We looked at the top strata of the mutual fund industry (the largest 100 funds) and ranked them by their cash holdings. The average cash position for these largest funds was about 9%; the median was 5.8%.

To be sure, this metric can be trickier than expected because there are different measures of what constitutes cash. Indeed, a fund can have long, short, net or long-rescaled cash positions, which can all be drastically different numbers. Funds that invest in currencies, or short positions, keep cash on hand as collateral. Sometimes that can be in the form of short-term T-bills, which are counted as cash-equivalent. So some measures of cash positions, while technically correct, are less meaningful than others to most investors. This list uses “net cash positions.”

In fact, we ran a list of funds last week using the long-rescaled cash metric, which we later decided was not as relevant to most clients as it could be. This list uses “net cash positions.”

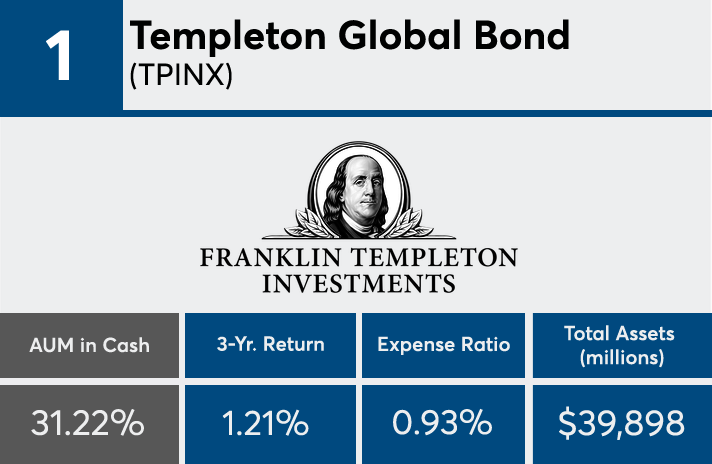

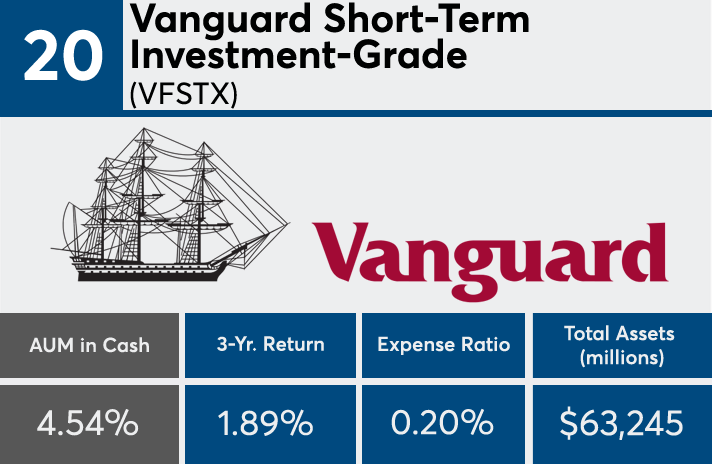

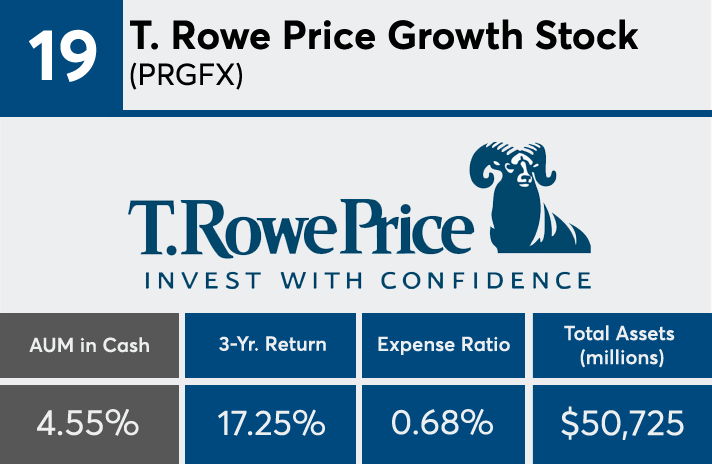

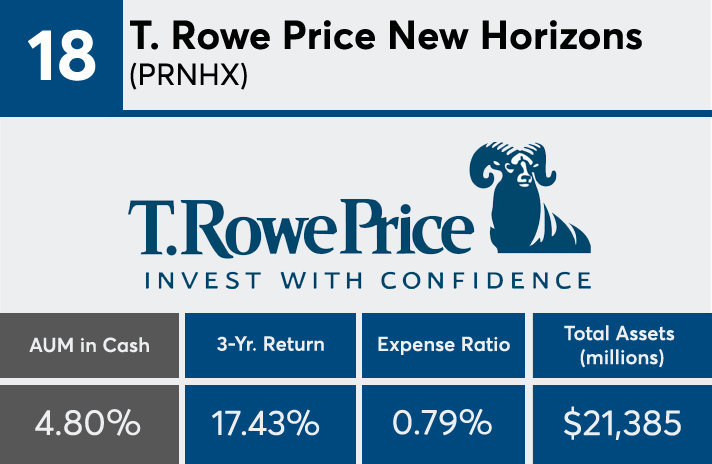

Scroll through to see the largest funds with the highest net cash positions. All data from Morningstar Direct.

20. Vanguard Short-Term Investment-Grade (VFSTX)

19. T. Rowe Price Growth Stock (PRGFX)

18. T. Rowe Price New Horizons (PRNHX)

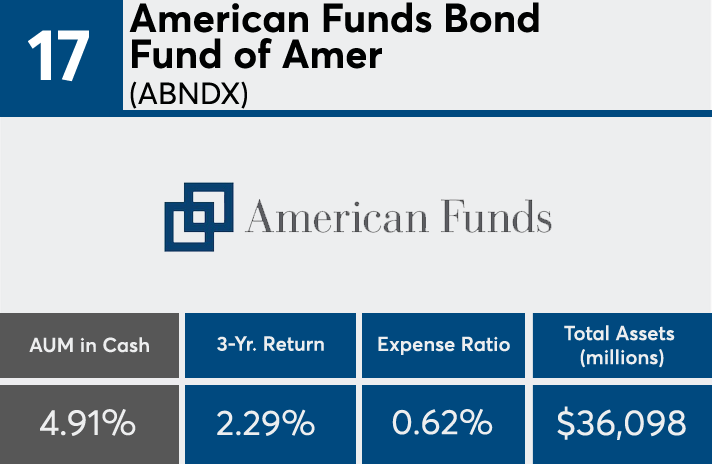

17. American Funds Bond Fund of Amer (ABNDX)

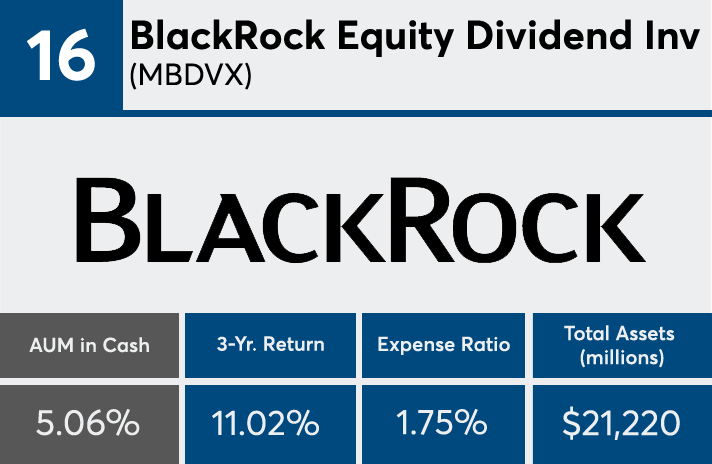

16. BlackRock Equity Dividend Inv (MBDVX)

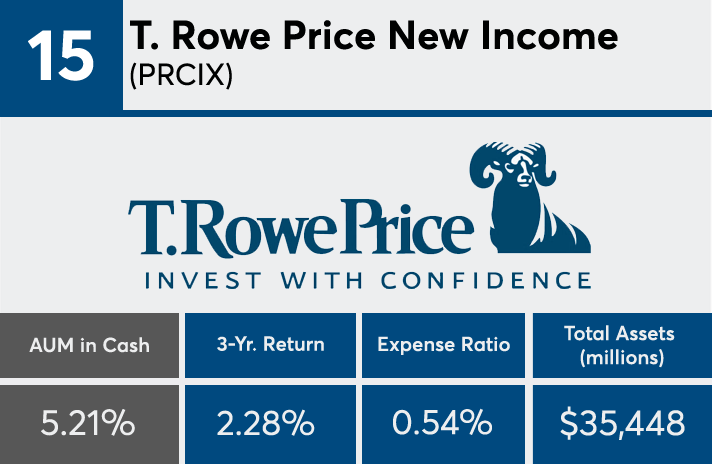

15. T. Rowe Price New Income (PRCIX)

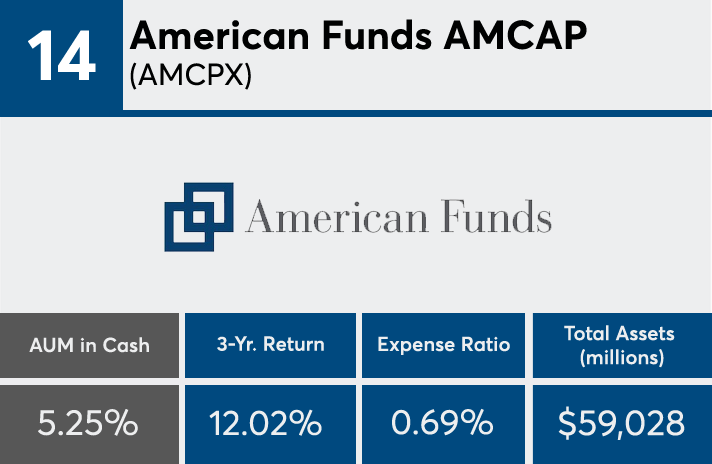

14. American Funds AMCAP (AMCPX)

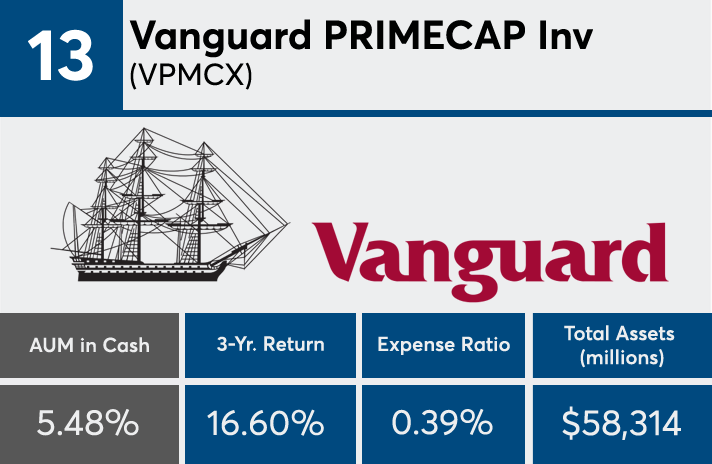

13. Vanguard PRIMECAP Inv (VPMCX)

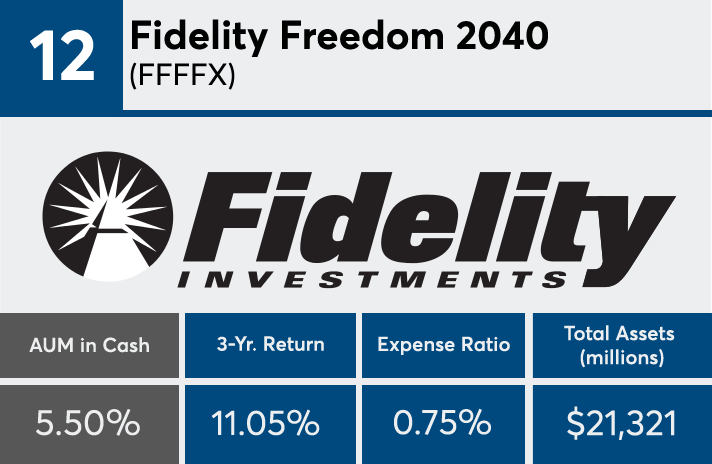

12. Fidelity Freedom 2040 (FFFFX)

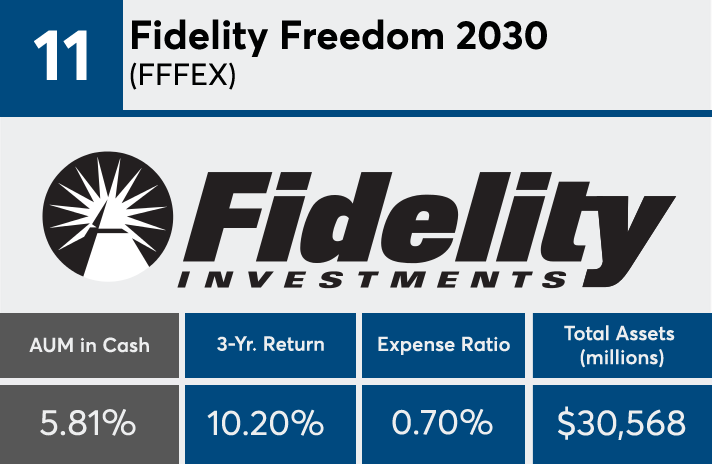

11. Fidelity Freedom 2030 (FFFEX)

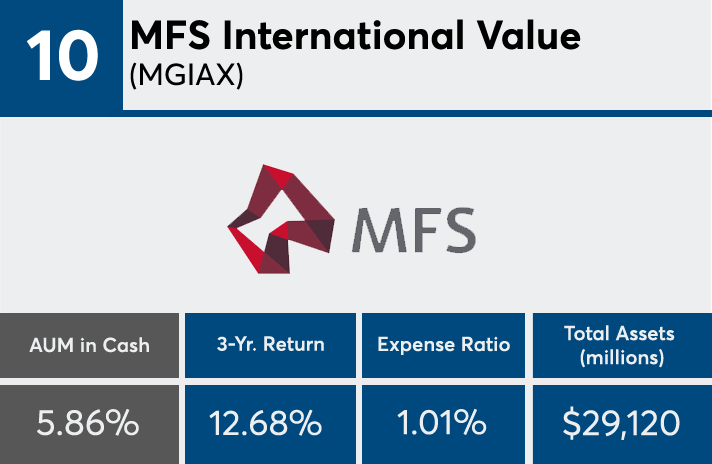

10. MFS International Value (MGIAX)

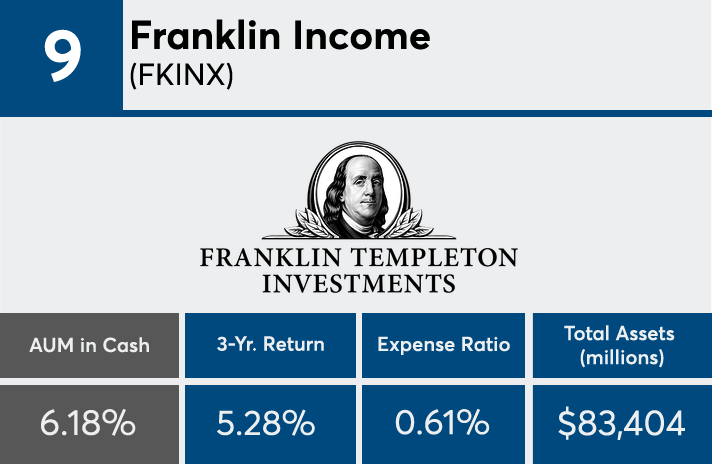

9. Franklin Income (FKINX)

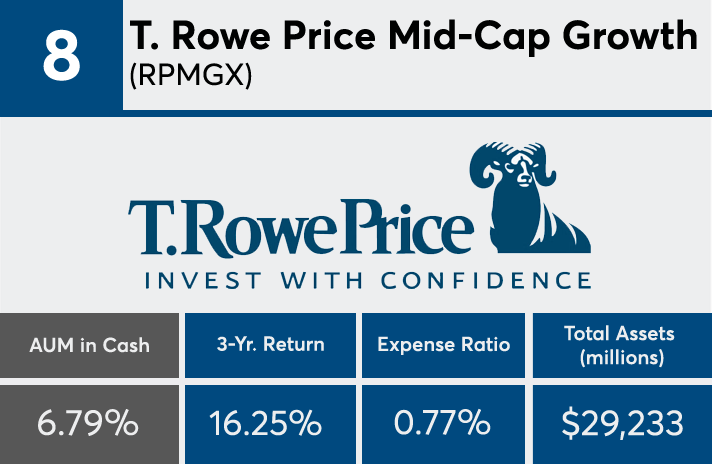

8. T. Rowe Price Mid-Cap Growth (RPMGX)

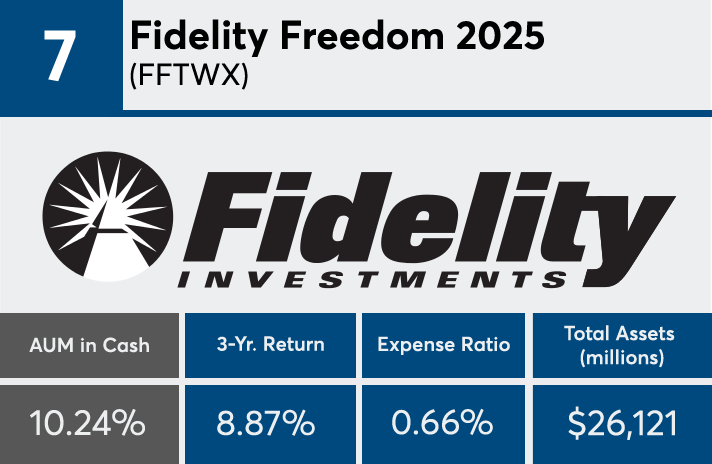

7. Fidelity Freedom 2025 (FFTWX)

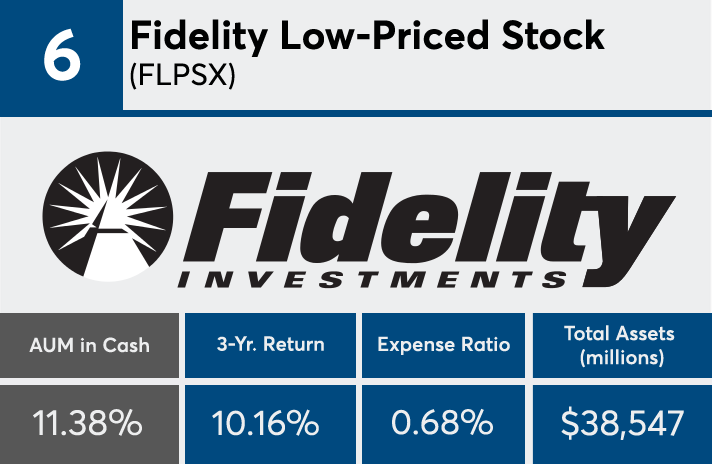

6. Fidelity Low-Priced Stock (FLPSX)

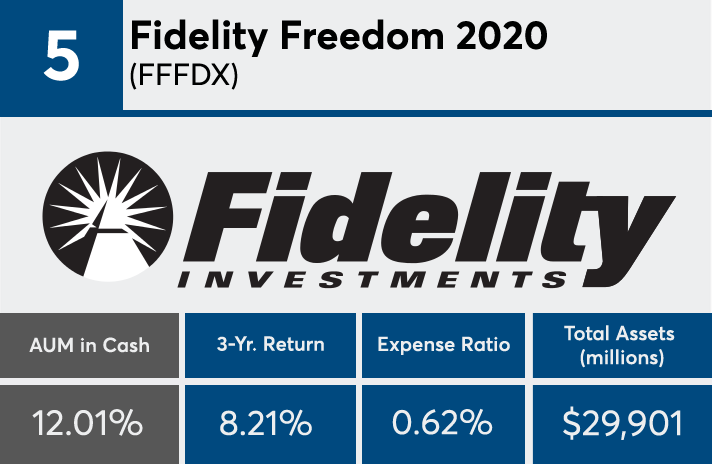

5. Fidelity Freedom 2020 (FFFDX)

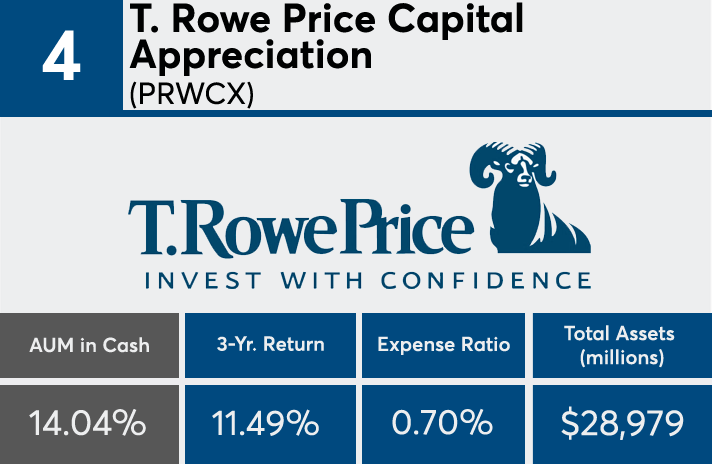

4. T. Rowe Price Capital Appreciation (PRWCX)

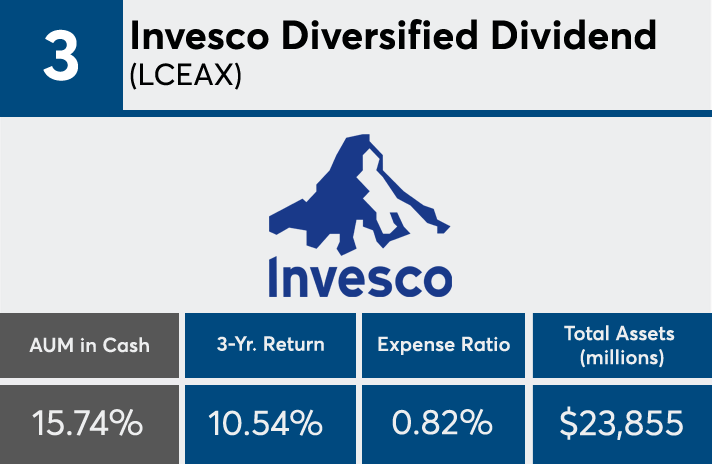

3. Invesco Diversified Dividend (LCEAX)

2. First Eagle Global (SGENX)