Searching for silver linings

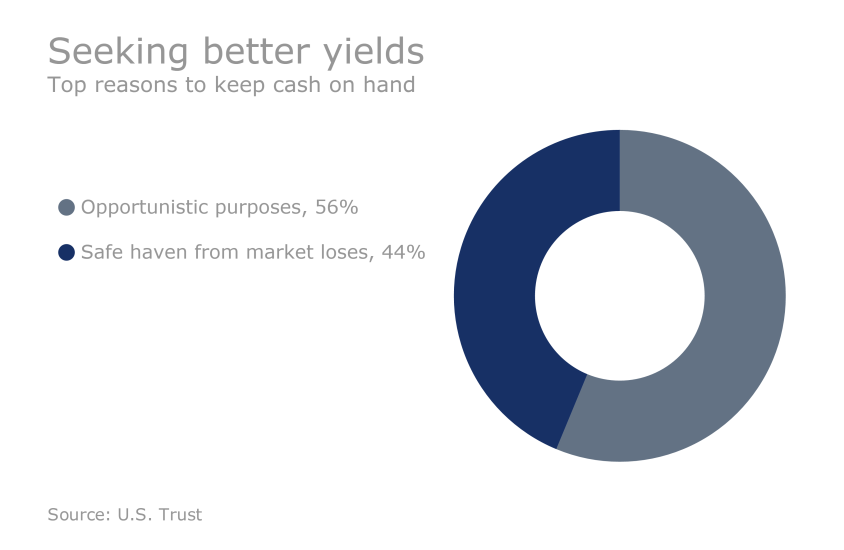

The nation's ultrawealthy 1%, however, are more optimistic about returns in 2016, the study suggests. They keep their liquid positions high for opportunistic purposes, whether it's buying in a down market or on a rising trend.

Click through our slideshow and learn more about the investing characteristics and nuances of the very rich.

Pessimism grows with age

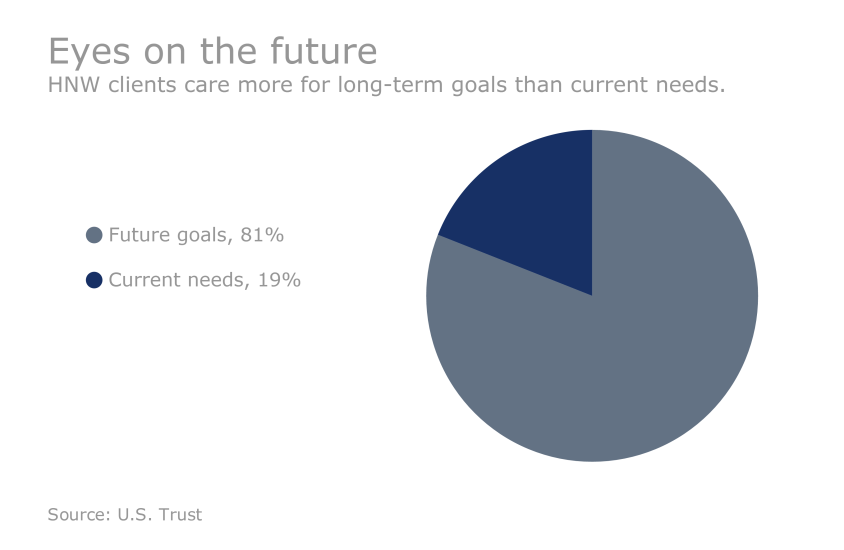

HNW investors seek balanced, risk-managed growth

Asset protection overtakes growth as priority

Near-term opportunities gain importance

Basic approach yields greatest returns

Alternative, non-correlated strategies driven by millennial and Gen X investors.

Liquidity is key