J.D. Power, which released its study this week, gives the greatest weight on its 1,000-point scale to clients’ views of their financial advisors. But what shapes those perceptions?

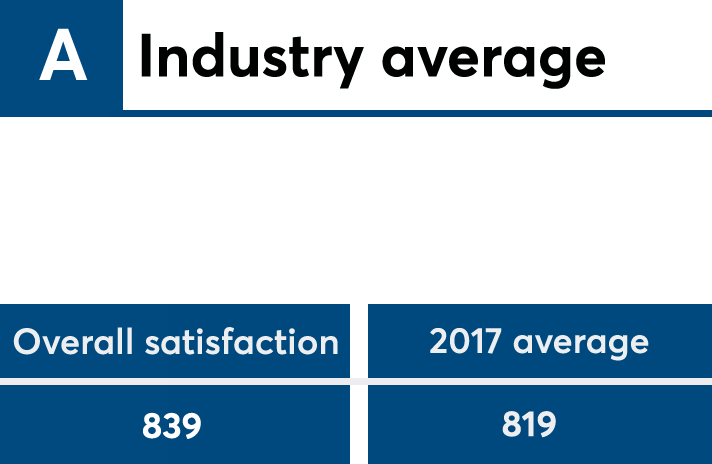

Mike Foy, senior director of J.D. Power’s wealth management unit, does not attribute the 15-year record score of 839 points entirely to the strong gains in the stock market over the past year. (J.D. Power quizzed 4,419 clients in December before the

Even with those market tailwinds, investment performance was the third most important factor of eight overall. The higher ratings also reflect better client experiences as technology allows for full-service advice and self-directed tools, Foy says.

“The lines between those two groups have become very blurry,” Foy says. “You increasingly have more and more folks who are looking for some combination of advice but also the tools to do some things themselves. We included questions about aspects of the experience that we’ve historically only asked self-directed investors.”

The new elements include measures of online and mobile experience and access to research, in addition to existing categories like product offerings, commissions and fees. Schwab has always received positive scores on products and low prices, but the firm scored the best in the new metrics, Foy says.

Schwab offers many different types of services across its business lines with well-integrated access points for clients, says Tim Welsh, CEO of consulting firm Nexus Strategy. With Fidelity and TD Ameritrade boasting similar appeal, the J.D. Power ranking looms large in Schwab’s marketing, he notes.

“In a sea of homogeny where everyone’s the same, any time you can differentiate yourself with a third-party award, you’re going to do it,” Welsh says. “It’s a great differentiator.”

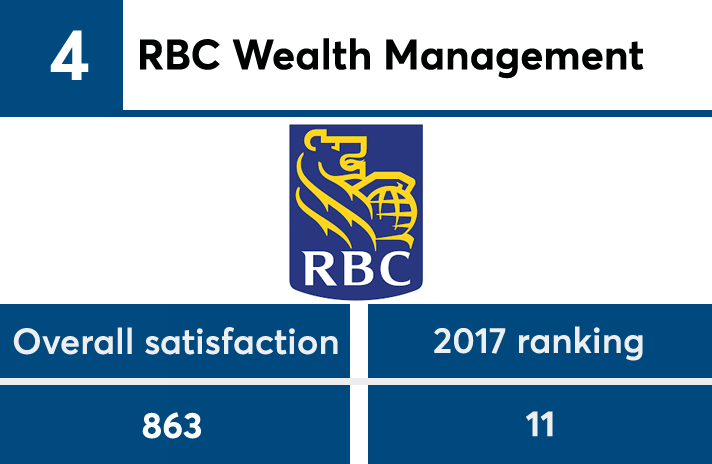

Other firms also achieved positive results in the annual survey. Edward Jones maintained its high position in the rankings, while RBC Wealth Management, Stifel Financial and Northwestern Mutual made significant gains on the strength of their advisor-client relationship ratings, Foy says.

On the other hand, Wells Fargo sank to the bottom of every measure of brand image, he notes. Revelations involving

Fidelity’s position in the rankings also fell, although the firm’s overall score went up. Since the survey measures direct retail clients of firms’ advisors rather than custodial clients, the results display how Schwab has improved its full-service advice over the past several years, Foy says.

“Fidelity has a lot of the same strengths that Schwab has, in terms of the legacy as a discount brokerage. They have a strong digital platform, they do well around fees,” Foy says. “Schwab has made a bit more progress in terms of improving the quality of that financial advisor experience.”

To see how firms measured up in last year’s study,

18. Advisor Group

2018 score (on 1,000-point scale): 800

*J.D. Power only reports results for firms with at least 100 clients taking the survey. Advisor Group did not have a large enough sample to make the 2017 rankings.

17. Citigroup

2017 ranking: 15

2018 score (on 1,000-point scale): 811

2017 score: 805

2018 vs. 2017: +6

16. Wells Fargo Advisors

2017 ranking: 7

2018 score (on 1,000-point scale): 814

2017 score: 824

2018 vs. 2017: -10

15. Morgan Stanley

2017 ranking: 16

2018 score (on 1,000-point scale): 821

2017 score: 801

2018 vs. 2017: +20

13. (tie) PNC Wealth Management

2017 ranking: 12

2018 score (on 1,000-point scale): 824

2017 score: 810

2018 vs. 2017: +14

13. (tie) AXA Advisors

2017 ranking: 20

2018 score (on 1,000-point scale): 824

2017 score: 772

2018 vs. 2017: +52

12. Ameriprise

2017 ranking: 10

2018 score (on 1,000-point scale): 828

2017 score: 817

2018 vs. 2017: +11

11. JPMorgan Chase

2017 ranking: 14

2018 score (on 1,000-point scale): 838

2017 score: 807

2018 vs. 2017: +31

Average score

2017 score: 819

2018 vs. 2017: +20

Average change (across all firms): +28

Largest increase: Northwestern Mutual (+61)

Largest decrease: Wells Fargo Advisors (-10)

10. Northwestern Mutual

2017 ranking: 19

2018 score (on 1,000-point scale): 839

2017 score: 778

2018 vs. 2017: +61

9. Raymond James

2017 ranking: 8

2018 score (on 1,000-point scale): 842

2017 score: 819

2018 vs. 2017: +23

6. (tie) UBS Wealth Management Americas

2017 ranking: 5

2018 score (on 1,000-point scale): 851

2017 score: 827

2018 vs. 2017: +24

6. (tie) LPL Financial

2017 ranking: 13

2018 score (on 1,000-point scale): 851

2017 score: 809

2018 vs. 2017: +42

6. (tie) Fidelity Investments

2017 ranking: 2

2018 score (on 1,000-point scale): 851

2017 score: 835

2018 vs. 2017: +16

5. Merrill Lynch

2017 ranking: 9

2018 score (on 1,000-point scale): 852

2017 score: 818

2018 vs. 2017: +34

4. RBC Wealth Management

2017 ranking: 11

2018 score (on 1,000-point scale): 863

2017 score: 814

2018 vs. 2017: +49

3. Stifel Financial

2017 ranking: 6

2018 score (on 1,000-point scale): 865

2017 score: 826

2018 vs. 2017: +39

2. Edward Jones

2017 ranking: 3

2018 score (on 1,000-point scale): 866

2017 score: 833

2018 vs. 2017: +33

1. Charles Schwab

2017 ranking: 1

2018 score (on 1,000-point scale): 867

2017 score: 838

2018 vs. 2017: +29