For financial planners, that’s great news. After all, these wealthy households make up a growing pool of prospective clients. While many wealthy households already have ongoing relationships with advisors, a significant portion of them do not, the report by the Spectrem Group shows.

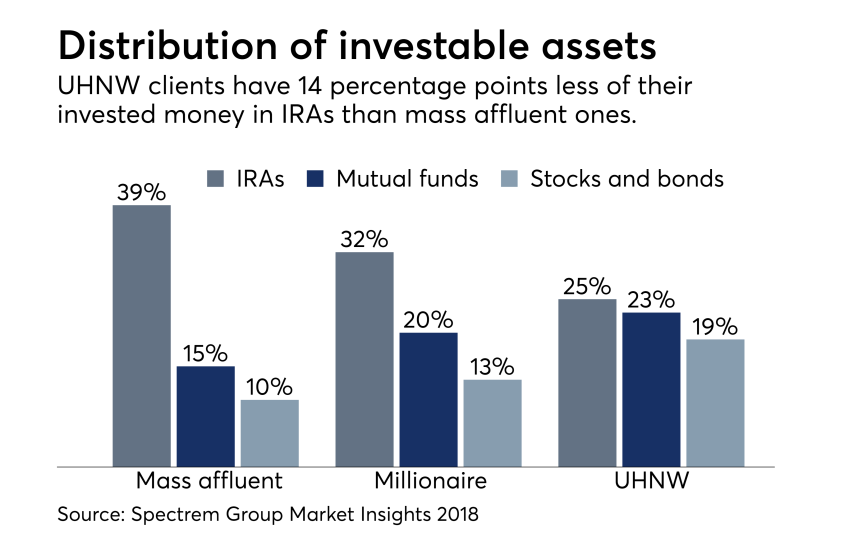

The suburban Chicago-based research firm surveys 4,500 wealthy investors each year for insight into the three key client segments. Mass affluent clients have a net worth between $100,000 and $1 million; millionaire clients have $1 million to $5 million; and UHNW clients have $5 million and above.

Spectrem reported sizeable increases in each group, and millionaire investors grew at the fastest rate since the year after the financial crisis in 2009.

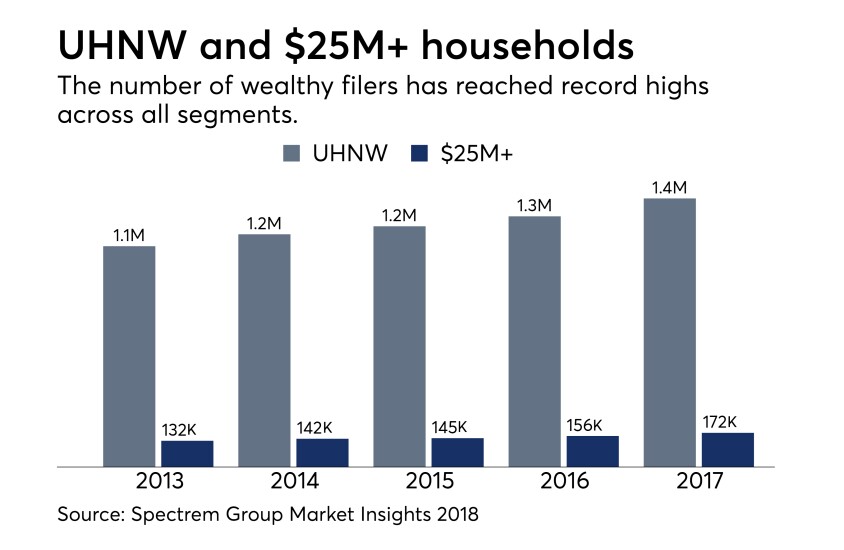

The total number of millionaires grew by nearly 600,000 in 2017 to around 10 million. Mass affluent households jumped by roughly half a million to 31 million. And UHNW households expanded by 90,000 to 1.3 million, as households with $25 million or more increased by 10% to 172,000.

The jump in HNW clients resulted from population growth, baby boomers’ wealth peaking ahead of their retirement years and stock market gains, Spectrem’s Managing Director Catherine McBreen says. Smaller factors like inheritances to boomers from late parents also played a role, she says.

“As the ranks of the affluent grow, it presents opportunities for advisors to show their value to those who heretofore may not have felt they had enough assets to warrant an advisor,” McBreen wrote in an email. “Furthermore, as the events in recent weeks have indicated, an advisor can help calm troubled nerves, and create an array of investments that best meet the investors’ needs and goals.”

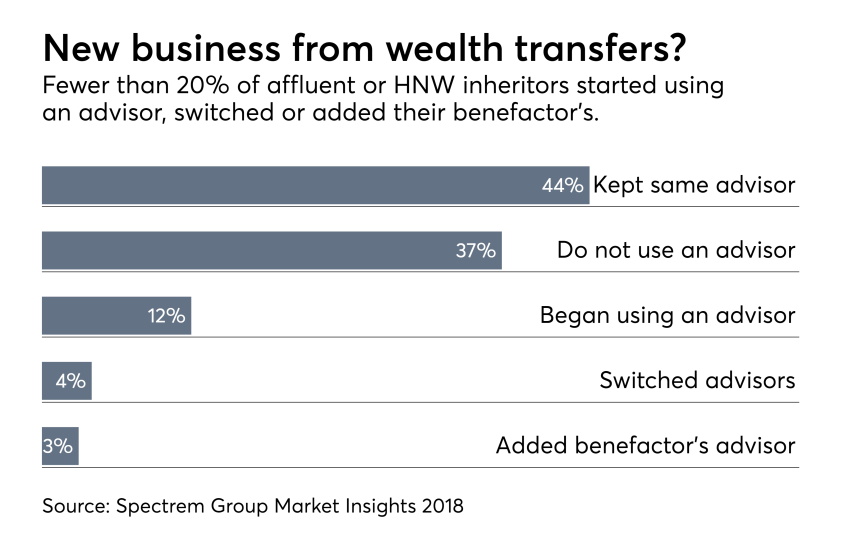

Wealth transfers will also put major assets into the hands of Generation X and millennials. However, only small percentages of inheritors either take on their benefactor’s advisor, start using an advisor or switch from existing ones at all, the survey says.

Younger inheritors also favor new ways of interacting with advisors such as texting and instant messaging, McBreen notes. The issue is “something that advisors need to be aware of as an expectation,” she says.

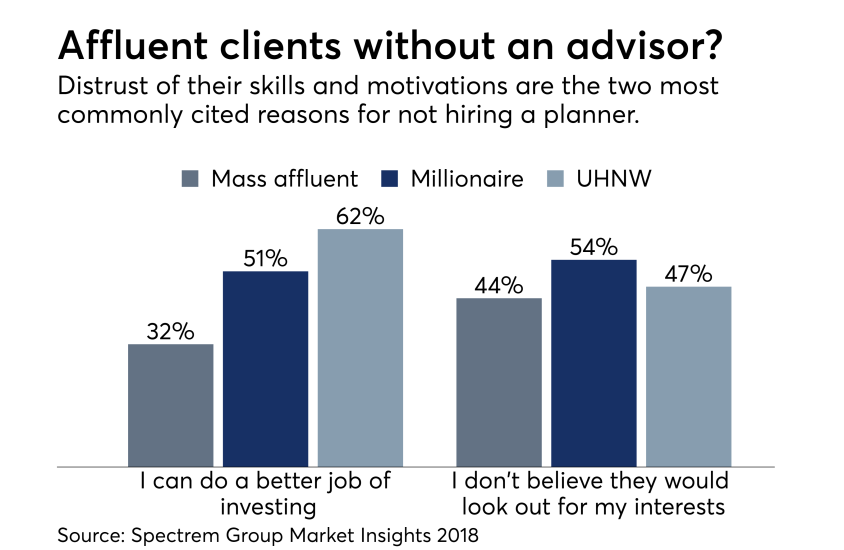

Many prospective wealthy clients across all segments and ages do not have an advisor, Spectrem’s research shows. The most common reasons they cite for not hiring one include that they don’t think advisors would look out for their best interests or they think they can do a better job.

As a CFP at a fee-only RIA, Rachael Bator of Boston-area firm Lake Street Advisors says she encourages prospective clients to ask questions relating to compensation structure, outside business activities and relationships with third-party corporations or professionals in order to make an educated decision.

If confronted by a prospect who believes they can do a better job investing on their own, advisors should point out the work that they can save the clients, Bator added in an email.

“Managing a multimillion dollar portfolio requires a sound strategy involving thorough analysis, appropriate asset allocation, efficient implementation and continuous monitoring,” Bator says.

“However, working with a qualified advisor doesn’t mean a prospective client has to relinquish full control of their personal investment strategy — instead, they should consider the advisor as someone joining their family’s ‘team.’”

To view key findings from Spectrem’s report, click through our slideshow. Figures come from Spectrem’s monthly online research, the firm’s proprietary modeling, third-party public research and consultations with advisors. Primary residences are not included in measures of net worth, and the figures on clients’ responses have a 4% margin of error.