LPL Financial's

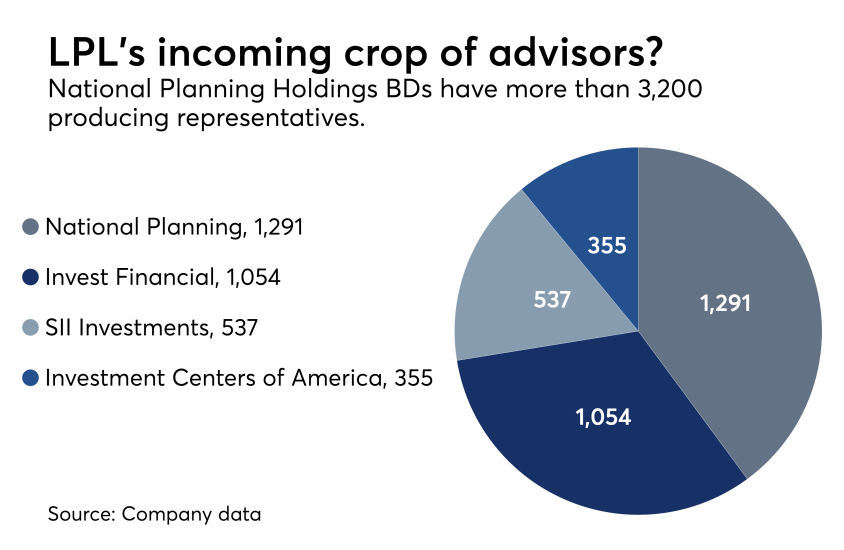

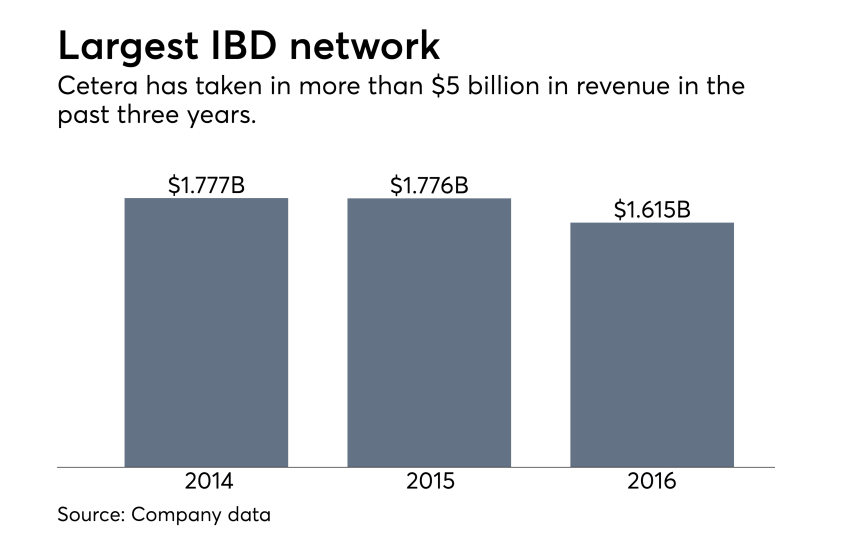

On the other hand, LPL also lost five NPH practices, including several offices of supervisory jurisdiction, with $6.8 billion in client assets to rivals after its massive acquisition in August. Separately, Cetera Financial Group and Triad Advisors grabbed three teams from LPL with $18 billion in client assets in other moves that made the list.

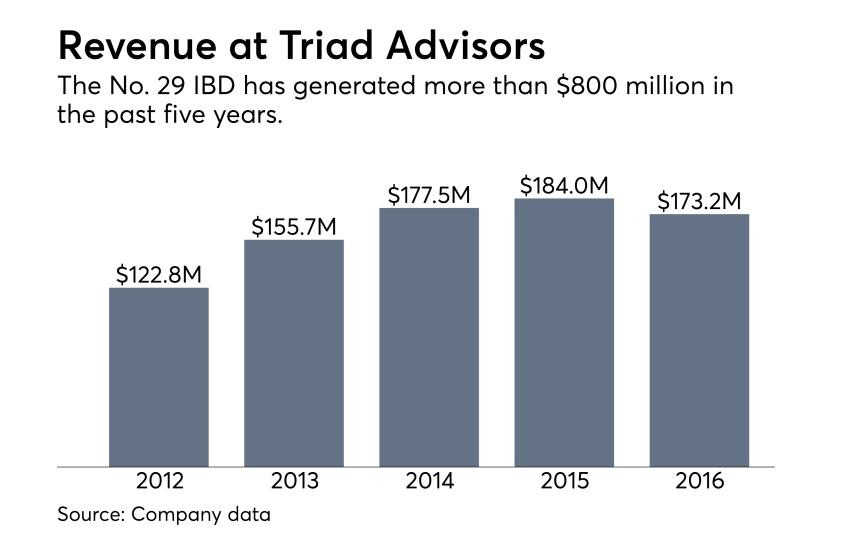

LPL made the highest volume of grabs out of the top 15 with six, but Cetera led the way in terms of client assets with moves totaling $13.8 billion. Triad, one of two Ladenburg Thalmann network firms with moves on the list, brought the third most assets onto its platform at $7.4 billion through its three deals.

The ranking stems from firms' recruiting announcements, leaving out moves by firms that do not publicly discuss their moves or issue such notices. Cambridge Investment Research, for example, added nearly $79 million in production this year for its second-best recruiting year ever, according to spokeswoman Cindy Schaus.

However, the No. 8 IBD's policy against discussing particular recruiting grabs "reflects our respect for privacy" in that the firm's executives "do not comment on or report such details on any individual basis," Schaus wrote in an email.

Follow the links for a list of the

15. Securities America grabs $744M National Planning super OSJ as exits mount

Dan Cairo of Elite Financial Network, a hybrid RIA with $744 million in client assets, opted for

To read more,

14. $800M indie team joins Raymond James from Wells Fargo

Kel Normann, Eric Vernon, Murphy Paderick and Miller Robins of The Normann Financial Group joined Raymond James' indie channel in Sanford, North Carolina, according to the firm. The team generates about $4 million in annual production.

To read more,

13. New IBD-to-OSJ trend? Cetera lands $820M HBW Partners

HBW Partners and all of its 55 advisers nationwide are making the move, CEO Barney Hellenbrand said in a statement. The Simi Valley, California-based firm has $820 million in assets under management.

To read more,

12. $826M National Planning firm joins LPL after NPH deal

Glastonbury, Connecticut-based Gateway Financial Partners emerged as the largest of a group of seven firms unveiled by LPL last week as bringing $500 million to $999 million in client assets into its fold. David Wood serves as the principal advisor of the practice.

To read more,

11. Triad Advisors grabs ex-Transamerica practice from Signator Investors

Partners Tim Kerrigan, Brian Damiani and Mike Kelly of Continuum Advisory bolted Signator Investors more than a year after Signator’s parent, John Hancock Financial Network,

To read more,

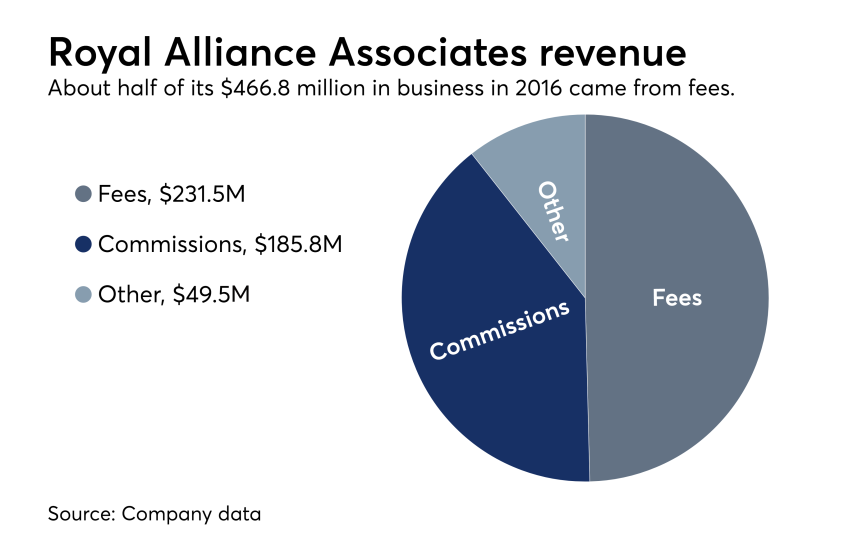

10. (tie) Royal Alliance adds $1.1B National Planning OSJ in fiduciary-focused move

Advisor Chris Lubbers’ Strategic Partners, an office of supervisory jurisdiction with 38 advisors, joined

To read more,

10. (tie) National Planning super OSJ turns down swarming poachers, joins LPL

But now, LPL has begun to reveal its haul. A National Planning practice with $1.1 billion in brokerage and advisory assets chose LPL Financial over competing offers.

Doug Ritter’s Discovery Financial Centers made the switch to LPL,

To read more,

9. (tie) LPL snags Northwest Bank's $1.3B investment program from Cetera

The Warren, Pennsylvania-based bank was looking for a strategic partner that could support its growing investment services program, which currently has approximately $1.3 billion in client brokerage and advisory assets, according to the bank.

The growth of the program was due in part to the bank's acquisition last year of 18 New York-based branches of First Niagara Bank, which had used LPL as its broker dealer. Northwest chose to align the program entirely with LPL's platform to operate more efficiently, according to the bank's program manager John Beard.

To read more,

9. (tie) After LPL deal, $1.3B National Planning firm bolts for Commonwealth

Stuart and Michael Paris of Paris International “would have never left” National Planning if the firm’s assets had not changed hands

To read more,

8. Securities America grabs $1.35B credit union super OSJ from LPL

The Arizona-based firm serves as a super Office of Supervisory Jurisdiction, or OSJ, supporting advisors who work for its affiliated credit unions as either employees or independent financial advisors. The affiliated advisors collectively manage $1.35 billion in client brokerage and fee-based advisory assets, according to Securities America.

To read more,

7. $1.5B firm bolts Securian, launches affiliated RIA

GCG Financial, which is affiliated with recently launched insurance and employee benefits firm Alera Group, had been with Securian for at least 25 years, according to FINRA BrokerCheck. GCG President Rick Levitz formed a new RIA alongside its broker-dealer switch, according to an

To read more,

6. $1.6B National Planning OSJ makes jump to LPL

Paula Key's Zuk Financial Group, which has 29 affiliated advisors and 45 support staff in 20 branches throughout California, joined LPL's hybrid RIA and traditional BD platforms, LPL announced. Key and the late Cori Zuk launched the Lake Forest-based practice back in 1974.

"We took part in a lengthy due diligence process, which included site visits, phone calls and other efforts to build relationships with the LPL leadership team," Key said in a statement. "LPL stood out for the flexibility of its platform and the firm’s enhanced resources, tools and systems."

To read more,

5. $1.7B National Planning super OSJ slams LPL, bolts for rival

Bill Brice’s Professional Investors Network, a super OSJ with about 70 advisors and $1.7 billion in client assets, opted for

To read more,

4. (tie) $2B super OSJ first National Planning practice to announce LPL move

Motske led a six-person task force that considered roughly a dozen BDs before picking LPL, he says. The Huntington Beach, Calif.-based super OSJ has more than $2 billion in client assets and more than 150 advisors.

Their choice of LPL stemmed from its hybrid RIA channel, its growing emphasis on fee-based business and the most seamless transition for the practice's clients, according to Motske.

"The other part was spending a little bit of time with Dan Arnold talking about our vision and Trilogy's vision moving forward," Motske says. "I think he was very excited about what we bring to the table."

To read more,

4. (tie) Woodbury Financial lures $2B OSJ after LPL deal

The move comes as Woodbury has been courting former NPH advisors, ever since

To read more,

3. LPL retains National Planning network in largest announced post-deal move

The Planners Network, an association of firms each aligning individually with LPL, started 18 years ago. Kären Locklin serves as its COO, while David Williams, the founder of Santa Rosa, California-based practice Retirement Investment Specialists, acts as board president of the network.

"Valuing our network so much, it was important that we choose a firm that would support our relationships and our businesses," Williams said in a statement. "With LPL, we have the ability to establish ourselves in a way that helps us to be able to pursue our individual goals and our group’s goals."

To read more,

2. (tie) Triad Advisors grabs $5B super OSJ from LPL

The Overland Park-based Resources Investment Advisors, which has more than 65 affiliated advisors, joined the No. 29 IBD, Triad

"When looking for a broker-dealer, we sought out a partner who truly valued independence, as defined by delivering to advisors the freedom to make the best decisions for themselves, their businesses and their clients," Resources Investment President Vince Morris said in a statement at the time of the firm's exit from LPL.

To read more,

2. (tie) LPL loses another top team to Cetera

Vice president James Laschinger, practicing in Alpharetta, Georgia, and executive vice president Sean Waggoner, practicing in Houston, both made the jump, per BrokerCheck records. The third member of the group, Sarah Keibler, operates from Seattle. The team managed at least $5 billion in client assets and upwards of 250 retirement plans in 2016, according to

To read more,

1. Ron Carson follows friend and former colleague Robert Moore to Cetera

Carson, a well-known coach to other advisers through his Peak Advisor Alliance, was one of top-producing planners at LPL through Carson Wealth Management Group. The Omaha, Nebraska-based practice includes nearly 1,100 advisors with almost $8 billion in client assets.

To read more,