We looked at the 20 largest net fund flows year-to-date; 12 were index funds. In money terms, though, passive won a more decisive victory: Index funds took in 80% of the $256 billion total that advisors and investors forked over to these 20 funds so far this year.

Consider the magnitude of these numbers. If $256 billion were one company’s revenue stream, it would rank #2 on the Fortune 500 — behind only Walmart. In fact, each of the top 16 fund flows are big enough that they would rank on the Fortune 500 individually, although many would be near the bottom of the list.

Scroll through to see the largest year-to-date net fund flows, as well as three-year annualized returns for each fund and expense ratios. All data from Morningstar.

20. Vanguard Short-Term Bond Index Inv (VBISX)

3-Yr. Return: 1.09%

Expense Ratio: 0.15%

Total Assets (millions): $51,069

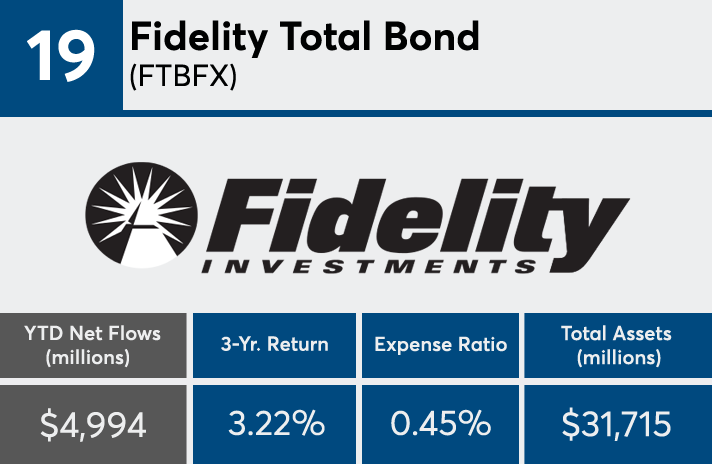

19. Fidelity Total Bond (FTBFX)

3-Yr. Return: 3.22%

Expense Ratio: 0.45%

Total Assets (millions): $31,715

18. Fidelity 500 Index Investor (FUSEX)

3-Yr. Return: 11.56%

Expense Ratio: 0.09%

Total Assets (millions): $136,827

17. Vanguard Value Index Inv (VIVAX)

3-Yr. Return: 10.81%

Expense Ratio: 0.18%

Total Assets (millions): $63,566

16. Vanguard Interm-Term Bond Index Inv (VBIIX)

3-Yr. Return: 2.54%

Expense Ratio: 0.15%

Total Assets (millions): $34,560

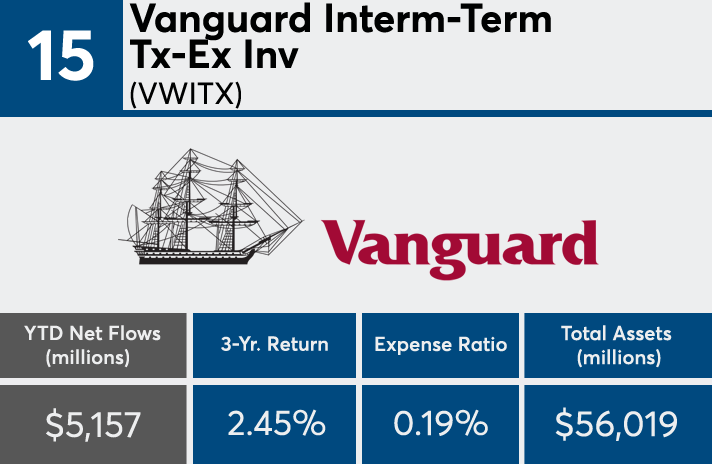

15. Vanguard Interm-Term Tx-Ex Inv (VWITX)

3-Yr. Return: 2.45%

Expense Ratio: 0.19%

Total Assets (millions): $56,019

14. Vanguard European Stock Index Investor (VEURX)

3-Yr. Return: 6.07%

Expense Ratio: 0.26%

Total Assets (millions): $18,176

13. Dodge & Cox Income (DODIX)

3-Yr. Return: 3.03%

Expense Ratio: 0.43%

Total Assets (millions): $53,560

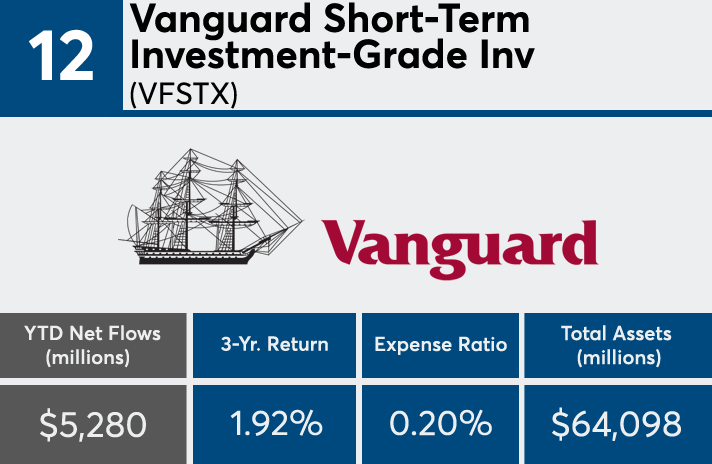

12. Vanguard Short-Term Investment-Grade Inv (VFSTX)

3-Yr. Return: 1.92%

Expense Ratio: 0.20%

Total Assets (millions): $64,098

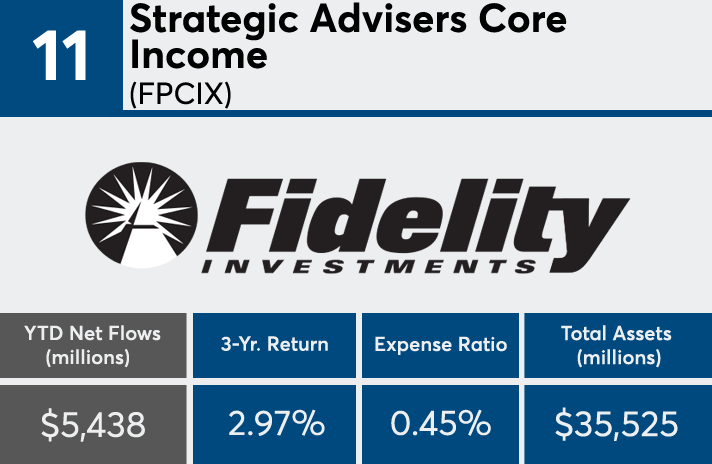

11. Strategic Advisers Core Income (FPCIX)

3-Yr. Return: 2.97%

Expense Ratio: 0.45%

Total Assets (millions): $35,525

10. Fidelity US Bond Index Investor (FBIDX)

3-Yr. Return: 2.05%

Expense Ratio: 0.14%

Total Assets (millions): $34,615

9. American Funds American Balanced A (ABALX)

3-Yr. Return: 8.39%

Expense Ratio: 0.60%

Total Assets (millions): $123,185

8. Prudential Total Return Bond A (PDBAX)

3-Yr. Return: 3.46%

Expense Ratio: 0.76%

Total Assets (millions): $29,480

7. Oakmark International Investor (OAKIX)

3-Yr. Return: 9.55%

Expense Ratio: 1.00%

Total Assets (millions): $42,170

6. Vanguard Emerging Mkts Stock Idx Inv (VEIEX)

3-Yr. Return: 6.46%

Expense Ratio: 0.32%

Total Assets (millions): $89,216

5. Vanguard Total Bond Market Index Inv (VBMFX)

3-Yr. Return: 2.08%

Expense Ratio: 0.15%

Total Assets (millions): $193,321

4. Vanguard Developed Markets Index Admiral (VTMGX)

3-Yr. Return: 7.84%

Expense Ratio: 0.07%

Total Assets (millions): $104,114

3. Vanguard Total Intl Stock Index Inv (VGTSX)

3-Yr. Return: 7.54%

Expense Ratio: 0.19%

Total Assets (millions): $321,185

2. Vanguard 500 Index Investor (VFINX)

3-Yr. Return: 11.50%

Expense Ratio: 0.14%

Total Assets (millions): $383,897

1. Vanguard Total Stock Mkt Idx Inv (VTSMX)

3-Yr. Return: 11.27%

Expense Ratio: 0.15%

Total Assets (millions): $656,961