But the data tracked by Financial Planning’s exclusive annual FP50 survey charts a clear path forward: A greater emphasis than ever on fee income. The firms best positioned to take advantage of this trend may not be the leaders on this year's ranking.

For the moment, however, here are the IBDs which racked up the highest total revenue across their fee, commission and other lines of business.

For more in-depth coverage, please see FP50: The case for optimism for the nation’s largest independent broker-dealers. p/:0�`

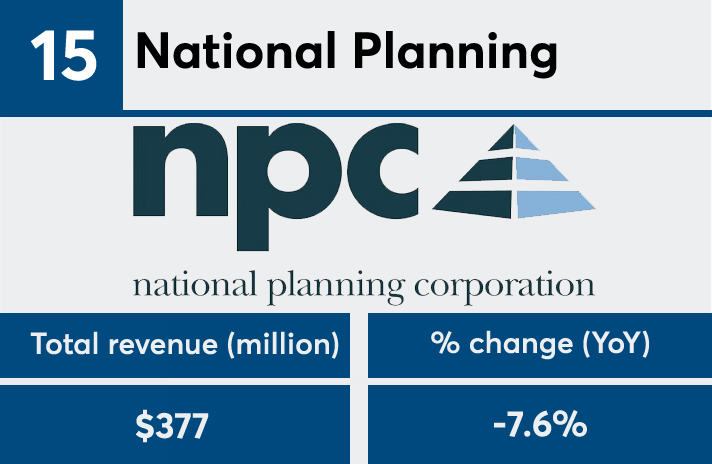

15. National Planning

% change (YoY): -7.6%

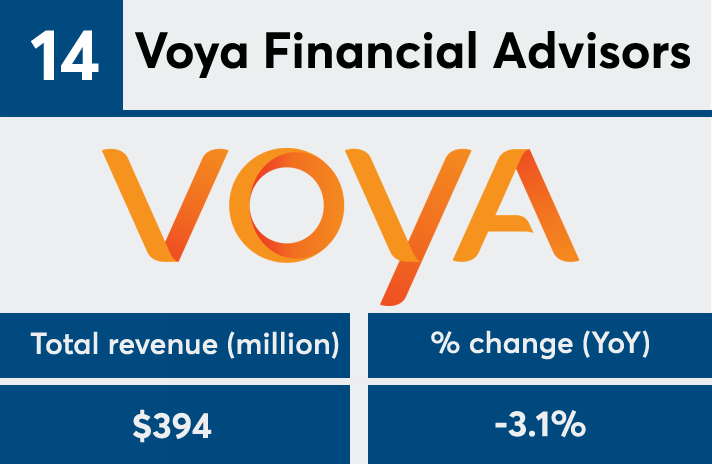

14. Voya Financial Advisors

% change (YoY): -3.1%

13. Kestra Financial

% change (YoY): -1%

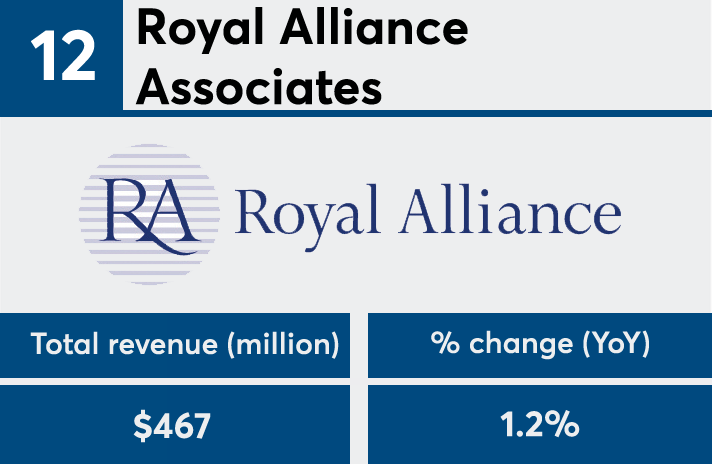

12. Royal Alliance Associates

% change (YoY): 1.2%

11. Waddell & Reed Financial Advisors

% change (YoY): -7.4%

10. Cetera Advisor Networks

% change (YoY): -7.1%

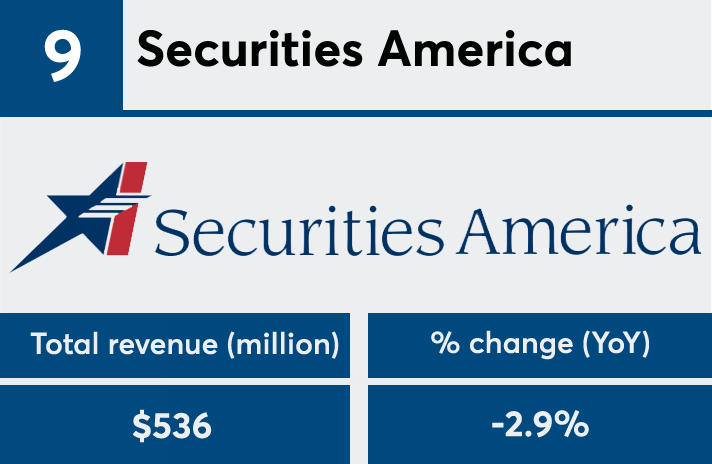

9. Securities America

% change (YoY): -2.9%

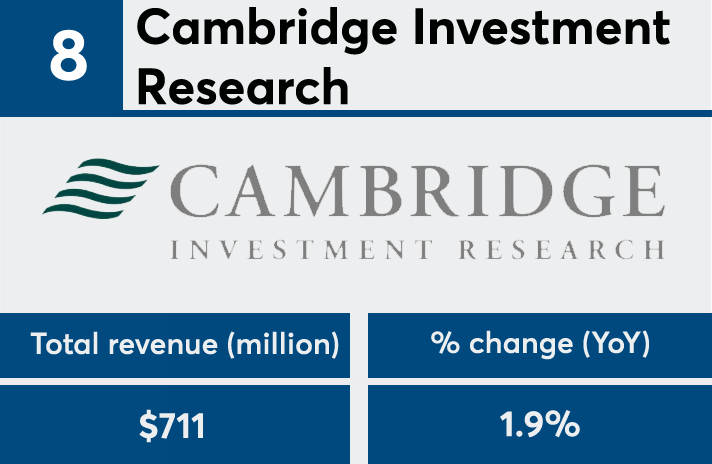

8. Cambridge Investment Research

% change (YoY): 1.9%

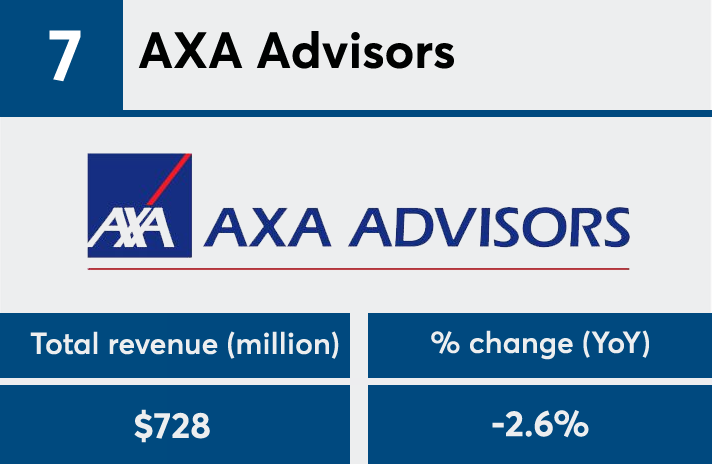

7. AXA Advisors

% change (YoY): -2.6%

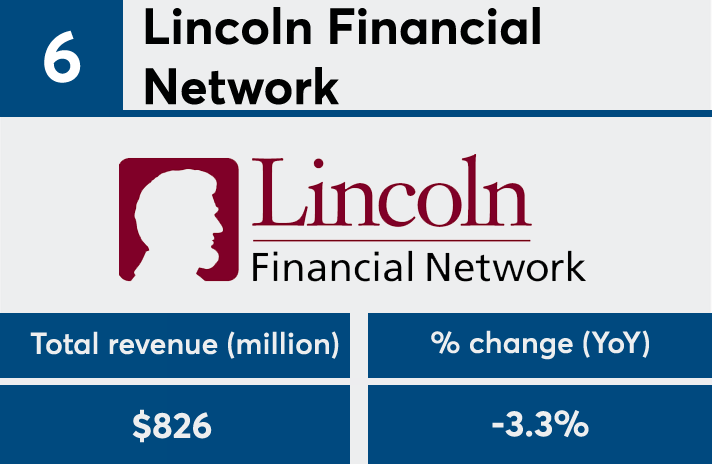

6. Lincoln Financial Network

% change (YoY): -3.3%

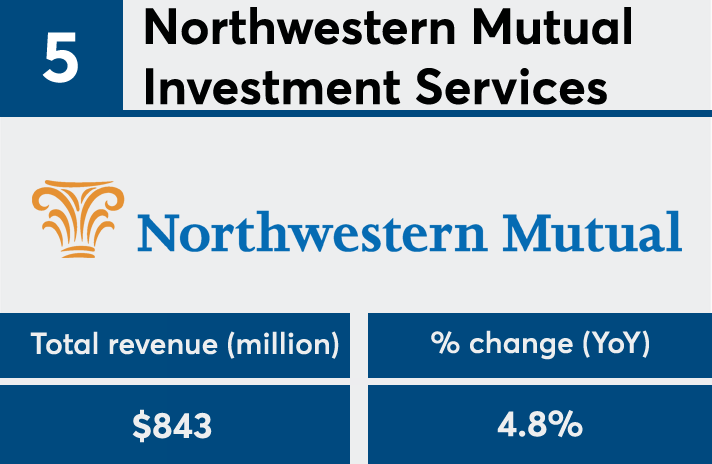

5. Northwestern Mutual Investment Services

% change (YoY): 4.8%

4. Commonwealth Financial Network

% change (YoY): 6.1%

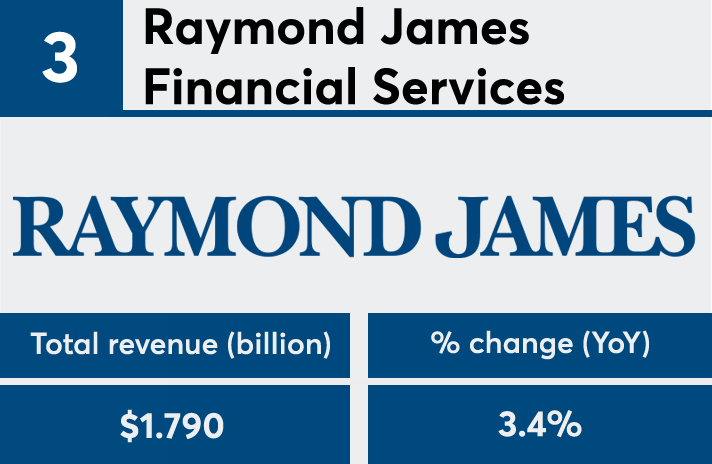

3. Raymond James Financial Services

% change (YoY): 3.4%

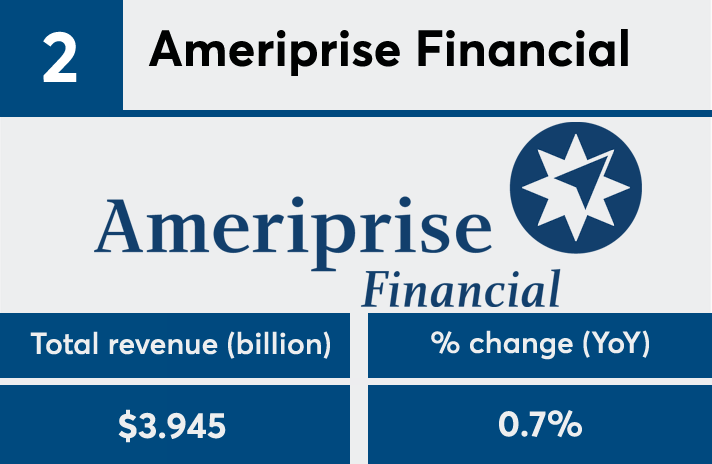

2. Ameriprise Financial

% change (YoY): 0.7%

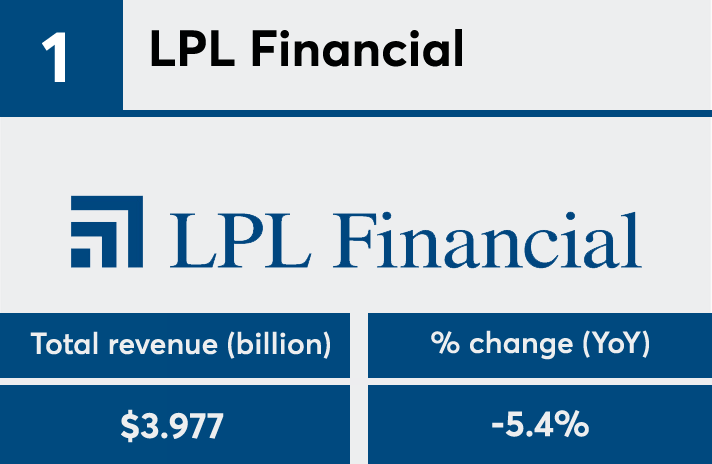

1. LPL Financial

% change (YoY): -5.4