FP50 2016: Which IBDs have the most client assets?

The survey also showed that AUM growth has been lackluster across the industry — four IBDs reported a decline, compared to the prior year. Click through to see how the firms stack up against each other.

For more in-depth coverage, please see

Data is of year-end 2015.

10. Royal Alliance Associates

% Change: -4.3%

9. Securities America

% Change: 2.1%

8. Northwestern Mutual Investment Services

% Change: 2.4%

7. Kestra Financial

% Change: 5.2%

6. MML Investors Services

% Change: -1.1%

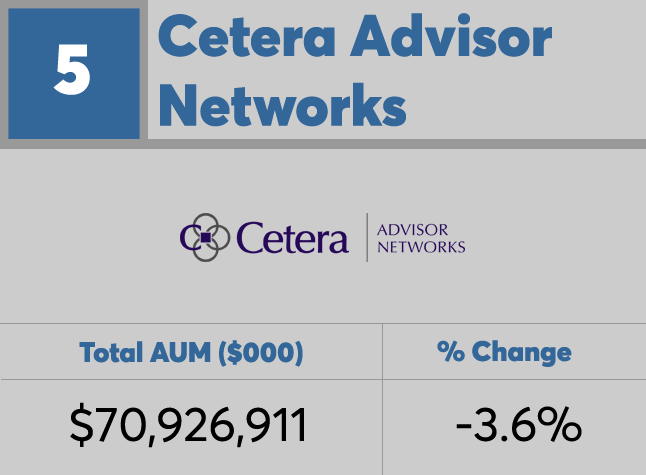

5. Cetera Advisor Networks

% Change: -3.6%

4. Commonwealth Financial Network

% Change: 4.8%

3. AXA Advisors

% Change: -1.1%

2. Raymond James Financial Services

% Change: 1.8%

1. LPL Financial

% Change: 0.1%