Similar to the worst player on an all-star team, the worst-performing mutual funds sometimes still score runs when the overall markets are strong enough. Case in point: The worst-performing international funds in 2017 with at least $100 million in assets were all in the black.

After this month’s slideshow on the

For some context, the long-term average annualized return of U.S. stocks is just 7%, adjusted for inflation (closer to 10% in unadjusted numbers).

When advisors and investors only need a dartboard to get returns like this, it’s easy to think they’re geniuses. But a look at the three-year marks (average among these 20 is 7.8%) will remind them that everything reverts to the mean over time. Still impressive, although hardly apace with the U.S. equity market advance of 13% for the same period. In addition, expense ratios of U.S.-focused funds tend to be considerably cheaper.

Looking forward, some skeptics wonder if emerging markets, a subset of international funds, will be able to maintain their current strides amid a stronger dollar and potential global economic slowdown.

Scroll through to see the 20 worst-performing mutual funds with at least $100 million in assets. As usual, three-year performance and expense ratios are also listed. All data from Morningstar Direct.

20. SEI Global Managed Volatility A (SIIT) (SGMAX)

3-Yr. Returns: N/A

Expense Ratio: 0.25%

Net Assets (millions): $2,078.95

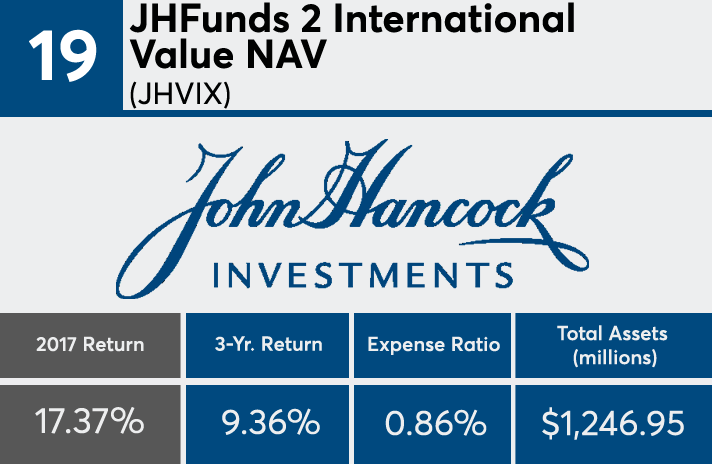

19. JHFunds 2 International Value NAV (JHVIX)

3-Yr. Returns: 9.36%

Expense Ratio: 0.86%

Net Assets (millions): $1,246.95

18. Templeton Foreign A (TEMFX)

3-Yr. Returns: 9.18%

Expense Ratio: 1.19%

Net Assets (millions): $7,530.21

17. VALIC Company I Foreign Value (VCFVX)

3-Yr. Returns: 9.14%

Expense Ratio: 0.80%

Net Assets (millions): $943.41

16. Tweedy, Browne Value (TWEBX)

3-Yr. Returns: 8.28%

Expense Ratio: 1.39%

Net Assets (millions): $603.98

15. BlackRock International Dividend Inv A (BREAX)

3-Yr. Returns: 6.37%

Expense Ratio: 1.10%

Net Assets (millions): $418.16

14. Ivy Cundill Global Value A (ICDAX)

3-Yr. Returns: 7.59%

Expense Ratio: 1.65%

Net Assets (millions): $197.75

13. Janus Henderson European Focus A (HFEAX)

3-Yr. Returns: 5.10%

Expense Ratio: 1.27%

Net Assets (millions): $1,625

12. Invesco Global Low Volatility Eq Yld A (GTNDX)

3-Yr. Returns: 5.33%

Expense Ratio: 1.52%

Net Assets (millions): $107.36

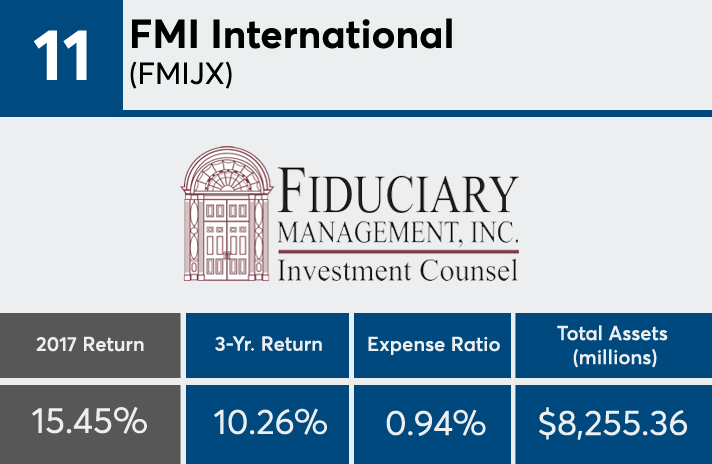

11. FMI International (FMIJX)

3-Yr. Returns: 10.26%

Expense Ratio: 0.94%

Net Assets (millions): $8,255.36

10. Tweedy, Browne Global Value (TBGVX)

3-Yr. Returns: 7.70%

Expense Ratio: 1.38%

Net Assets (millions): $10,540.05

9. Fidelity Canada (FICDX)

3-Yr. Returns: 5.76%

Expense Ratio: 1.02%

Net Assets (millions): $1,226.10

8. First Eagle Overseas A (SGOVX)

3-Yr. Returns: 8.25%

Expense Ratio: 1.14%

Net Assets (millions): $18,765.98

7. Wintergreen Investor (WGRNX)

3-Yr. Returns: 5.66%

Expense Ratio: 2.00%

Net Assets (millions): $348.23

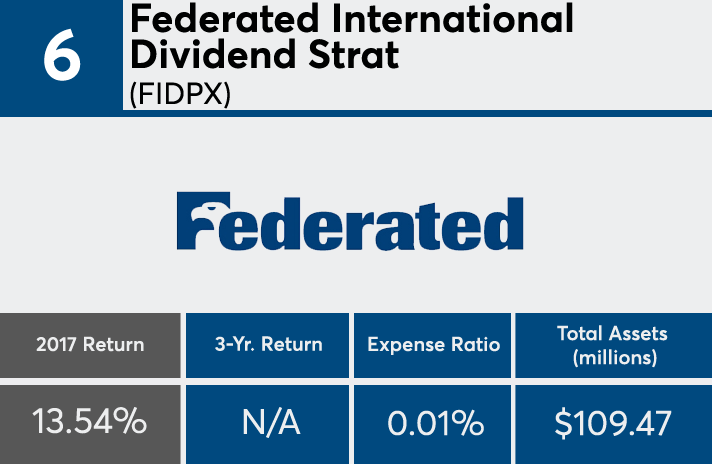

6. Federated International Dividend Strat (FIDPX)

3-Yr. Returns: N/A

Expense Ratio: 0.01%

Net Assets (millions): $109.47

5. First Eagle Global A (SGENX)

3-Yr. Returns: 8.98%

Expense Ratio: 1.10%

Net Assets (millions): $59,556.35

4. Templeton World A (TEMWX)

3-Yr. Returns: 8.60%

Expense Ratio: 1.05%

Net Assets (millions): $4,639.14

3. Brandes International Small Cap Equity A (BISAX)

3-Yr. Returns: 10.70%

Expense Ratio: 1.32%

Net Assets (millions): $1,774.96

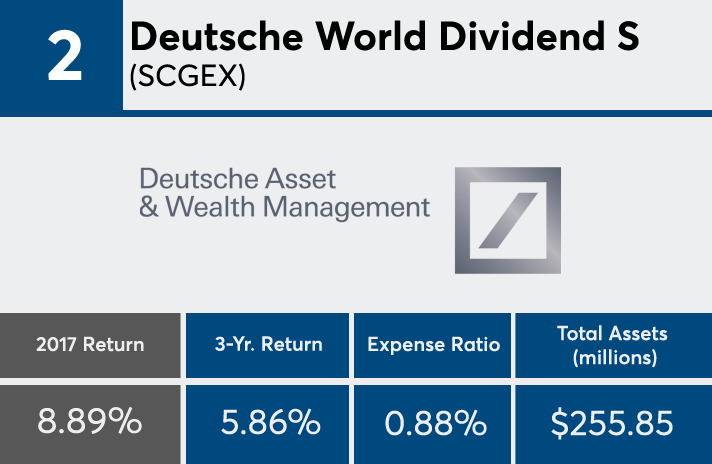

2. Deutsche World Dividend S (SCGEX)

3-Yr. Returns: 5.86%

Expense Ratio: 0.88%

Net Assets (millions): $255.85

1. Cambiar Global Ultra Focus Investor (CAMAX)

3-Yr. Returns: 8.55%

Expense Ratio: 1.35%

Net Assets (millions): $114.54