Indeed, the S&P 500 has posted an impressive 13.8% annualized gain for the past five years, as measured by the biggest ETF that tracks the benchmark index (SPY). Over the past year, it’s even better at 16.8%.

But underlying those impressive returns — the part too often ignored by clients — is a level of risk that can creep up to an unwarranted level for the corresponding returns.

The Sharpe Ratio helps illustrate whether a high return was the result of excess risk taking compared to similar funds, says Tom Roseen, head of research services at Lipper. “The best fund is not necessarily the one with the highest return, but the one with the most superior risk-adjusted return,” he says.

“Historically, some folks would say a Sharpe of 2 or greater is what was needed,” he adds. “However, I look at Sharpe as a ranking tool.”

Greg McBride, chief financial analyst at Bankrate, illustrates this idea with a story that any client can relate to. “It’s one thing to get to the airport in time for your flight, but what did it take to get there? Was it a white-knuckle ride weaving in and out of traffic, or a leisurely, low-stress ride with plenty of time to spare? The ride that gets you to the airport without the stress is the one with the higher Sharpe Ratio.”

So in the name of metaphorical low-stress rides to the airport — i.e., returns without the volatility — we collected the mutual funds and ETFs with the best risk-adjusted returns.

Scroll through to see the 20 funds with the highest three-year Sharpe Ratios. Only funds with at least $100 million in assets were included. We also show three-year returns, assets and, as usual, expense ratios for each fund. All data from Morningstar Direct.

20. Fidelity Select Software & IT Svcs Port (FSCSX)

3-Yr. Sharpe Ratio: 1.45%

Expense Ratio: 0.73%

Total Assets (millions): $5,913.78

19. iShares Edge MSCI USA Momentum Fctr ETF (MTUM)

3-Yr. Sharpe Ratio: 1.468%

Expense Ratio: 0.15%

Total Assets (millions): $9,448.39

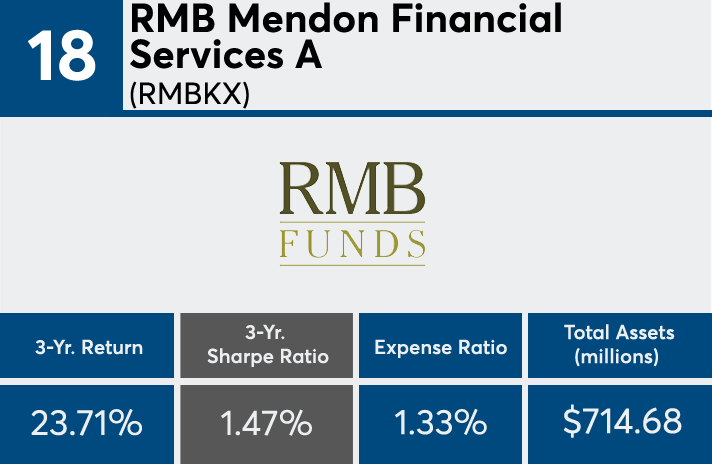

18. RMB Mendon Financial Services A (RMBKX)

3-Yr. Sharpe Ratio: 1.471%

Expense Ratio: 1.33%

Total Assets (millions): $714.68

Front Load: 5.00%

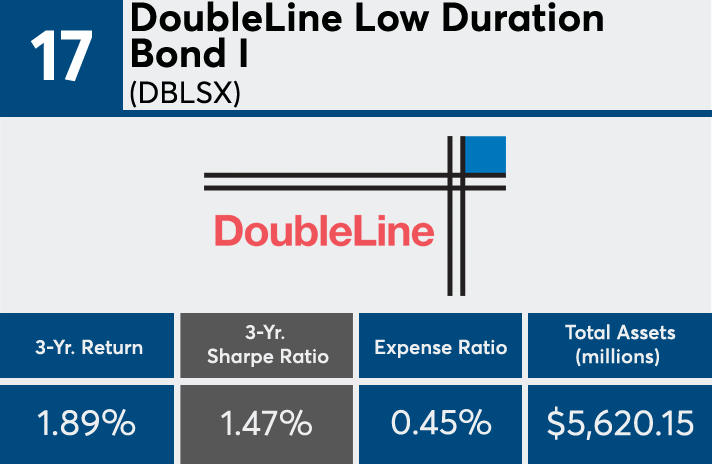

17. DoubleLine Low Duration Bond I (DBLSX)

3-Yr. Sharpe Ratio: 1.473%

Expense Ratio: 0.45%

Total Assets (millions): $5,620.15

16. Invesco Dynamic Software ETF (PSJ)

3-Yr. Sharpe Ratio: 1.48%

Expense Ratio: 0.63%

Total Assets (millions): $206.25

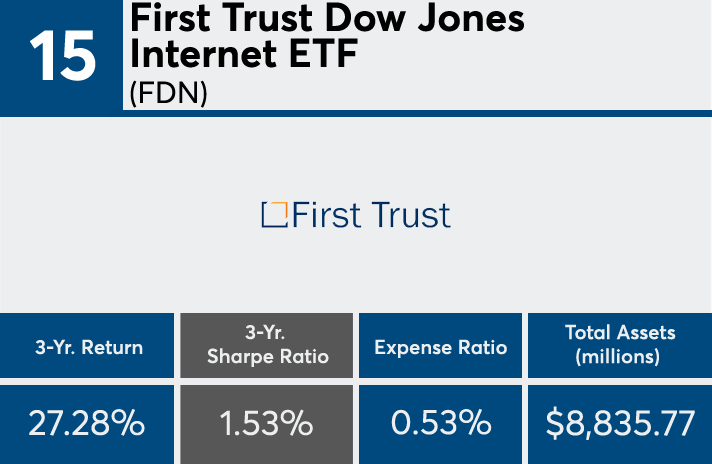

15. First Trust Dow Jones Internet ETF (FDN)

3-Yr. Sharpe Ratio: 1.53%

Expense Ratio: 0.53%

Total Assets (millions): $8,835.77

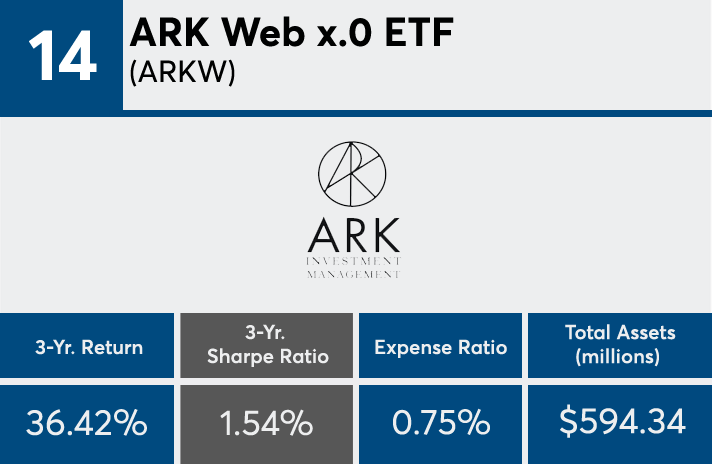

14. ARK Web x.0 ETF (ARKW)

3-Yr. Sharpe Ratio: 1.54%

Expense Ratio: 0.75%

Total Assets (millions): $594.34

13. Zeo Strategic Income I (ZEOIX)

3-Yr. Sharpe Ratio: 1.55%

Expense Ratio: 1.06%

Total Assets (millions): $289.83

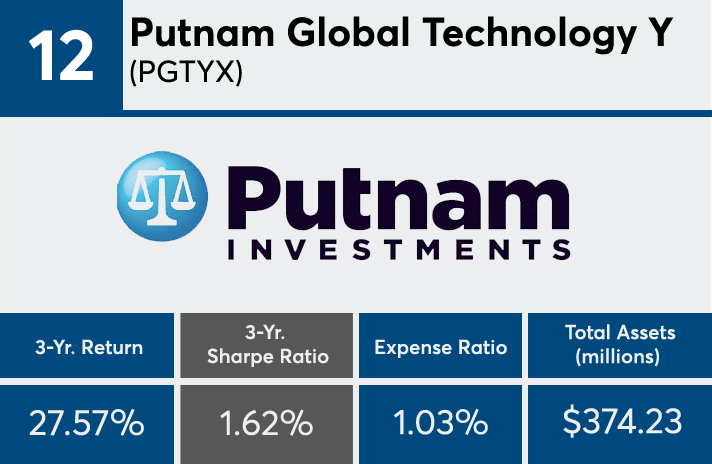

12. Putnam Global Technology Y (PGTYX)

3-Yr. Sharpe Ratio: 1.62%

Expense Ratio: 1.03%

Total Assets (millions): $374.23

11. Hennessy Japan Small Cap Investor (HJPSX)

3-Yr. Sharpe Ratio: 1.67%

Expense Ratio: 1.61%

Total Assets (millions): $245.42

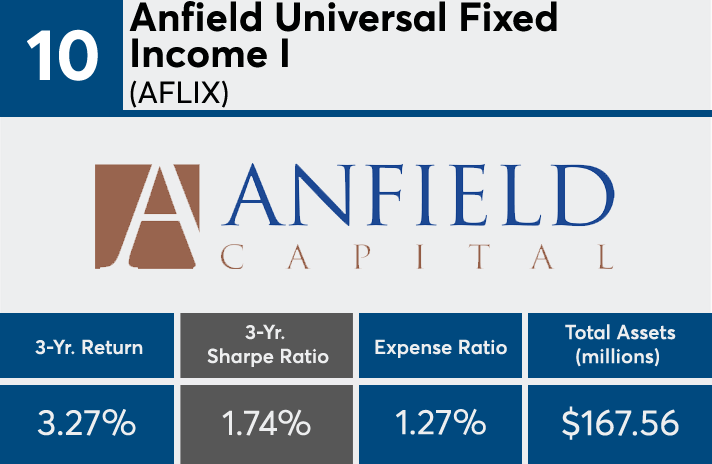

10. Anfield Universal Fixed Income I (AFLIX)

3-Yr. Sharpe Ratio: 1.74%

Expense Ratio: 1.27%

Total Assets (millions): $167.56

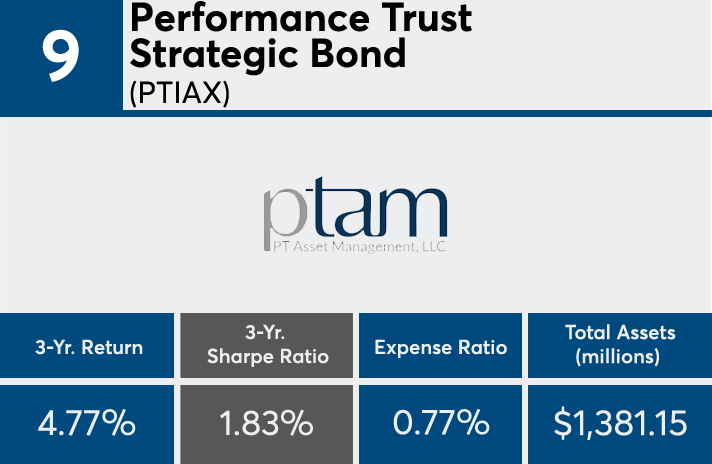

9. Performance Trust Strategic Bond (PTIAX)

3-Yr. Sharpe Ratio: 1.83%

Expense Ratio: 0.77%

Total Assets (millions): $1,381.15

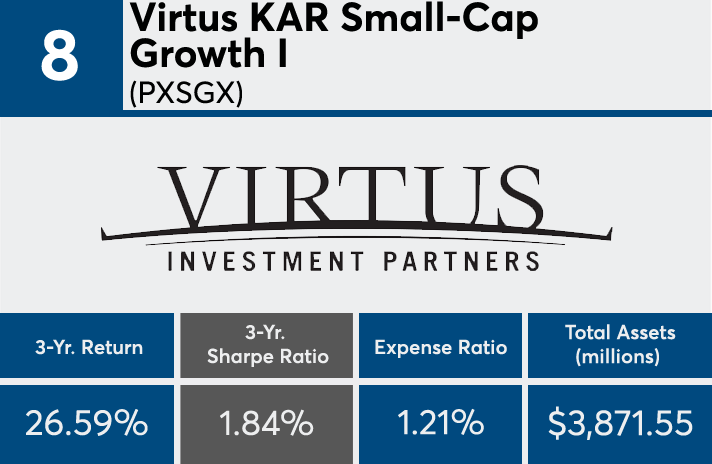

8. Virtus KAR Small-Cap Growth I (PXSGX)

3-Yr. Sharpe Ratio: 1.84%

Expense Ratio: 1.21%

Total Assets (millions): $3,871.55

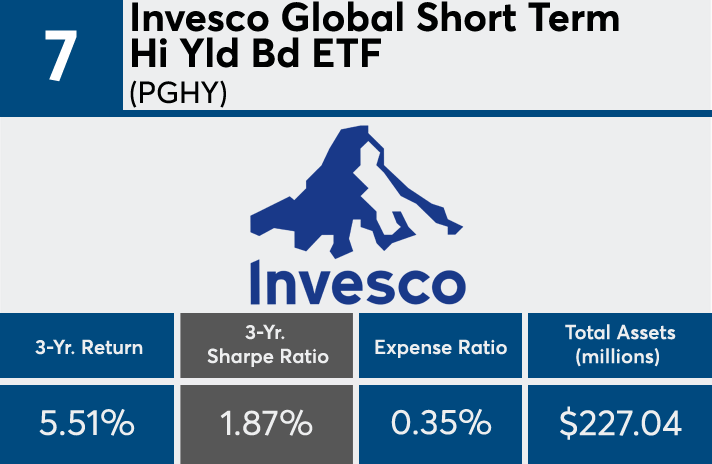

7. Invesco Global Short Term Hi Yld Bd ETF (PGHY)

3-Yr. Sharpe Ratio: 1.87%

Expense Ratio: 0.35%

Total Assets (millions): $227.04

6. First Trust Low Duration Oppos ETF (LMBS)

3-Yr. Sharpe Ratio: 2.15%

Expense Ratio: 0.68%

Total Assets (millions): $1,314.48

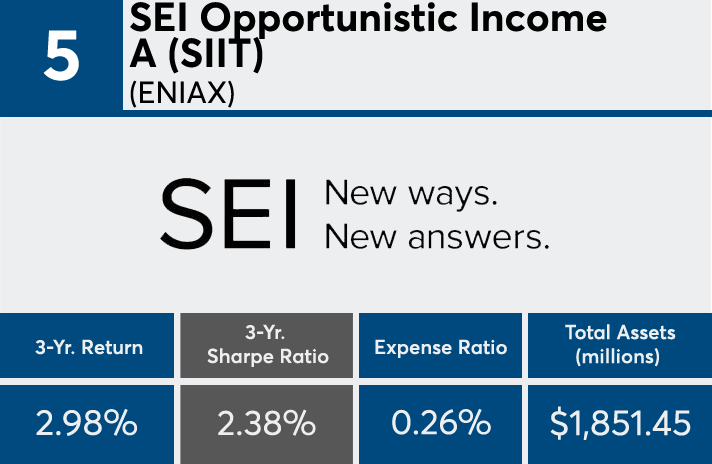

5. SEI Opportunistic Income A (SIIT) (ENIAX)

3-Yr. Sharpe Ratio: 2.38%

Expense Ratio: 0.26%

Total Assets (millions): $1,851.45

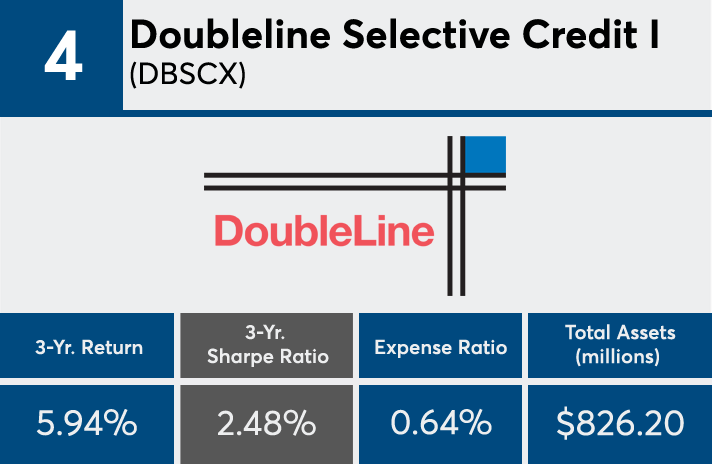

4. Doubleline Selective Credit I (DBSCX)

3-Yr. Sharpe Ratio: 2.48%

Expense Ratio: 0.64%

Total Assets (millions): $826.20

3. Colorado BondShares A Tax-Exempt (HICOX)

3-Yr. Sharpe Ratio: 2.64%

Expense Ratio: 0.61%

Total Assets (millions): $1,216.29

Front Load: 4.75%

2. AlphaCentric Income Opportunities I (IOFIX)

3-Yr. Sharpe Ratio: 2.77%

Expense Ratio: 1.50%

Total Assets (millions): $2,125.66

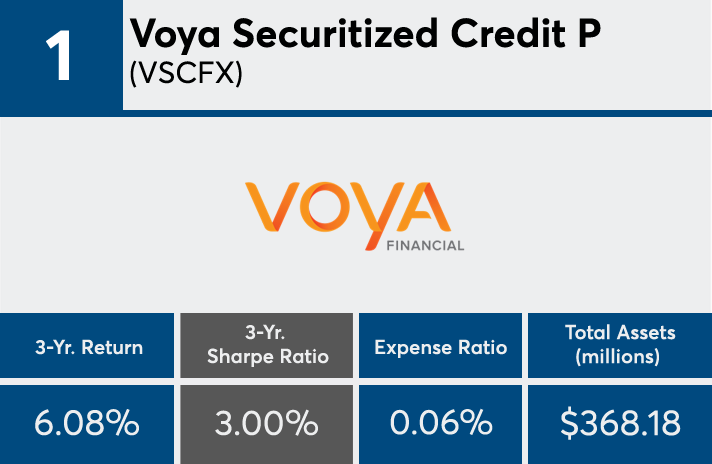

1. Voya Securitized Credit P (VSCFX)

3-Yr. Sharpe Ratio: 3.00%

Expense Ratio: 0.06%

Total Assets (millions): $368.18