Even though high P/E ratios can be a caution signal for investors, “they do not necessarily mean the market is overvalued,” says Greg McBride, chief financial analyst at Bankrate. “Strong corporate earnings growth might already be discounted in the price of the market or an individual security,” he says.

He notes that sectors can be very different in terms of valuations. “P/E ratios for certain companies or certain sectors might be elevated, or at very low levels, to reflect the growth expectations, or lack thereof,” McBride says. “High P/E companies and sectors are fast growers, but must maintain that growth rate to sustain the valuation. Low P/E companies and sectors can be great values, or they can be discarded by investors if their valuation reflects problems on the horizon.”

Scroll through to see the 20 mutual funds with the lowest P/E ratios, as well as their 12-month returns, five-year returns, expense ratios and assets. We have a tie this time at the top of the list, which we indicated in the slides. And those funds with loads also are indicated beneath the data slides. All data from Morningstar.

20. Fidelity Series Floating Rate Hi Inc (FFHCX)

1-Yr. Return: 5.10%

5-Yr. Return: 3.74%

Expense Ratio: 0.01%

Net Assets (millions): $462.07

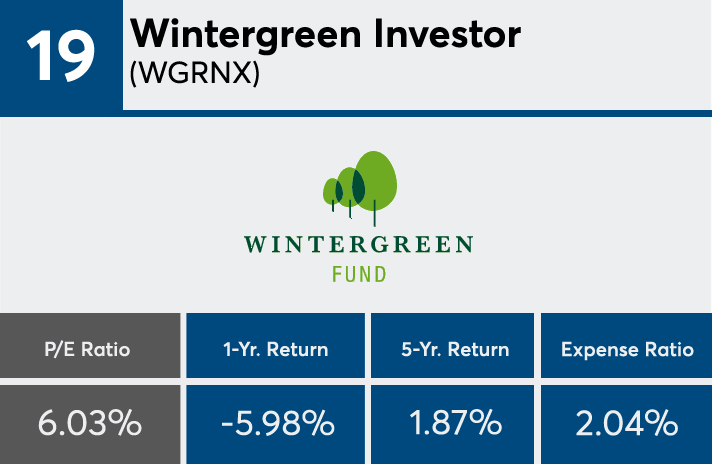

19. Wintergreen Investor (WGRNX)

1-Yr. Return: -5.98%

5-Yr. Return: 1.87%

Expense Ratio: 2.04%

Net Assets (millions): $271.90

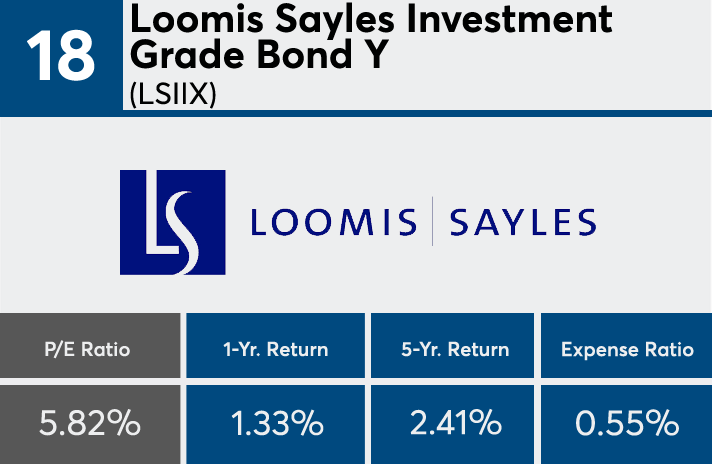

18. Loomis Sayles Investment Grade Bond Y (LSIIX)

1-Yr. Return: 1.33%

5-Yr. Return: 2.41%

Expense Ratio: 0.55%

Net Assets (millions): $5,684.80

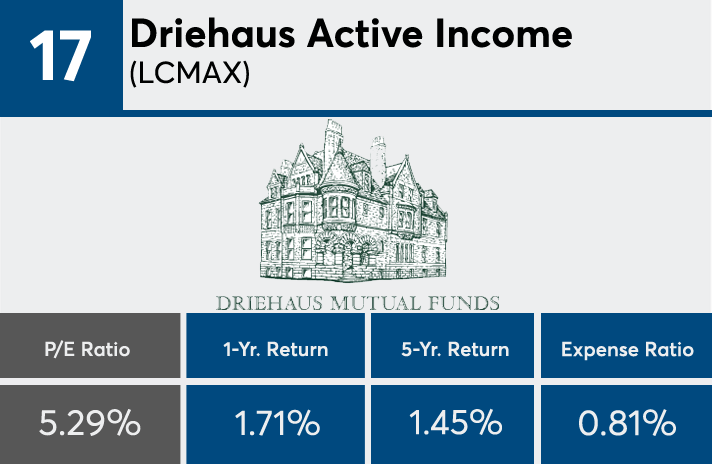

17. Driehaus Active Income (LCMAX)

1-Yr. Return: 1.71%

5-Yr. Return: 1.45%

Expense Ratio: 0.81%

Net Assets (millions): $1,576.16

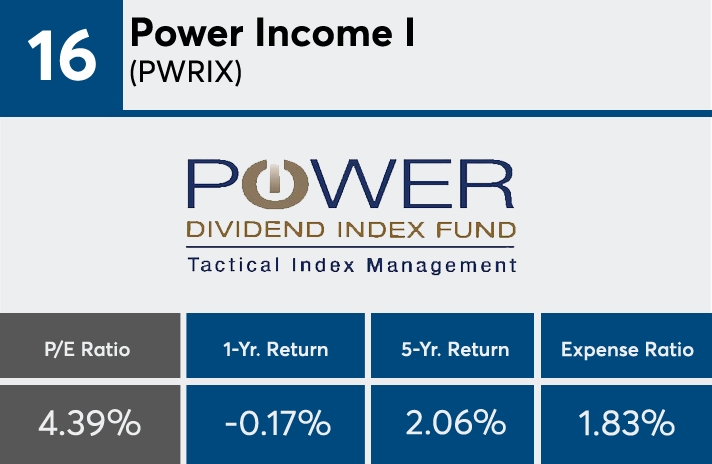

16. Power Income I (PWRIX)

1-Yr. Return: -0.17%

5-Yr. Return: 2.06%

Expense Ratio: 1.83%

Net Assets (millions): $167.30

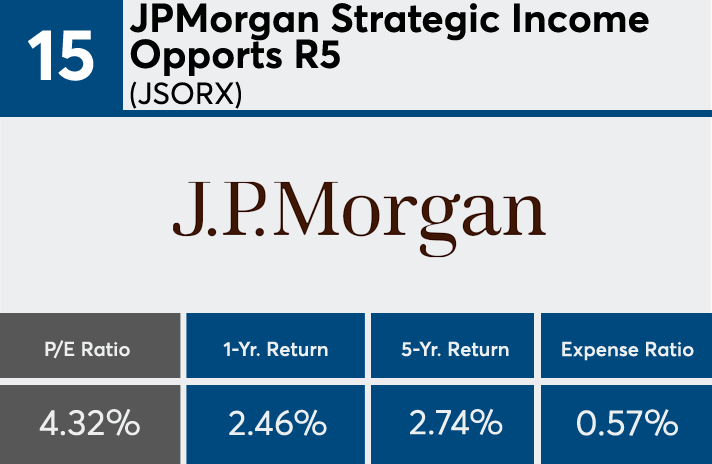

15. JPMorgan Strategic Income Opports R5 (JSORX)

1-Yr. Return: 2.46%

5-Yr. Return: 2.74%

Expense Ratio: 0.57%

Net Assets (millions): $12,338.14

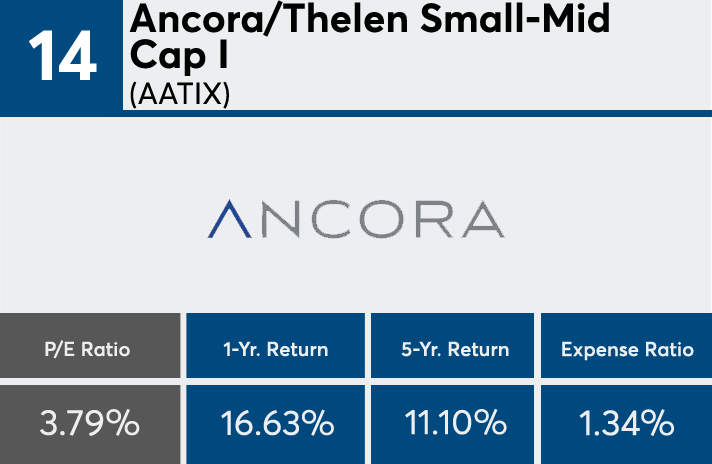

14. Ancora/Thelen Small-Mid Cap I (AATIX)

1-Yr. Return: 16.63%

5-Yr. Return: 11.10%

Expense Ratio: 1.34%

Net Assets (millions): $114.50

13. Putnam High Yield A (PHYIX)

1-Yr. Return: 2.76%

5-Yr. Return: 4.36%

Expense Ratio: 1.03%

Net Assets (millions): $1,462.14

Front Load: 4.00%

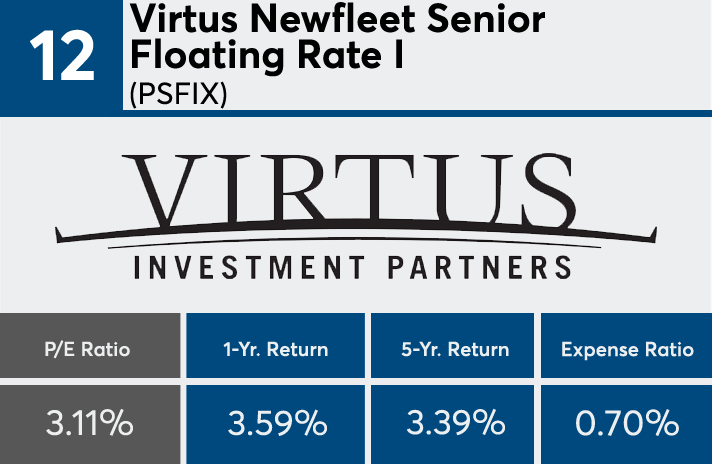

12. Virtus Newfleet Senior Floating Rate I (PSFIX)

1-Yr. Return: 3.59%

5-Yr. Return: 3.39%

Expense Ratio: 0.70%

Net Assets (millions): $515.21

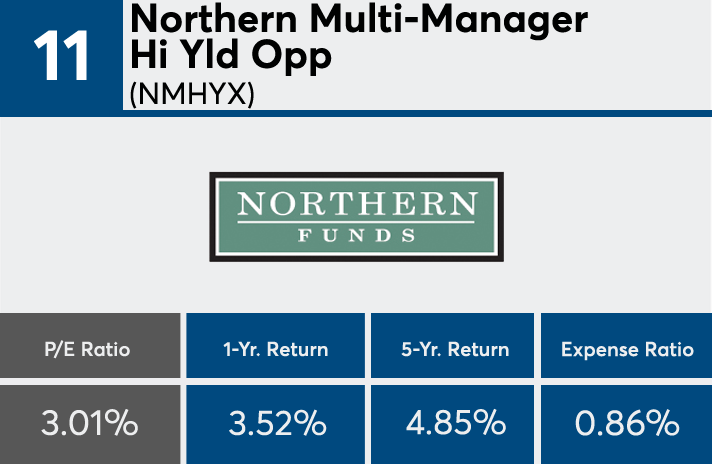

11. Northern Multi-Manager Hi Yld Opp (NMHYX)

1-Yr. Return: 3.52%

5-Yr. Return: 4.85%

Expense Ratio: 0.86%

Net Assets (millions): $280.41

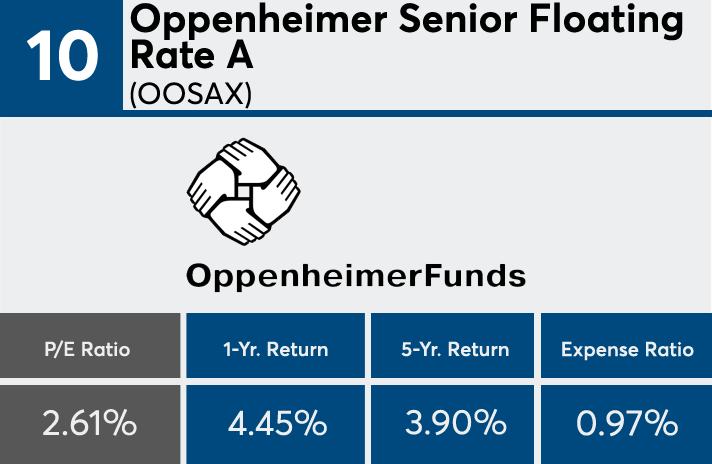

10. Oppenheimer Senior Floating Rate A (OOSAX)

1-Yr. Return: 4.45%

5-Yr. Return: 3.90%

Expense Ratio: 0.97%

Net Assets (millions): $15,113.11

Front Load: 3.50%

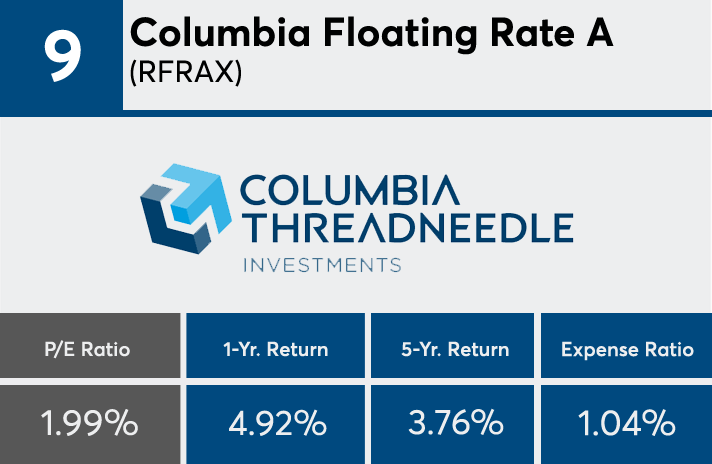

9. Columbia Floating Rate A (RFRAX)

1-Yr. Return: 4.92%

5-Yr. Return: 3.76%

Expense Ratio: 1.04%

Net Assets (millions): $1,228.12

Front Load: 3.00%

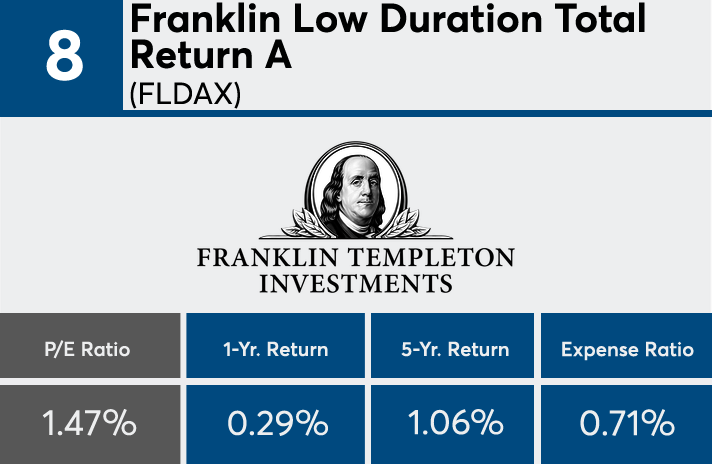

8. Franklin Low Duration Total Return A (FLDAX)

1-Yr. Return: 0.29%

5-Yr. Return: 1.06%

Expense Ratio: 0.71%

Net Assets (millions): $2,667.53

Front Load: 2.25%

7. Nuveen Symphony Floating Rate Income I (NFRIX)

1-Yr. Return: 3.75%

5-Yr. Return: 3.90%

Expense Ratio: 0.74%

Net Assets (millions): $2,284.85

Front Load: 2.25%

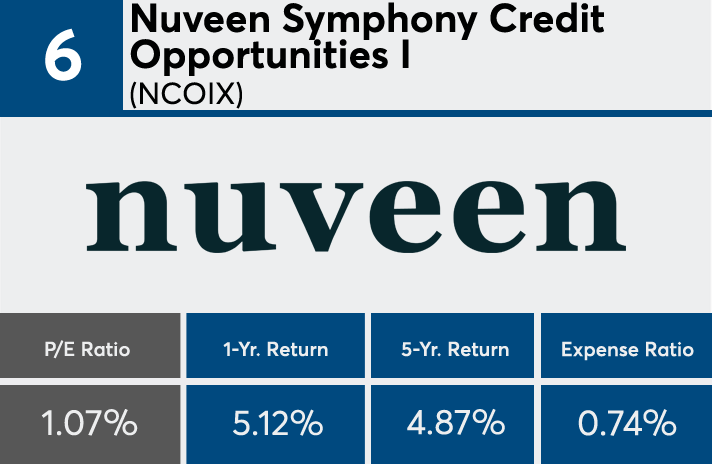

6. Nuveen Symphony Credit Opportunities I (NCOIX)

1-Yr. Return: 5.12%

5-Yr. Return: 4.87%

Expense Ratio: 0.74%

Net Assets (millions): $703.19

5. Highland Global Allocation A (HCOAX)

1-Yr. Return: 2.35%

5-Yr. Return: 5.03%

Expense Ratio: 1.17%

Net Assets (millions): $443.72

Front Load: 5.75%

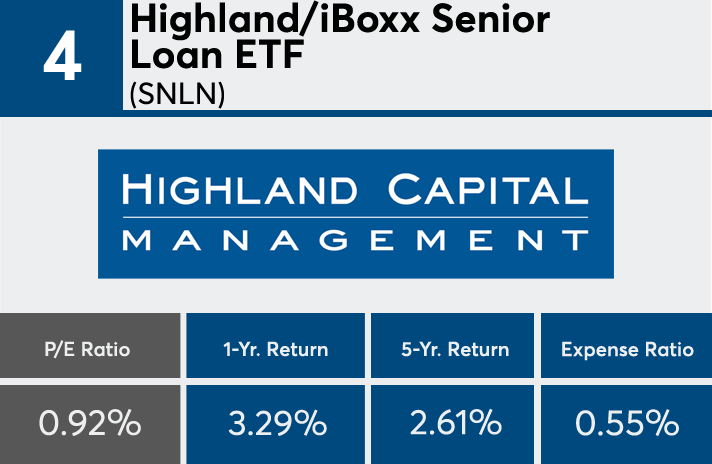

4. Highland/iBoxx Senior Loan ETF (SNLN)

1-Yr. Return: 3.29%

5-Yr. Return: 2.61%

Expense Ratio: 0.55%

Net Assets (millions): $609.17

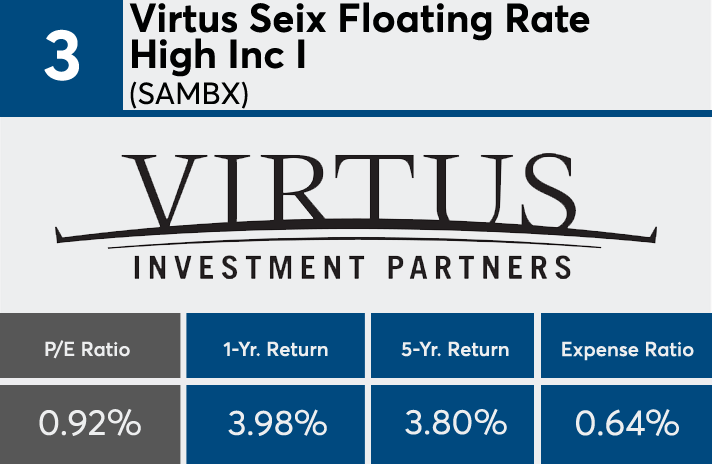

3. Virtus Seix Floating Rate High Inc I (SAMBX)

1-Yr. Return: 3.98%

5-Yr. Return: 3.80%

Expense Ratio: 0.64%

Net Assets (millions): $3,367.05

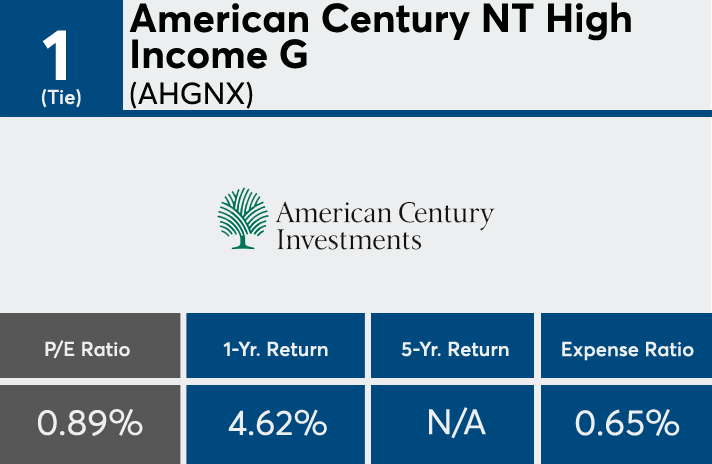

1. (Tie) American Century NT High Income G (AHGNX)

1-Yr. Return: 4.62%

5-Yr. Return: N/A

Expense Ratio: 0.65%

Net Assets (millions): $804.20

1. (Tie) Putnam Floating Rate Income A (PFLRX)

1-Yr. Return: 3.82%

5-Yr. Return: 3.15%

Expense Ratio: 1.03%

Net Assets (millions): $781.03

Front Load: 1.00%