio: 1.35%

Net Assets (millions): $111.23

19. VelocityShares 1x Dly Invrs VSTOXXFtsETN (EXIV)

3-Yr. Return: N/A

1-Yr. Flows (millions): N/A

Expense Ratio: 1.35%

Net Assets (millions): $29.88

18. iPath S&P 500 Dynamic VIX ETN (XVZ)

3-Yr. Return: -8.98

1-Yr. Flows (millions): $13.41

Expense Ratio: 0.95%

Net Assets (millions): $21.15

17. VelocityShares 1x Long VSTOXX Futs ETN (EVIX)

3-Yr. Return: N/A

1-Yr. Flows (millions): N/A

Expense Ratio: 1.35%

Net Assets (millions): $16.43

16. VelocityShares VIX MT ETN (VIIZ)

3-Yr. Return: -26.54

1-Yr. Flows (millions): $0.38

Expense Ratio: 0.89%

Net Assets (millions): $1.20

15. iPath S&P 500 VIX MT Futures ETN (VXZ)

3-Yr. Return: -26.55%

1-Yr. Flows (millions): $24.09

Expense Ratio: 0.89%

Net Assets (millions): $28.92

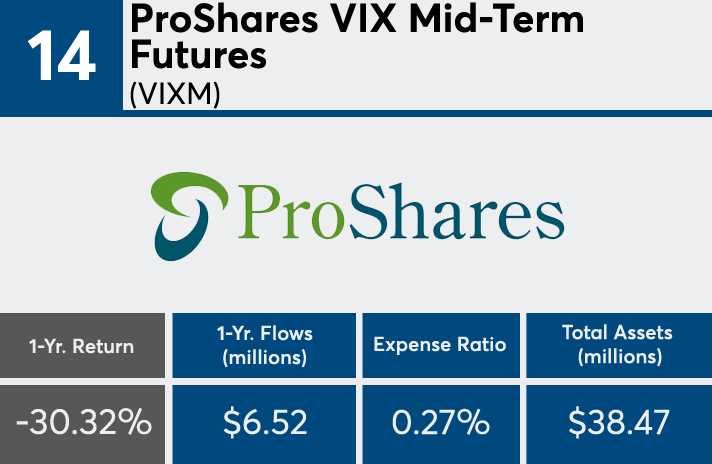

14. ProShares VIX Mid-Term Futures (VIXM)

3-Yr. Return: -26.73%

1-Yr. Flows (millions): $6.52

Expense Ratio: 0.27%

Net Assets (millions): $38.47

13. iPath S&P 500 VIX ST Futures ETN (VXX)

3-Yr. Return: -54.42%

1-Yr. Flows (millions): $756.24

Expense Ratio: 0.89%

Net Assets (millions): $1,386.25

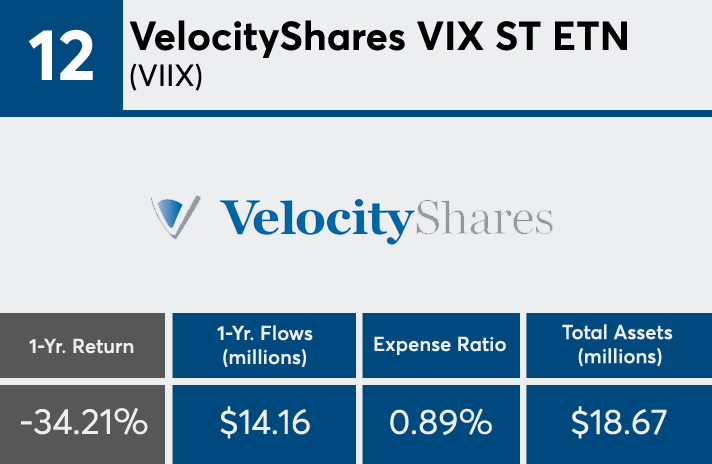

12. VelocityShares VIX ST ETN (VIIX)

3-Yr. Return: 54.42%

1-Yr. Flows (millions): $14.16

Expense Ratio: 0.89%

Net Assets (millions): $18.67

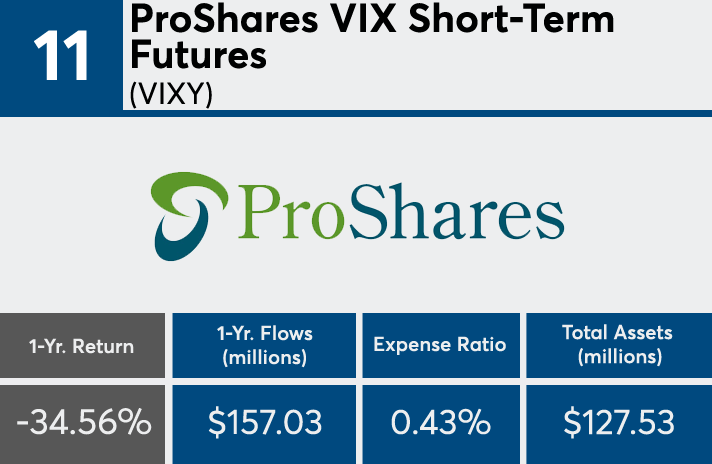

11. ProShares VIX Short-Term Futures (VIXY)

3-Yr. Return: -54.46%

1-Yr. Flows (millions): $157.03

Expense Ratio: 0.43%

Net Assets (millions): $127.53

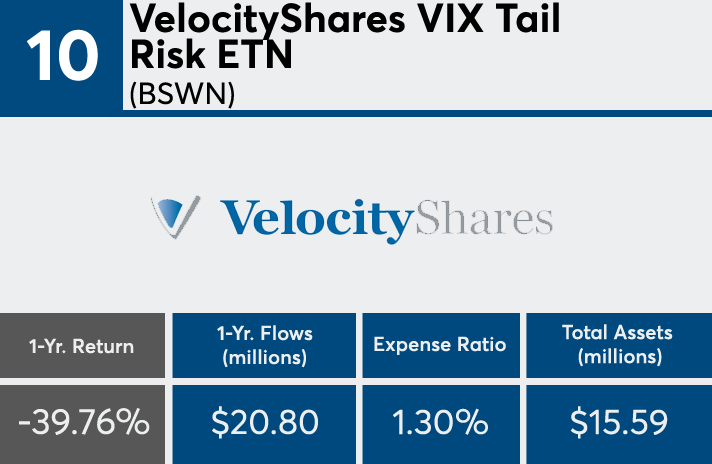

10. VelocityShares VIX Tail Risk ETN (BSWN)

3-Yr. Return: N/A

1-Yr. Flows (millions): $20.80

Expense Ratio: 1.30%

Net Assets (millions): $15.59

9. VelocityShares VIX Variable L/S ETN (LSVX)

3-Yr. Return: N/A

1-Yr. Flows (millions): $0.03

Expense Ratio: 1.30%

Net Assets (millions): $12.27

8. Rex VolMaxx Lng VIX Wkly Futs Strat ETF (VMAX)

3-Yr. Return: N/A

1-Yr. Flows (millions): $3.95

Expense Ratio: 2.90%

Net Assets (millions): $6.10

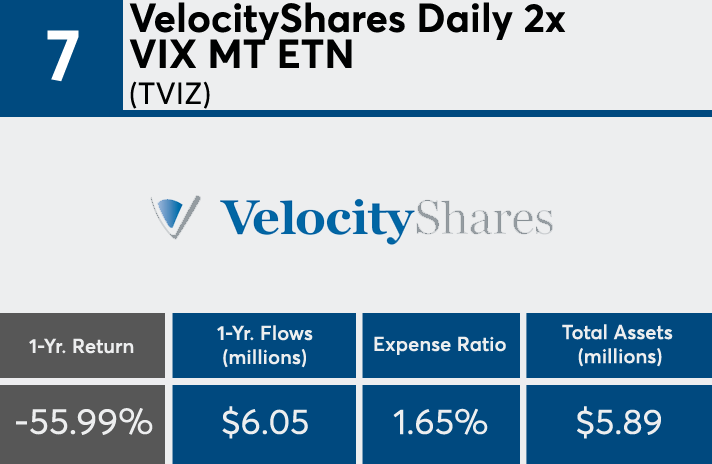

7. VelocityShares Daily 2x VIX MT ETN (TVIZ)

3-Yr. Return: -52.02%

1-Yr. Flows (millions): $6.05

Expense Ratio: 1.65%

Net Assets (millions): $5.89

6. VelocityShares VIX Shrt Volatil Hdg ETN (XIVH)

3-Yr. Return: N/A

1-Yr. Flows (millions): ($0.14)

Expense Ratio: 1.30%

Net Assets (millions): $15.04

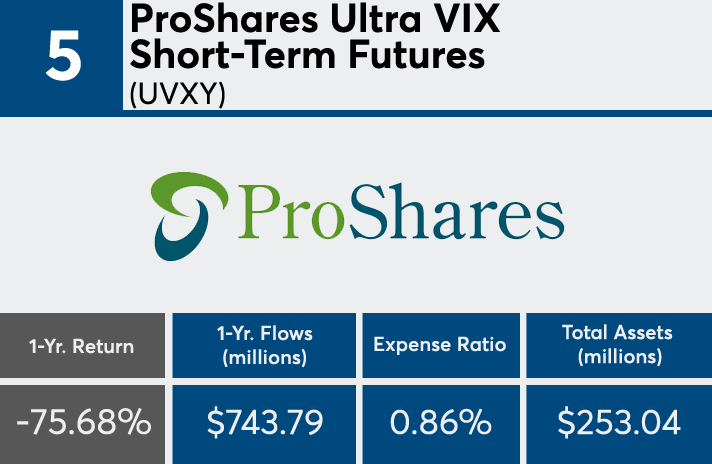

5. ProShares Ultra VIX Short-Term Futures (UVXY)

3-Yr. Return: -87.82%

1-Yr. Flows (millions): $743.79

Expense Ratio: 0.86%

Net Assets (millions): $253.04

4. VelocityShares Daily 2x VIX ST ETN (TVIX)

3-Yr. Return: -88.28%

1-Yr. Flows (millions): $581.22

Expense Ratio: 1.65%

Net Assets (millions): $387.33

3. ProShares Short VIX Short-Term Futures (SVXY)

3-Yr. Return: -26.32%

1-Yr. Flows (millions): $559.48

Expense Ratio: 0.83%

Net Assets (millions): $803.23

2. REX VolMAXX Short VIX Wkly FutsStratETF (VMIN)

3-Yr. Return: N/A

1-Yr. Flows (millions): $8.35

Expense Ratio: 3.13%

Net Assets (millions): $5.82

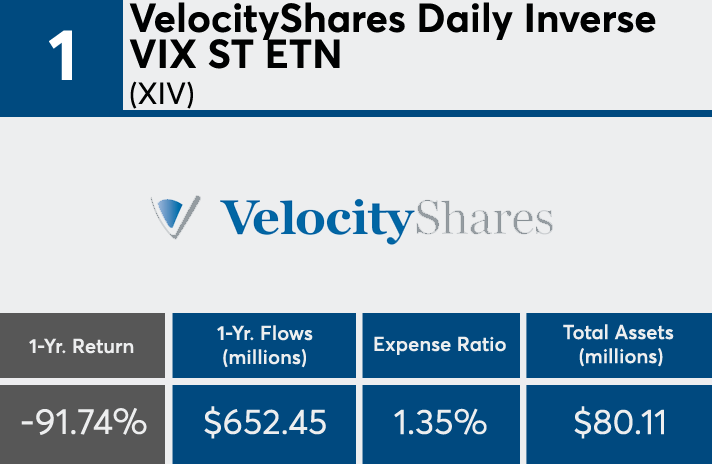

1. VelocityShares Daily Inverse VIX ST ETN (XIV)

3-Yr. Return: -43.20%

1-Yr. Flows (millions): $652.45

Expense Ratio: 1.35%

Net Assets (millions): $80.11