Finance Apps: Who Are the Real Power Users?

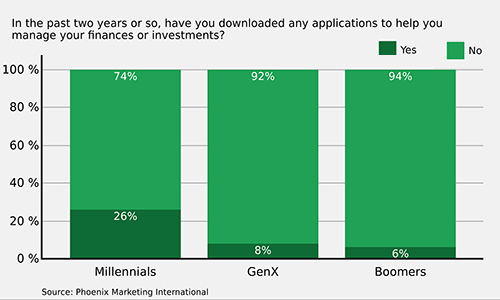

But when it comes to wealth management, personal finance or even spending tracking -- Gen Xers and boomers are more actively engaged.

"As instant access to information and the firms they deal with is a key driving force for most millennials, our data clearly shows that these young investors want the ability to connect with their banking or investing accounts from anywhere at any time," says David M. Thompson, managing director, Phoenix's Affluent Practice.

"Some boomers are downloading personal finance apps, I'm guessing retirement-related. [And] some GenX, who have been investing for a longer time-frame than millennials, are gravitating towards digital wallet and personal spending tracking apps."

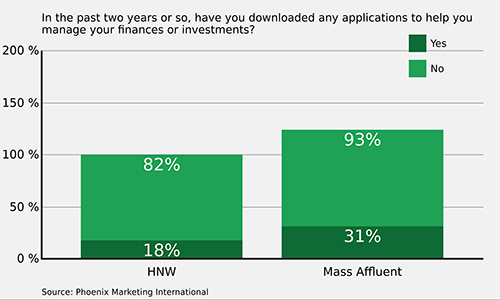

Phoenix Marketing examined the download patterns of HNW investors in its recent study of mobile financial app use among households with $100,000 or more in investible assets. Here's a closer look at the data. --Suleman Din

Click here to read a single-page version.

Finance Apps: Who Are the Real Power Users?

Finance Apps: Who Are the Real Power Users?

Finance Apps: Who Are the Real Power Users?

Finance Apps: Who Are the Real Power Users?

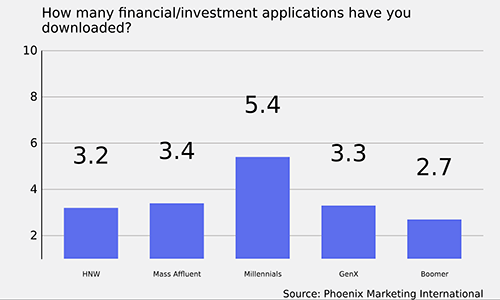

Yet among boomers and Gen X investors, the mix of financial apps was more varied.

Gen X investors actually led all age groups in downloading investing apps (55%), personal spending trackers (25%), and digital wallet and asset management (32%).

Boomers had the highest interest in downloaded banking apps (67%) and were ranked first among the age groups in downloading personal finance apps (40%).

Finance Apps: Who Are the Real Power Users?