For starters, the sector is a petri dish for the future of advice — and not just regarding the development of advice technologies.

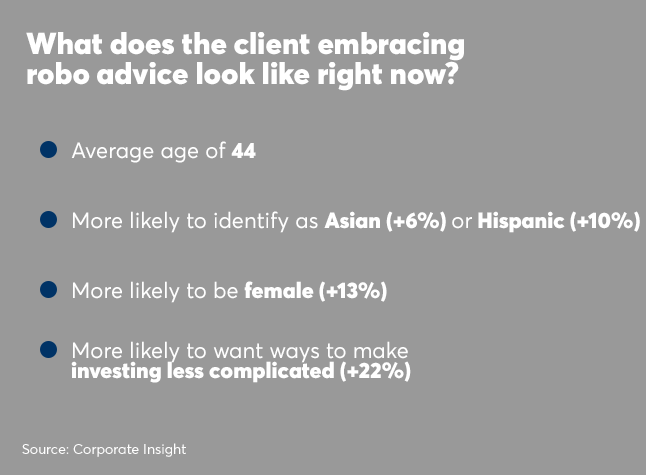

New research from Corporate Insight and other industry consulting firms demonstrate three trends arising from the digital space: more competition, creativity in gaining assets and a changing client.

There is great pressure to launch new platforms. Although digital wealth management represents roughly 1% of the industry's overall investment assets, its growth is in triple digits.

Millions of dollars have already been invested in the sector as a result: In building partnerships, placing equity investments, raising venture capital, advertising budgets or platform development. That will only expand.

Competition will only make it even more difficult for firms to add scale, forcing them to get more creative in how they approach, attract and educate clients. For some, that means redefining the concept of who the wealth management client is — or adding an entirely new segment of client that was historically ignored.

It's a shift that parallels a demographic change in the actual advice client, a trend that is showing up first among digital advice providers. -Suleman Din

Huge growth, driven by big names

Online managed accounts are winning

The digital advice arena is for gladiators only

Asset managers will continue their digital transition

The winding road to new assets

Image: Bloomberg News

Where are advisers losing relevance?

It's not just about algorithms

Digital allows for greater diversity

Older investors are intrigued by digital advice tools