Highlights From the Exclusive Tiburon CEO Summit

In addition to serious networking, one of the biggest draws of the Tiburon CEO Summit is Roame's keynote presentation with its in-depth overview of the industry, important trends and developments, as well as its granular data and charts.

The following slides highlight some of the most important takeaways from the CEO Summit, held last month in San Francisco.

"There's lots changing in the industry," says Roame. "You'll see some key inflection points in the data." -- Charles Paikert

Scroll through or click here to view this content as a one page version.

Image: iStock

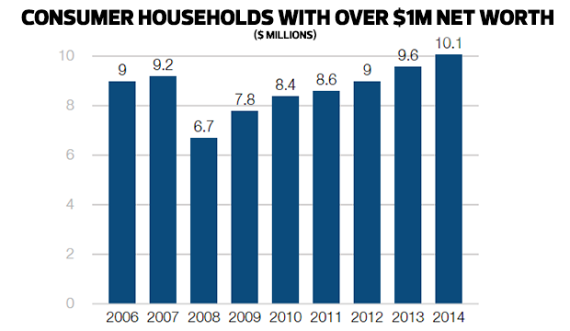

1) Good News for Wealth Managers

"Ten million households that have one million bucks that is a common yardstick to which many advisors can relate," says Roame.

All data according to Tiburon.

2) Advisor Channel: Look Who's Number One

"But the growth is all going to the fee-based financial advisors and dually registered advisors," Roame notes.

All data according to Tiburon.

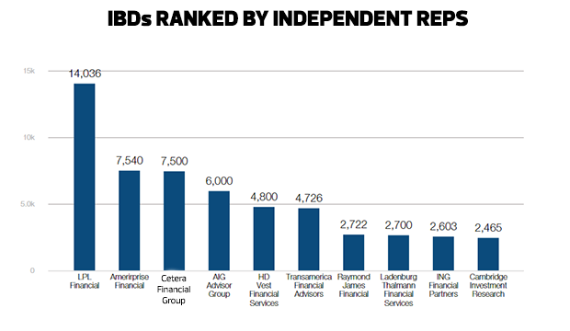

3) IDBS: Not Even Close

Roame believes LPL will rise to the challenge. "LPL is an impressive franchise and likely will recover well," he predicts.

All data according to Tiburon.

4) Custodians: Schwab Still On Top

All data according to Tiburon.

5) Rise of the Robos

"It's likely to grow far more but many of the robos will disappear," according to Roame. "We expect those robos that serve defined contribution plans to be most successful, followed by the discount brokerage firms and mutual fund companies."

All data according to Tiburon.

6) Robo VC Sweepstakes: Three-Horse Race

Each has a distinctive strategy Wealthfront is focusing on the online consumer market, Betterment targets consumers but also operates in the B-to-B market with a white label service for advisors, while Personal Capital charges higher fees and supplements its digital service with human advisors.

All data according to Tiburon.

7) M&A: Edelman Is Back

Edelman sold a majority stake in his advisory firm to private equity company Hellman & Friedman last month for a reported $800 million. Typically there are only about 10 M&A deals each year for RIA firms with $1 billion or more in AUM, but this year there have already been at least 20 such transactions.

All data according to Tiburon.