New Data on the Wealthiest Clients: What Advisors Need to Know

As wealthy clients get richer, they are looking not only for help managing their wealth, but for assistance with a broad range of needs, from preparing their heirs to steward the family fortune to strategies around impact investing.

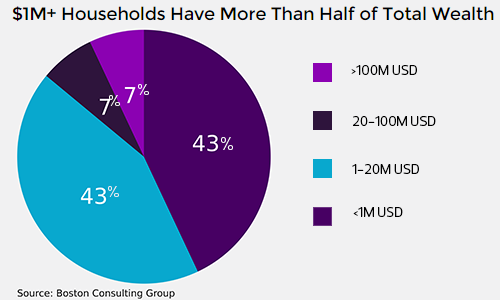

Recent surveys from Boston Consulting Group, U.S. Trust, and Capgemini Financial Services with RBC Wealth Management highlight key trends among wealthy and ultrawealthy individuals. --Andrew Welsch

Click through to learn about the most important trends or view as a single page here.

Graphs created with Datavisu.al

New Data on the Wealthiest Clients: What Advisors Need to Know

Graphs created with Datavisu.al

New Data on the Wealthiest Clients: What Advisors Need to Know

"Markets going up can still mask a weak engine for capturing net new assets," says Bruce Holley, a senior partner at Boston Consulting Group, which does an annual study of global wealth.

Graphs created with Datavisu.al

New Data on the Wealthiest Clients: What Advisors Need to Know

Business models have converged, Holley says, making it more difficult for firms to stand out in a crowded marketplace.

"It is increasingly more difficult [for clients] to differentiate between a trust, a bank and a brokerage firm," he says.

Graphs created with Datavisu.al

New Data on the Wealthiest Clients: What Advisors Need to Know

"They want to delve deeper into important personal and family matters, such as philanthropy, values-based and eldercare planning and teaching their children financial skills. ... There is a huge opportunity and necessity for advisors to broaden the conversation and better communicate with their clients to help them truly achieve their goals," Heilmann says.

U.S. Trust's recent study surveyed 640 wealthy investors with at least $3 million in investable assets, not including the value of their primary home.

Graphs created with Datavisu.al

New Data on the Wealthiest Clients: What Advisors Need to Know

"Part of this may be that the bull market is aging, and that may be weighing on some investors' minds," says Keith Banks, president of U.S. Trust.

Graphs created with Datavisu.al

New Data on the Wealthiest Clients: What Advisors Need to Know

"Over 90% of high-net-worth individuals say it's important to spend time driving social impact. But we found there's a gap between the support they're getting and what they'd like to get, especially among younger clients."

Graphs created with Datavisu.al

New Data on the Wealthiest Clients: What Advisors Need to Know

U.S. Trust's Heilmann says that this concern has showed up in previous studies, which led U.S. Trust to create a financial literacy program for clients' adult and teenage children, to help better prepare them for their inheritance.

"This is something that we at U.S. Trust took very seriously," he says.

Graphs created with Datavisu.al

New Data on the Wealthiest Clients: What Advisors Need to Know

Graphs created with Datavisu.al