"A really disproportionate flow has gone into fixed income," explains Robert Johnson, the director of economic analysis at Morningstar. "Target-date funds have done better … because [clients] want one-step control. They don’t want to sit there and pick between 23 funds in a fund family. They would rather just have one picked for their age."

Scroll through to see the top 20 mutual funds with more than $1 billion in assets ranked by their net share class inflows over the last five years. The following flow data was last reported on Oct. 31 and returns on Nov. 4. All data is from Morningstar.

DFA Five-Year Global Fixed-Income I (DFGBX)

5-Yr. Return: 2.22%

Expense Ratio: 0.27%

Net Assets (millions): $12,653

Vanguard Target Retirement 2040 Inv (VFORX)

5-Yr. Return: 9.23%

Expense Ratio: 0.16%

Net Assets (millions): $17,170

Strategic Advisers Core (FCSAX)

5-Yr. Return: 12.13%

Expense Ratio: 0.56%

Net Assets (millions): $22,211

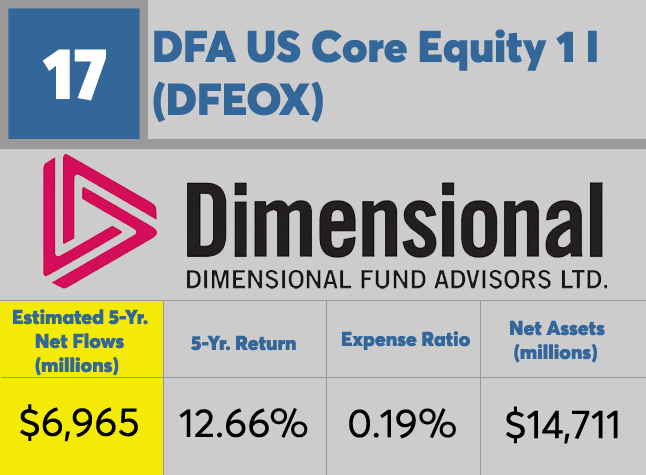

DFA US Core Equity 1 I (DFEOX)

5-Yr. Return: 12.66%

Expense Ratio: 0.19%

Net Assets (millions): $14,711

Baird Aggregate Bond Inst (BAGIX)

5-Yr. Return: 4.07%

Expense Ratio: 0.30%

Net Assets (millions): $10,296

Vanguard Target Retirement 2020 Inv (VTWNX)

5-Yr. Return: 7.53%

Expense Ratio: 0.14%

Net Assets (millions): $27,126

AQR Managed Futures Strategy I (AQMIX)

5-Yr. Return: 4.02%

Expense Ratio: 1.22%

Net Assets (millions): $13,964

Baird Core Plus Bond Inst (BCOIX)

5-Yr. Return: 4.08%

Expense Ratio: 0.30%

Net Assets (millions): $12,825

Vanguard Target Retirement 2030 Inv (VTHRX)

5-Yr. Return: 8.54%

Expense Ratio: 0.15%

Net Assets (millions): $24,659

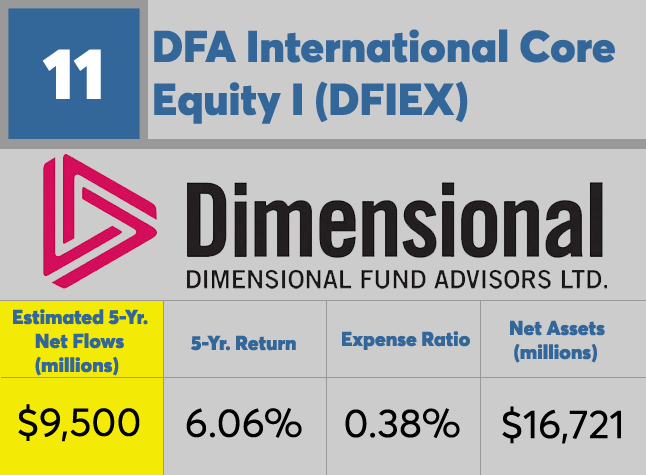

DFA International Core Equity I (DFIEX)

5-Yr. Return: 6.06%

Expense Ratio: 0.38%

Net Assets (millions): $16,721

Old Westbury Large Cap Strategies (OWLSX)

5-Yr. Return: 8.87%

Expense Ratio: 1.15%

Net Assets (millions): $14,609

T. Rowe Price New Income (PRCIX)

5-Yr. Return: 3.01%

Expense Ratio: 0.54%

Net Assets (millions): $31,151

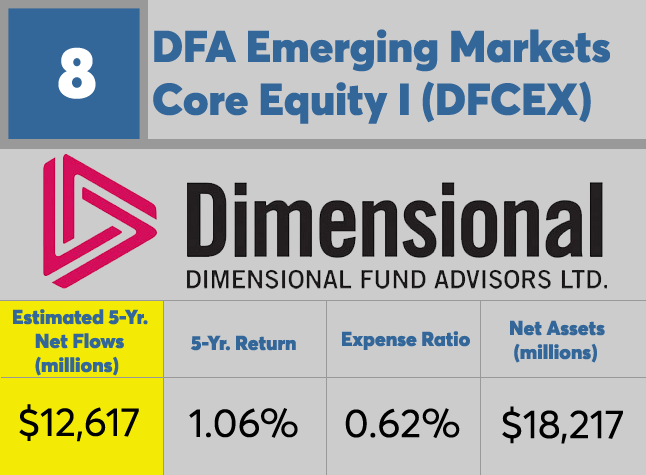

DFA Emerging Markets Core Equity I (DFCEX)

5-Yr. Return: 1.06%

Expense Ratio: 0.62%

Net Assets (millions): $18,216

Oakmark International I (OAKIX)

5-Yr. Return: 8.38%

Expense Ratio: 0.95%

Net Assets (millions): $23,881

Vanguard Dividend Growth Inv (VDIGX)

5-Yr. Return: 11.86%

Expense Ratio: 0.33%

Net Assets (millions): $30,146

Dodge & Cox Income (DODIX)

5-Yr. Return: 4.02%

Expense Ratio: 0.43%

Net Assets (millions): $47,068

Strategic Advisers Core Income (FPCIX)

5-Yr. Return: 3.60%

Expense Ratio: 0.48%

Net Assets (millions): $29,175

Vanguard Total Bond Market II Idx Inv (VTBIX)

5-Yr. Return: 2.70%

Expense Ratio: 0.09%

Net Assets (millions): $109,078

DoubleLine Total Return Bond I (DBLTX)

5-Yr. Return: 4.48%

Expense Ratio: 0.47%

Net Assets (millions): $61,518

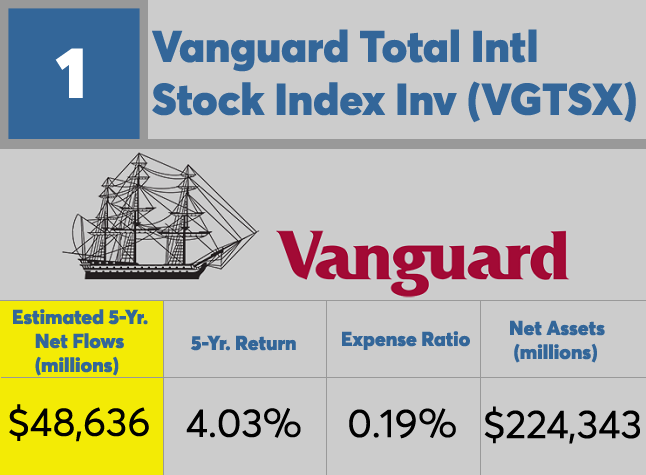

Vanguard Total Intl Stock Index Inv (VGTSX)

5-Yr. Return: 4.03%

Expense Ratio: 0.19%

Net Assets (millions): $224,343