Risk factors can vary widely, so focusing on the potential downside is as important (probably more important) as the potential upside.

This list of 20 mutual funds and ETFs has some broad-based offerings, yet also includes high-yield funds, hedged and leveraged mutual funds, any of which could be a tough fit with many portfolios.

As usual, we limited the list to funds with at least $100 million, since very small funds have an inherent liquidity risk. But it’s worth noting just how many small funds we screened out this time: 16. The 20th fund here would have been ranked 36th if we included any size.

To be sure, if we included all funds regardless of size, the fund atop the list would have been REX VolMAXX Short VIX (VMIN), an ETF based on market volatility. Its YTD dividend was 9.9%, but it had less than $23 million in assets.

All data from Morningstar.

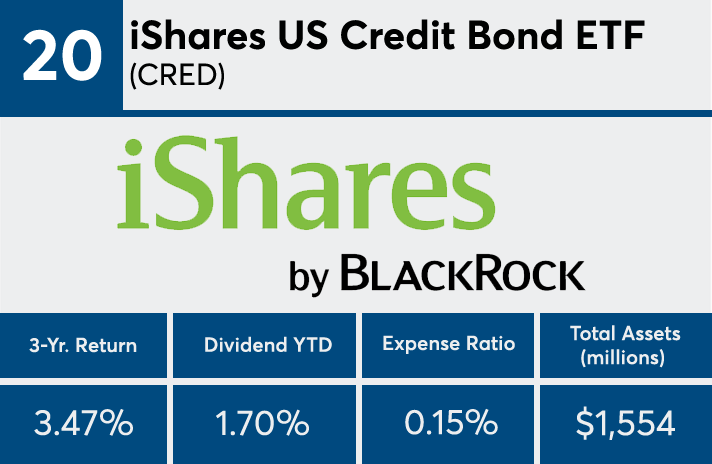

20. iShares US Credit Bond ETF (CRED)

Dividend YTD: 1.70%

Expense Ratio: 0.15%

Total Assets (millions): $1,554

19. ProShares High Yield—Interest Rate Hdgd (HYHG)

Dividend YTD: 1.80%

Expense Ratio: 0.50%

Total Assets (millions): $151

18. Vanguard Utilities ETF (VPU)

Dividend YTD: 1.81%

Expense Ratio: 0.10%

Total Assets (millions): $3,281

17. Vanguard Consumer Staples ETF (VDC)

Dividend YTD: 1.87%

Expense Ratio: 0.10%

Total Assets (millions): $4,455

16. iShares iBoxx $ Invmt Grade Corp Bd ETF (LQD)

Dividend YTD: 1.91%

Expense Ratio: 0.15%

Total Assets (millions): $37,613

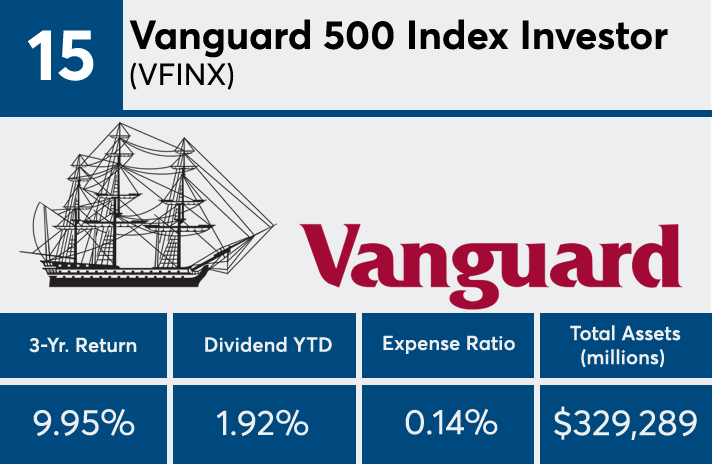

15. Vanguard 500 Index Investor (VFINX)

Dividend YTD: 1.92%

Expense Ratio: 0.14%

Total Assets (millions): $329,289

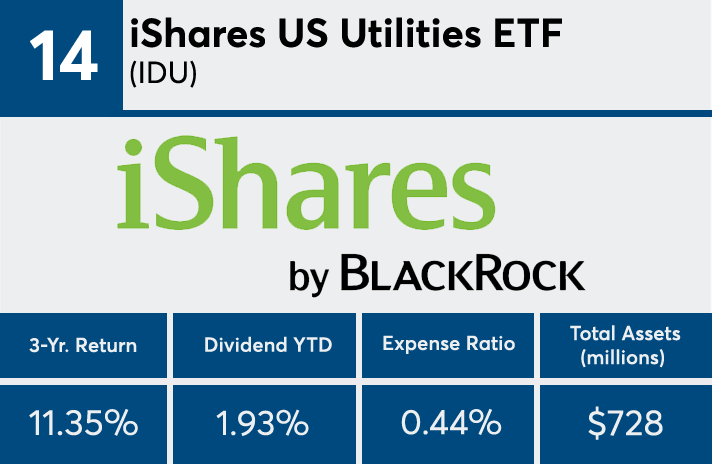

14. iShares US Utilities ETF (IDU)

Dividend YTD: 1.93%

Expense Ratio: 0.44%

Total Assets (millions): $728

13. iShares Mortgage Real Estate Capped ETF (REM)

Dividend YTD: 2.01%

Expense Ratio: 0.48%

Total Assets (millions): $1,377

12. iShares Interest Rate Hdg Hi Yld Bd ETF (HYGH)

Dividend YTD: 2.14%

Expense Ratio: 0.54%

Total Assets (millions): $178

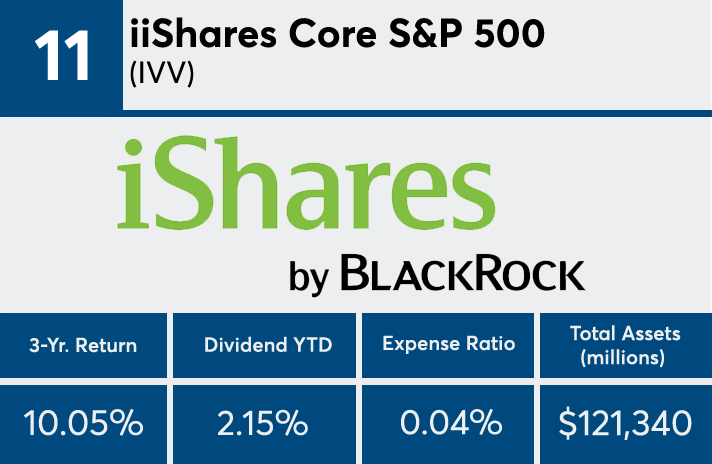

11. iShares Core S&P 500 (IVV)

Dividend YTD: 2.15%

Expense Ratio: 0.04%

Total Assets (millions): $121,340

10. SPDR S&P 500 ETF (SPY)

Dividend YTD: 2.22%

Expense Ratio: 0.10%

Total Assets (millions): $237,503

9. iShares iBoxx $ High Yield Corp Bd ETF (HYG)

Dividend YTD: 2.27%

Expense Ratio: 0.49%

Total Assets (millions): $18,900

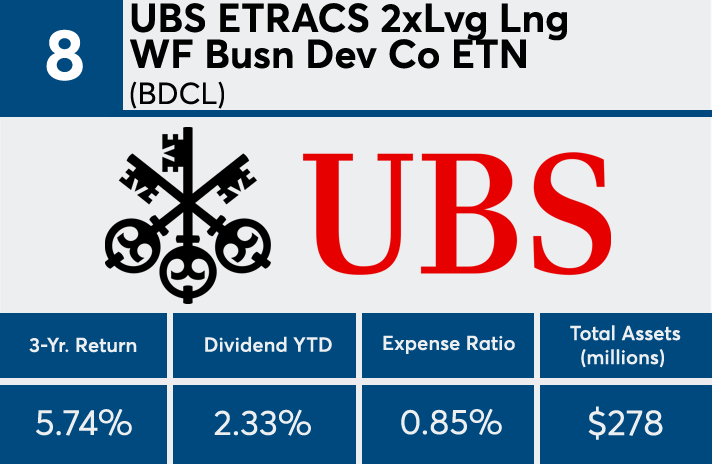

8. UBS ETRACS 2xLvg Lng WF Busn Dev Co ETN (BDCL)

Dividend YTD: 2.326%

Expense Ratio: 0.85%

Total Assets (millions): $278

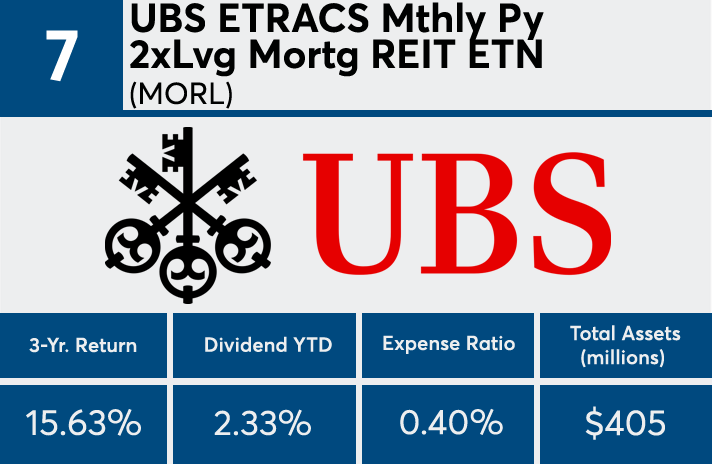

7. UBS ETRACS Mthly Py 2xLvg Mortg REIT ETN (MORL)

Dividend YTD: 2.329%

Expense Ratio: 0.40%

Total Assets (millions): $405

6. BlackRock Exchange BlackRock (STSEX)

Dividend YTD: 2.50%

Expense Ratio: 0.62%

Total Assets (millions): $175

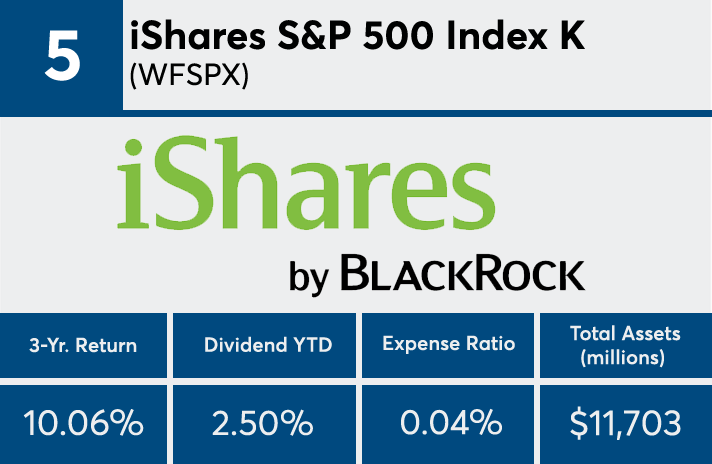

5. iShares S&P 500 Index K (WFSPX)

Dividend YTD: 2.505%

Expense Ratio: 0.04%

Total Assets (millions): $11,703

4. SPDR Dow Jones Industrial Average ETF (DIA)

Dividend YTD: 2.58%

Expense Ratio: 0.17%

Total Assets (millions): $16,659

3. iShares JP Morgan USD Em Mkts Bd ETF (EMB)

Dividend YTD: 2.65%

Expense Ratio: 0.40%

Total Assets (millions):$11,801

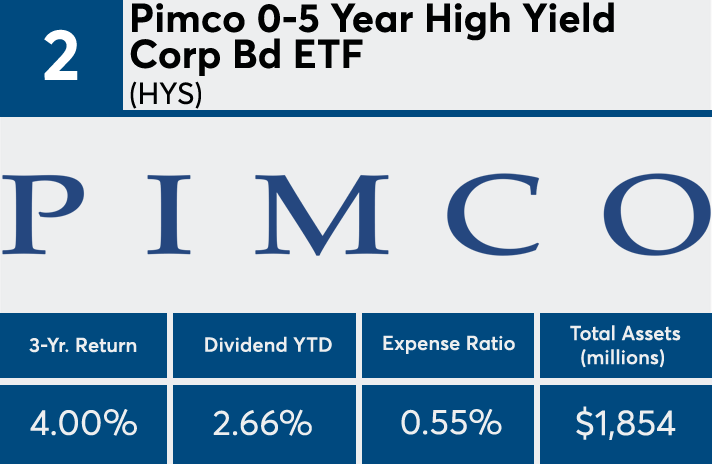

2. Pimco 0-5 Year High Yield Corp Bd ETF (HYS)

Dividend YTD: 2.66%

Expense Ratio: 0.55%

Total Assets (millions): $1,854

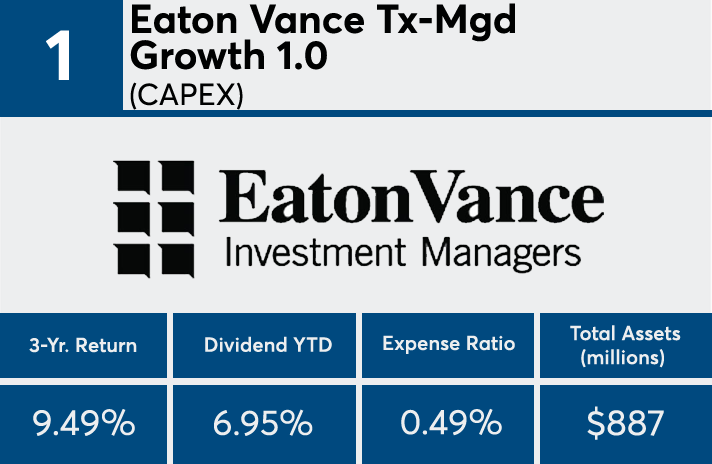

1. Eaton Vance Tx-Mgd Growth 1.0 (CAPEX)

Dividend YTD: 6.95%

Expense Ratio: 0.49%

Total Assets (millions): $887