Click through to see the 20 mutual funds with at least $1 billion in assets with the highest alpha, each compared to its respective benchmarks, for the past three years.

It's worth noting that alternative strategies have a strong showing on this list and that expense ratios are rarely rock-bottom. The median expense is 1.05%, and on this list they run as high as 1.97%. All data from Morningstar.

20. Fidelity Real Estate Investment Port (FRESX)

3-Yr. Return: 11.67%

Expense Ratio: 0.77%

Total Assets (millions): $4,619

19. PIMCO Income Instl (PIMIX)

3-Yr. Return: 5.93%

Expense Ratio: 0.45%

Total Assets (millions): $75.368

18. Vanguard Global Minimum Volatility Admr (VMNVX)

3-Yr. Return: 10.12%

Expense Ratio: 0.17%

Total Assets (millions): $1,703

17. JHancock Balanced (SVBAX)

3-Yr. Return: 5.63%

Expense Ratio: 1.09%

Total Assets (millions): $1,864

16. Dreyfus Global Real Return (DRRIX)

3-Yr. Return: 1.99%

Expense Ratio: 0.88%

Total Assets (millions): $1,411

15. MFS International Value (MGIAX)

3-Yr. Return: 4.82%

Expense Ratio: 1.01%

Total Assets (millions): $25,600

14. Westwood Income Opportunity Instl (WHGIX)

3-Yr. Return: 5.40%

Expense Ratio: 0.84%

Total Assets (millions): $2,572

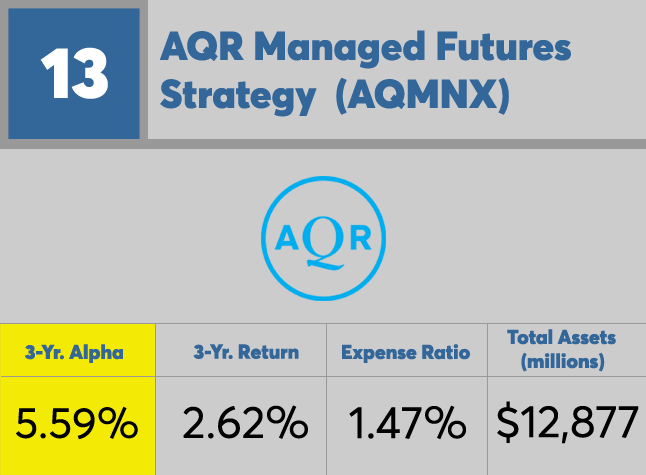

13. AQR Managed Futures Strategy (AQMNX)

3-Yr. Return: 2.62%

Expense Ratio: 1.47%

Total Assets (millions): $12,877

12. Eaton Vance Glbl Macro Abs Ret Advtg (EGRIX)

3-Yr. Return: 6.03%

Expense Ratio: 1.23%

Total Assets (millions): $1,790

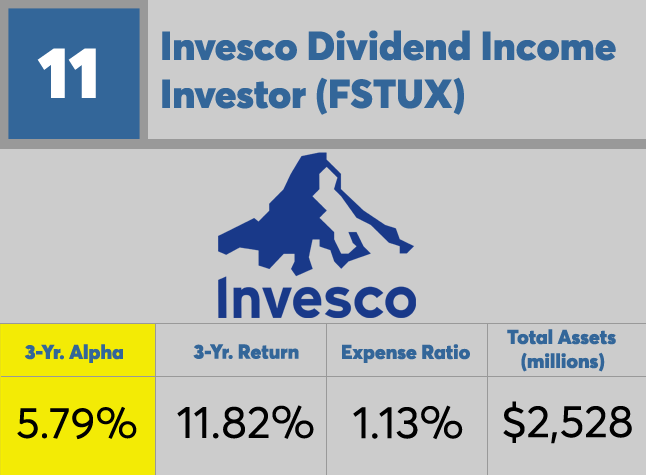

11. Invesco Dividend Income Investor (FSTUX)

3-Yr. Return: 11.82%

Expense Ratio: 1.13%

Total Assets (millions): $2,528

10. T. Rowe Price Global Technology (PRGTX)

3-Yr. Return: 20.18%

Expense Ratio: 0.90%

Total Assets (millions): $3,803

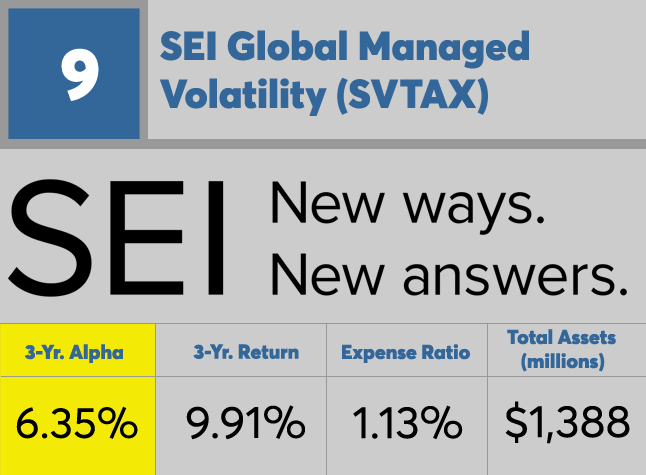

9. SEI Global Managed Volatility (SVTAX)

3-Yr. Return: 9.91%

Expense Ratio: 1.13%

Total Assets (millions): $1,388

8. Fidelity Select Medical Equip & Systems (FSMEX)

3-Yr. Return: 16.02%

Expense Ratio: 0.75%

Total Assets (millions): $3,130

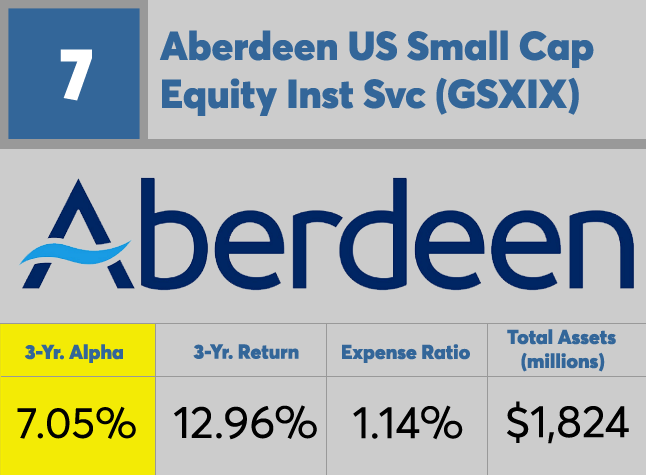

7. Aberdeen US Small Cap Equity Inst Svc (GSXIX)

3-Yr. Return: 12.96%

Expense Ratio: 1.14%

Total Assets (millions): $1,824

6. Fidelity Select Gold (FSAGX)

3-Yr. Return: -0.90%

Expense Ratio: 0.93%

Total Assets (millions): $1,544

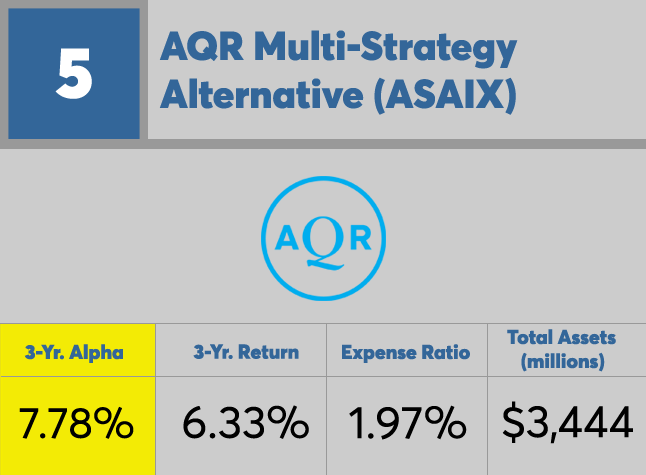

5. AQR Multi-Strategy Alternative (ASAIX)

3-Yr. Return: 20.97%

Expense Ratio: 1.12%

Total Assets (millions): $1,925

4. Fidelity Select Semiconductors (FSELX)

3-Yr. Return: 22.41%

Expense Ratio: 0.74%

Total Assets (millions): $3,011

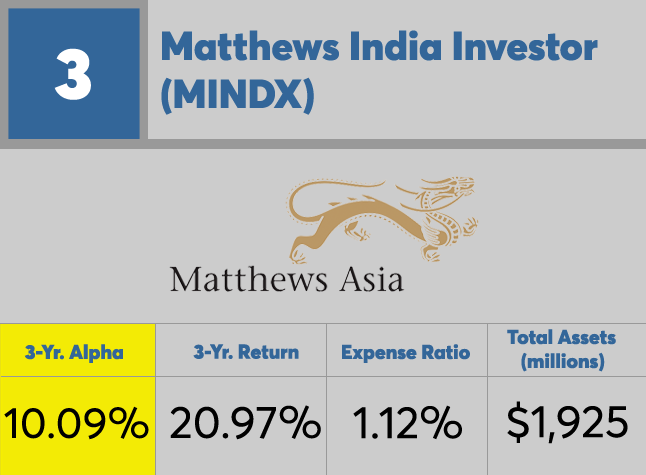

3. Matthews India Investor (MINDX)

3-Yr. Return: 20.97%

Expense Ratio: 1.12%

Total Assets (millions): $1,925

2. Western Asset Macro Opportunities (LAOSX)

3-Yr. Return: 5.09%

Expense Ratio: 1.23%

Total Assets (millions): $1,004

1. AQR Style Premia Alternative (QSPIX)

3-Yr. Return: 8.36%

Expense Ratio: 1.49%

Total Assets (millions): $4,065