A challenging time for some of the largest wealth management firms

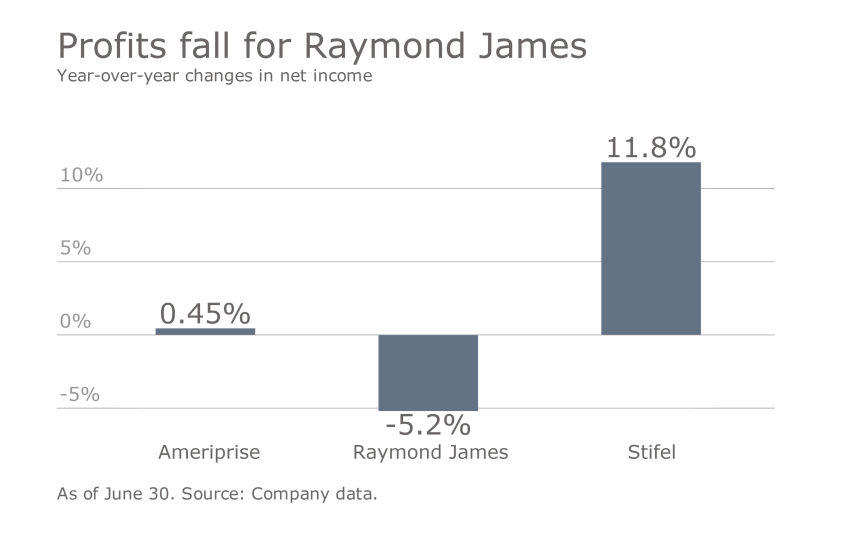

Ameriprise and Raymond James, on the other hand, were underperformers.

Click through our slideshow to see how all three were left standing in the second quarter.

Read more:

A huge jump for one brokerage

Raymond James ended the quarter with just a bump in revenue growth, attributable to account and service fee income. The slight increase was driven by fees associated with the firm's multi-bank cash sweep program — a result of an increase in short-term interest rates and an expansion in client cash balances — relating to clients' reactions to market volatility and uncertainty.

Ameriprise revenues dropped in year-over-year growth because of lower client activities and a decline in average market equity for their performance, the firm says.

Read more:

Wrestling with costs

While Stifel revenues were up, so were its expenses. The firm blamed a double-digit surge in costs on increases in compensation and benefits and business expenditures. Expenses for commissions and floor brokerages, however, shrunk by 3%.

Operational costs were up for Raymond James, due to a hike in legal and regulatory expenses, the firm says.

Read more:

On the rebound

Raymond James reported a drop in profits due to rise in costs. Securities commissions and fee revenues declined slightly, but fees from fee-based accounts increased. This was partially offset by declines in commissions on mutual funds, equity securities and new issue sales credits.

Read more:

Total headcount grows for most

Raymond James's aggressive recruiting paid off with the most advisers among all three firms. As a result, client net inflows increased and assets under management jumped 6% year-over-year.

Ameriprise also saw an increase in total headcount.

Read more:

Two brokerages are hiring

Ameriprise's total headcount increased despite fewer employees coming into the firm.

Two firms pave the road to independence

After the end of the second quarter, that number got smaller as the St. Louis-based firm sold the IBD it had acquired via its purchase of Sterne Agee. Over 500 independent advisers left with the unit.

Read more: