Northwestern Mutual, John Hancock’s Signator Investors and MassMutual’s MML Investors Services each made the top 10

The findings provide the latest evidence that IBDs are cutting their head counts to focus on their most productive advisors in an effort to drive revenue. For example,

Firms with payouts on the rise have also been making moves fueling

Commonwealth Financial Network returned the highest reported payout to its advisors in the IBD space each of the past three years. Its 2017 average payout of $512,000 is at least double that of each of the firms on the top 10 fastest-growing payouts list, except for The Strategic Financial Alliance.

Strategic Financial, which is

To see which firms’ payouts have increased the most in the past year, click through our slideshow. For a list of the firms with the highest total revenue,

Securian Financial Services

2017 revenue rank: #20

Average payout: $237,000

Payout rank: #13

% change in payout year-over-year: 13.4%

% change rank: #10

The Strategic Financial Alliance

2017 revenue rank: #52

Average payout: $329,000

Payout rank: #3

% change in payout year-over-year: 17.41%

% change rank: #9

Voya Financial Advisors

2017 revenue rank: #15

Average payout: $188,000

Payout rank: #26

% change in payout year-over-year: 17.47%

% change rank: #8

Northwestern Mutual

2017 revenue rank: #6

Average payout: $134,000

Payout rank: #33

% change in payout year-over-year: 19.0%

% change rank: #7

PlanMember Securities

2017 revenue rank: #47

Average payout: $131,000

Payout rank: #34

% change in payout year-over-year: 20.6%

% change rank: #6

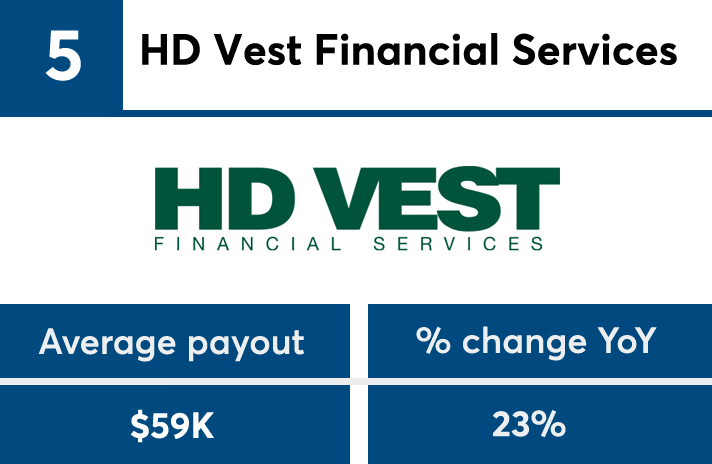

HD Vest Financial Services

2017 revenue rank: #19

Average payout: $59,000

Payout rank: #43

% change in payout year-over-year: 23.0%

% change rank: #5

Waddell & Reed Financial Advisors

2017 revenue rank: #13

Average payout: $202,000

Payout rank: #20

% change in payout year-over-year: 26.9%

% change rank: #4

Principal Securities

2017 revenue rank: #22

Average payout: $96,000

Payout rank: #38

% change in payout year-over-year: 29.1%

% change rank: #3

MML Investors Services

2017 revenue rank: #5

Average payout: $76,000

Payout rank: #42

% change in payout year-over-year: 30.4%

% change rank: #2

Signator Investors

2017 revenue rank: #16

Average payout: $164,000

Payout rank: #28

% change in payout year-over-year: 33.7%

% change rank: #1