Even in times of low volatility, individual portfolios may carry high (read unwarranted) levels of risk. In that light, we collected the equity mutual funds and ETFs with the best risk-adjusted returns as measured by Sharpe ratios. The eyes of many clients may glaze over, but it’s your job to remind them how concepts like risk and standard deviation can affect their savings.

Scroll through to see the 20 funds with the highest three-year Sharpe ratios. All data is from Morningstar.

20. PowerShares S&P 500® Quality ETF (SPHQ)

3-Yr. Return: 11.78%

Expense Ratio: 0.29%

Fund Size (millions): $1,203

19. Fidelity Select Semiconductors (FSELX)

3-Yr. Return: 22.37%

Expense Ratio: 0.74%

Fund Size (millions): $3,147

18. Columbia Seligman Comms & Info (SLMCX)

3-Yr. Return: 19.88%

Expense Ratio: 1.35%

Fund Size (millions): $4,973

17. SEI US Managed Volatility (SVYAX)

3-Yr. Return: 10.69%

Expense Ratio: 0.24%

Fund Size (millions): $1,468

16. Columbia Seligman Global Technology (SHGTX)

3-Yr. Return: 20.35%

Expense Ratio: 1.40%

Fund Size (millions): $899

15. First Trust Morningstar Div Leaders ETF (FDL)

3-Yr. Return: 12.28%

Expense Ratio: 0.45%

Fund Size (millions): $1,763

14. Fidelity Real Estate Income (FRIFX)

3-Yr. Return: 7.14%

Expense Ratio: 0.81%

Fund Size (millions): $4,955

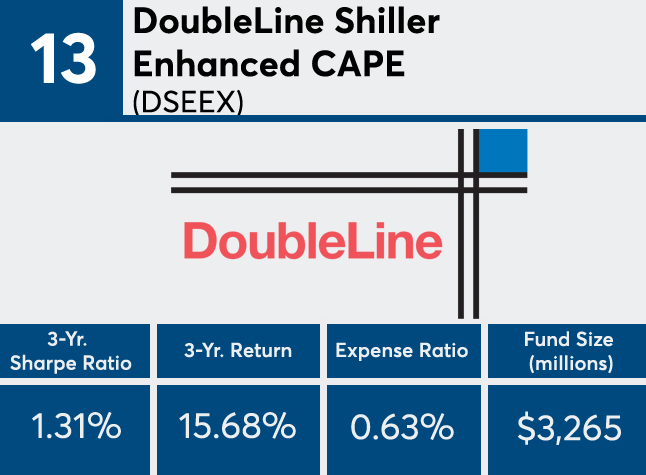

13. DoubleLine Shiller Enhanced CAPE (DSEEX)

3-Yr. Return: 15.68%

Expense Ratio: 0.63%

Fund Size (millions): $3,265

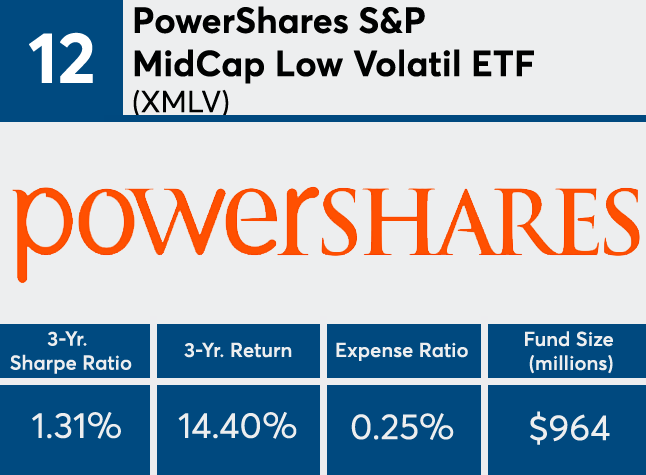

12. PowerShares S&P MidCap Low Volatil ETF (XMLV)

3-Yr. Return: 14.40%

Expense Ratio: 0.25%

Fund Size (millions): $964

11. SEI Dynamic Asset Allocation (SDLAX)

3-Yr. Return: 13.64%

Expense Ratio: 0.08%

Fund Size (millions): $2,356

10. iShares Edge MSCI Min Vol USA (USMV)

3-Yr. Return: 12.10%

Expense Ratio: 0.15%

Fund Size (millions): $12,516

9. American Century Equity Income Inv (TWEIX)

3-Yr. Return: 10.73%

Expense Ratio: 0.94%

Fund Size (millions): $12,285

8. First Trust Value Line Dividend ETF (FVD)

3-Yr. Return: 12.36%

Expense Ratio: 0.70%

Fund Size (millions): $3,392

7. AQR Large Cap Defensive Style (AUEIX)

3-Yr. Return: 12.91%

Expense Ratio: 0.39%

Fund Size (millions): $981

6. Invesco Dividend Income Investor (FSTUX)

3-Yr. Return: 10.90%

Expense Ratio: 1.13%

Fund Size (millions): $2,521

5. PowerShares High Yld Eq Div Achiev ETF (PEY)

3-Yr. Return: 15.84%

Expense Ratio: 0.54%

Fund Size (millions): $1,044

4. Vanguard Global Minimum Volatility Admr (VMNVX)

3-Yr. Return: 10.29%

Expense Ratio: 0.17%

Fund Size (millions): $1,768

3. Lazard Global Listed Infrastructure Inst (GLIFX)

3-Yr. Return: 13.05%

Expense Ratio: 0.96%

Fund Size (millions): $4,212

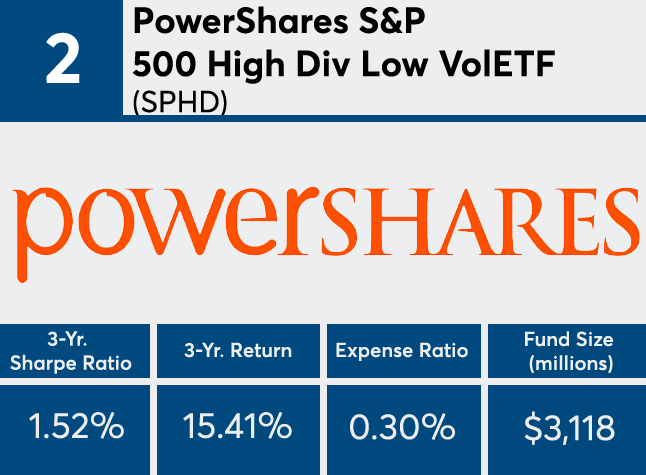

2. PowerShares S&P 500 High Div Low VolETF (SPHD)

3-Yr. Return: 15.41%

Expense Ratio: 0.30%

Fund Size (millions): $3,118

1. Fidelity Series Real Estate Income (FSRWX)

3-Yr. Return: 6.60%

Expense Ratio: 0.61%

Fund Size (millions): $883