Managed volatility funds dominate the list of top five-year performers based on returns.

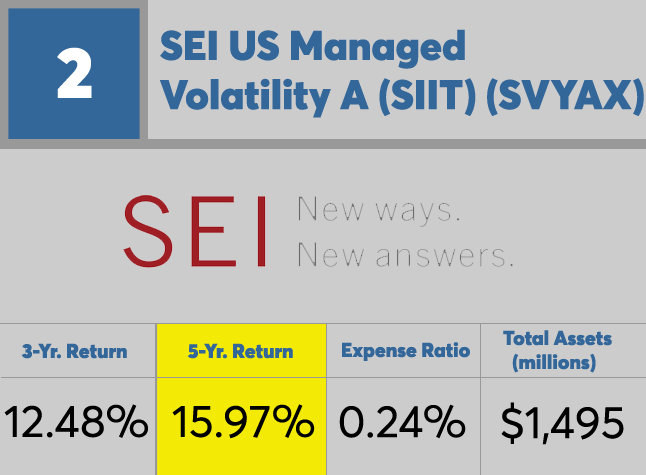

Some of the top performing funds also offer low fees — the SEI Institutional Investments Trust U.S. Managed Volatility Fund, for instance, has an expense ratio of 24 basis points.

Data from Morningstar.

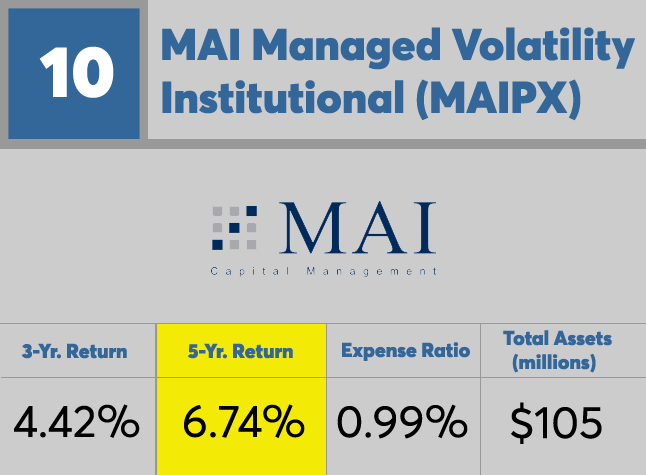

MAI Managed Volatility Institutional (MAIPX)

5-Yr. Return: 6.73%

Expense Ratio: 0.99%

Total Assets (millions): $105

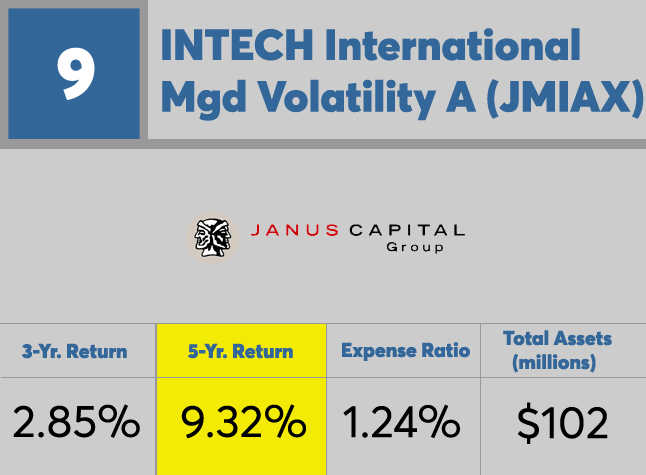

INTECH International Mgd Volatility A (JMIAX)

5-Yr. Return: 9.31%

Expense Ratio: 1.24%

Total Assets (millions): $102

Invesco Global Low Volatility Eq Yld A (GTNDX)

5-Yr. Return: 9.56%

Expense Ratio: 1.48%

Total Assets (millions): $119

SEI Global Managed Volatility A (SIMT) (SVTAX)

5-Yr. Return: 12.53%

Expense Ratio: 1.11%

Total Assets (millions): $1,703

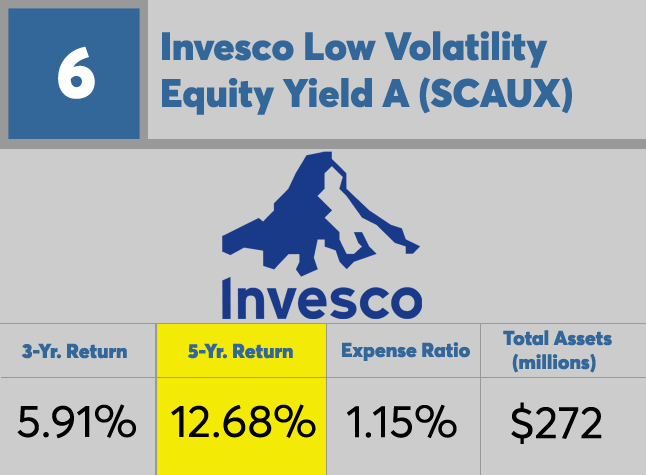

Invesco Low Volatility Equity Yield A (SCAUX)

5-Yr. Return: 12.68%

Expense Ratio: 1.15%

Total Assets (millions): $272

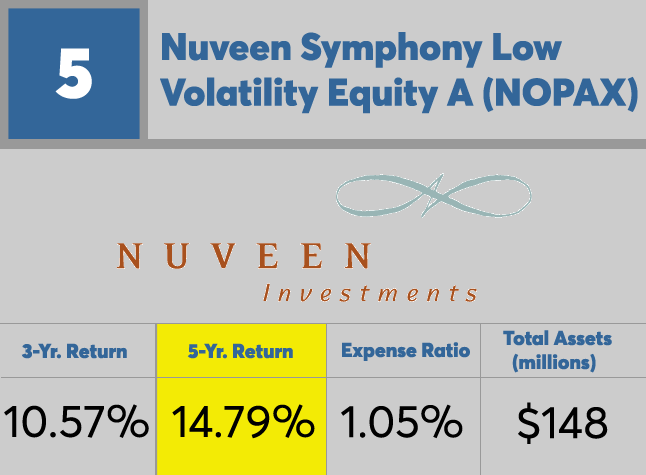

Nuveen Symphony Low Volatility Equity A (NOPAX)

5-Yr. Return: 14.79%

Expense Ratio: 1.05%

Total Assets (millions): $148

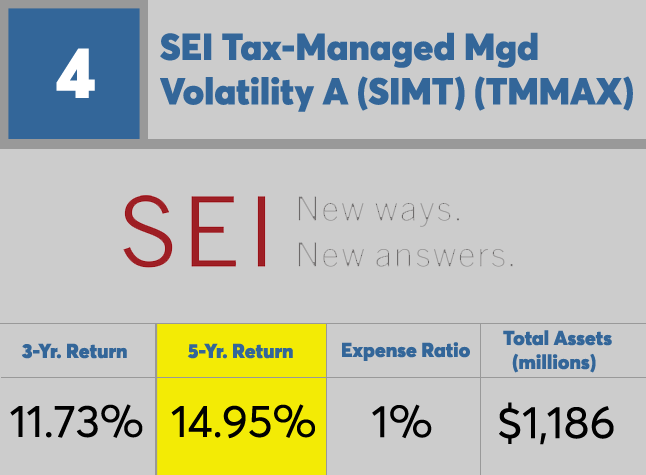

SEI Tax-Managed Mgd Volatility A (SIMT) (TMMAX)

5-Yr. Return: 14.95%

Expense Ratio: 1%

Total Assets (millions): $1,186

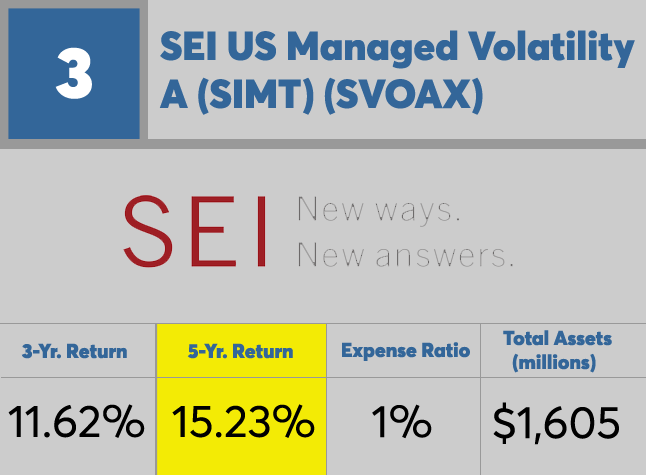

SEI US Managed Volatility A (SIMT) (SVOAX)

5-Yr. Return: 15.23%

Expense Ratio: 1%

Total Assets (millions): $1,605

SEI US Managed Volatility A (SIIT) (SVYAX)

5-Yr. Return: 15.97%

Expense Ratio: 0.24%

Total Assets (millions): $1,495

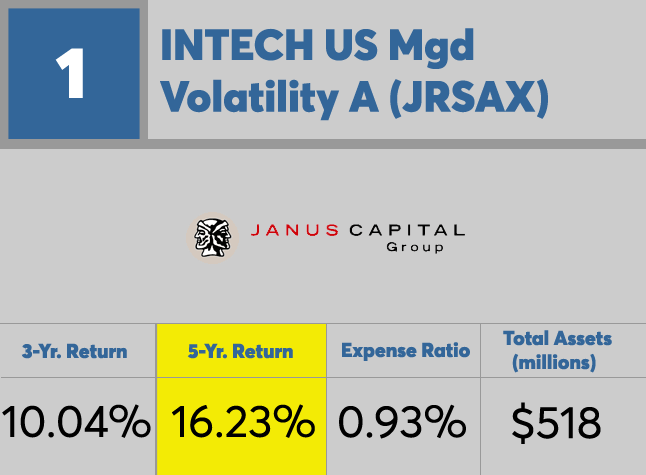

INTECH US Mgd Volatility A (JRSAX)

5-Yr. Return: 16.23%

Expense Ratio: 0.93%

Total Assets (millions): $518