Two of the industry’s main fund trackers differ in the details, but are directionally similar in recent analyses on fund flows showing investor interest in active funds last year for the first time since 2014.

Cerulli shows that actively managed funds had inflows of $19 billion, an organic growth of .2%. A small increase, to be sure, but these funds did not see outflows “eat into overall growth for the first time since 2014,” according to the latest Cerulli Edge report. Strong market conditions and advisor sentiment could lead to another year of positive active net flows, Cerulli says. It specifically cited environmental, social and corporate governance as likely areas of focus.

Meanwhile, Morningstar data shows that active funds had a $7 billion outflow, but it still characterized it as a “relative victory” after the extreme outflows of the previous two years. Taxable bonds and international equity accounted for the biggest inflows, with $178 billion and $35 billion, respectively, according to Morningstar.

Here, we rank the actively managed funds with the 20 largest inflows for 2017. The average inflow is nearly $2.5 billion, and the average annual return is 14%, although there was wide range from -1.9% to 26%. Click through to see all 20 funds, including total fund size and expense ratios. All data from Morningstar Direct.

20. JOHCM International Select I (JOHIX)

2017 Return: 22.89%

Expense Ratio: 1.01%

Net Assets (millions): $7,508.24

19. T. Rowe Price Dynamic Global Bond Inv (RPIEX)

2017 Return: -1.90%

Expense Ratio: 0.65%

Net Assets (millions): $2,171.46

18. Vanguard Target Retirement 2055 Inv (VFFVX)

2017 Return: 21.38%

Expense Ratio: 0.16%

Net Assets (millions): $6,330.92

17. Vanguard Target Retirement 2035 Inv (VTTHX)

2017 Return: 19.12%

Expense Ratio: 0.15%

Net Assets (millions): $31,702.03

16. Fidelity Large Cap Stock (FLCSX)

2017 Return: 18.15%

Expense Ratio: 0.62%

Net Assets (millions): $5,374.40

15. Vanguard Target Retirement 2045 Inv (VTIVX)

2017 Return: 21.42%

Expense Ratio: 0.16%

Net Assets (millions): $22,006.94

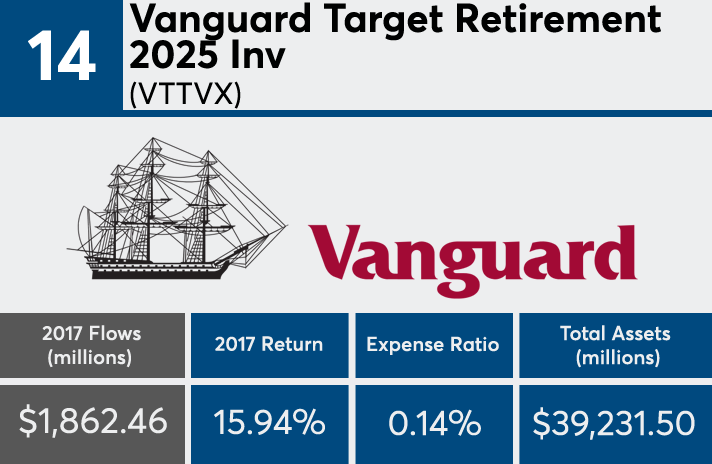

14. Vanguard Target Retirement 2025 Inv (VTTVX)

2017 Return: 15.94%

Expense Ratio: 0.14%

Net Assets (millions): $39,231.50

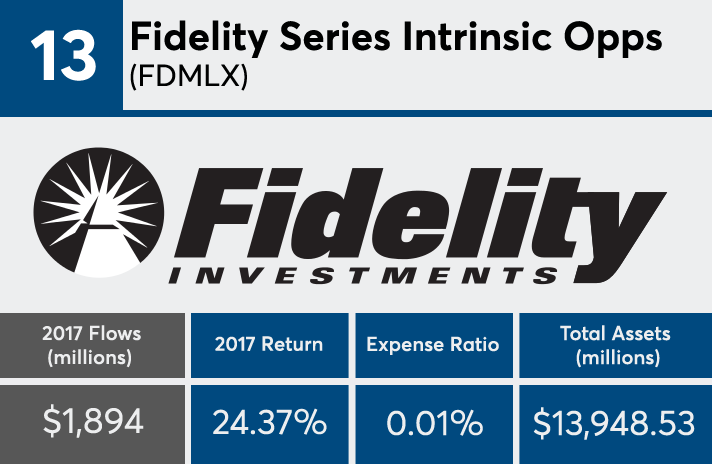

13. Fidelity Series Intrinsic Opps (FDMLX)

2017 Return: 24.37%

Expense Ratio: 0.01%

Net Assets (millions): $13,948.53

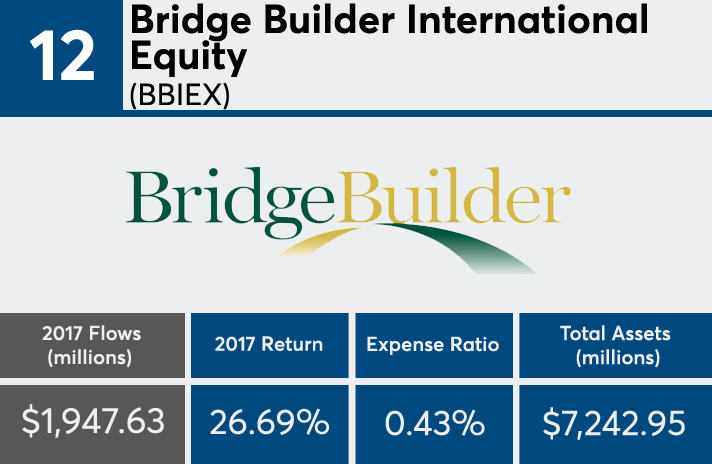

12. Bridge Builder International Equity (BBIEX)

2017 Return: 26.69%

Expense Ratio: 0.43%

Net Assets (millions): $7,242.95

11. Vanguard Target Retirement 2040 Inv (VFORX)

2017 Return: 20.71%

Expense Ratio: 0.16%

Net Assets (millions): $23,943.07

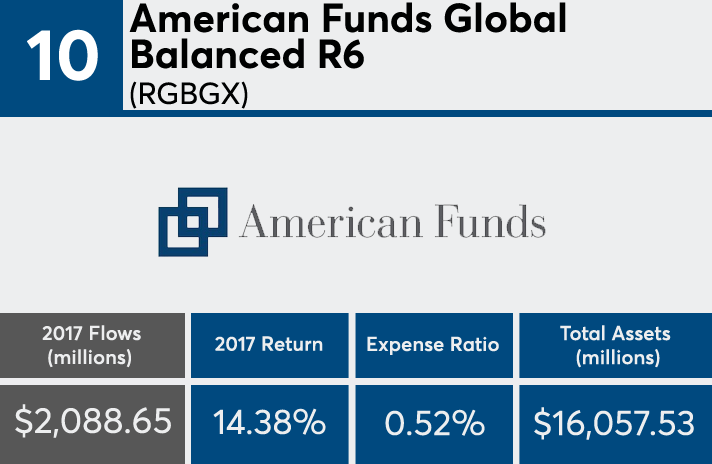

10. American Funds Global Balanced R6 (RGBGX)

2017 Return: 14.38%

Expense Ratio: 0.52%

Net Assets (millions): $16,057.53

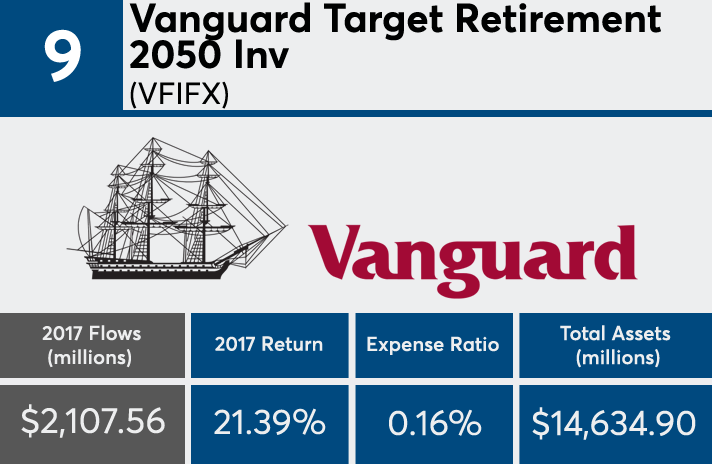

9. Vanguard Target Retirement 2050 Inv (VFIFX)

2017 Return: 21.39%

Expense Ratio: 0.16%

Net Assets (millions): $14,634.90

8. Fidelity Investment Grade Bond (FBNDX)

2017 Return: 3.92%

Expense Ratio: 0.45%

Net Assets (millions): $11,613.86

7. T. Rowe Price US Treasury Long-Term (PRULX)

2017 Return: 8.22%

Expense Ratio: 0.37%

Net Assets (millions): $2,975.66

6. Bridge Builder Core Plus Bond (BBCPX)

2017 Return: 4.19%

Expense Ratio: 0.19%

Net Assets (millions): $7,900.93

5. Vanguard Target Retirement 2030 Inv (VTHRX)

2017 Return: 17.52%

Expense Ratio: 0.15%

Net Assets (millions): $32,830.54

4. Fidelity Total Bond (FTBFX)

2017 Return: 4.19%

Expense Ratio: 0.45%

Net Assets (millions): $31,986.02

3. Bridge Builder Core Bond (BBTBX)

2017 Return: 4.13%

Expense Ratio: 0.17%

Net Assets (millions): $14,765.91

2. Dodge & Cox Income (DODIX)

2017 Return: 4.36%

Expense Ratio: 0.43%

Net Assets (millions): $54,286.76

1. Strategic Advisers Core Income (FPCIX)

2017 Return: 4.71%

Expense Ratio: 0.45%

Net Assets (millions): $36,220.78