The consulting and market research firm polled 5,500 self-directed investors as wealth management firms

Firms like Merrill Lynch,

J.D. Power broke the responses apart for the first time “to quantify how the experiences are different and how the drivers of satisfaction and loyalty are different,” says Mike Foy, the senior director of the firm’s wealth management practice. Advisors can take a great deal from the results, he says.

“They are coming at a premium price to a call center-type model,” Foy says. “So understanding what is being provided to clients within those [models] will help them think about what they need to do above and beyond that, to justify a higher price point for a client.”

Slashed fees certainly helped lead to the milestone

“Their PAS model is essentially hybrid and they have multiple ways to connect with advisors. They also have some of the best pricing in the industry,” O’Gara, a senior research analyst in the consulting firm’s wealth management unit, writes in an email. “If their clients are getting a great service at a great price, it becomes the foundation of a winning business model.”

Foy agrees, noting that some reports he’s seen questioning whether Vanguard’s infrastructure and client service have kept up with the flow of AUM were not borne out in the survey.

J.D. Power conducted the study in December 2017, quizzing the self-directed investors on seven criteria and investors seeking guidance on eight, with advisors’ services as the additional category. Firm interaction, account information, commissions and fees and product offerings also figured into the survey.

The top takeaways standing out for Foy include the lower marks for clients who have made the shift to hybrid platforms from personal advisors, often as a result of account-minimum requirements. The survey also shows that firms with hybrid offerings should boost the human aspects of them, Foy adds.

“Many of the clients who are part of that forced migration, call it, tend to certainly have lower satisfaction scores than those who come voluntarily into that model and have made that choice consciously,” he says.

“It’s important for firms to go beyond just on-demand advice and guidance. It’s not enough to just say, ‘Oh, here’s a number that you can call if you want help,’” Foy continues. “Some even minimal level of outreach made an enormous difference in client satisfaction.”

The top-line finding for O’Gara revolves around advisors’ use of technology. Firms and advisors must figure out how to leverage in-house and third-party resources with a “modularized approach,” he says, citing TD Ameritrade’s RIA platform as an example.

“My key takeaway for advisors is that technology will improve your efficiency,” O’Gara says. “It will improve every aspect of client service. Those advisors who do not fully embrace technology as a way to grow their books, and increase client satisfaction, will be in trouble.”

For the full rankings based on the overall satisfaction of self-directed clients seeking guidance, tracked on a 1,000-point scale, click through our slideshow. To view the results of last year’s self-directed client survey,

10. Wells Fargo

Seeking guidance rank: 10

DIY investor satisfaction index: 737

DIY investor rank: 10

2017 score: 760

2017 rank: 10

9. JPMorgan Chase

Seeking guidance rank: 9

DIY investor satisfaction index: 783

DIY investor rank: 3

2017 score: 738

2017 rank: 13

8. Morgan Stanley

Seeking guidance rank: 8

DIY investor satisfaction index: N/A

2017 score: N/A

*J.D. Power releases client survey results only for firms with at least 100 participating clients.

7. Capital One Investing

Seeking guidance rank: 7

DIY investor satisfaction index: 759

DIY investor rank: 8

2017 score: 797

2017 rank: 5

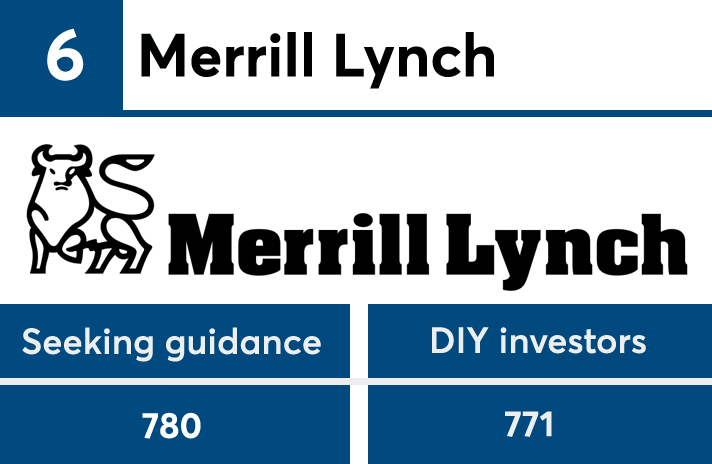

6. Merrill Lynch

Seeking guidance rank: 6

DIY investor satisfaction index: 771

DIY investor rank: 5

2017 score: 770

2017 rank: 9

5. Fidelity

Seeking guidance rank: 5

DIY investor satisfaction index: 767

DIY investor rank: 6

2017 score: 795

2017 rank: 7

Industry average

DIY investor satisfaction index: 775

2017 score: 779

4. TD Ameritrade

Seeking guidance rank: 4

DIY investor satisfaction index: 764

DIY investor rank: 7

2017 score: 804

2017 rank: 3

3. Charles Schwab

Seeking guidance rank: 3

DIY investor satisfaction index: 800

DIY investor rank: 2

2017 score: 800

2017 rank: 4

2. E-Trade Financial

Seeking guidance rank: 2

DIY investor satisfaction index: 774

DIY investor rank: 4

2017 score: 809

2017 rank: 2

1. Vanguard

Seeking guidance rank: 1

DIY investor satisfaction index: 802

DIY investor rank: 1

2017 score: 813

2017 rank: 1