ETF Surge: Top Performers of 2014

ETF assets have increased 18% in 2014 from $1.698 trillion to $2.007 trillion based on positive market performance and net new assets, according to London-based research firm ETFGI.

ETFGI reports that the U.S. listed ETF and ETP industry has gained $232 billion in net new assets this year, which is a new record, topping last years haul of $190 billion.

A number of the top-performing ETFs this year are focused on energy. Year-to-date, energy ETFs have attracted $9.25 billion of new money, the most of any sector behind real estate funds and more than triple the same period in 2013, according to Bloomberg.

Investors are betting that 2015 will bring an eventual rise in oil prices, which have seen weeks of declines.

Here are the year's top 10 performing ETFs that are still open to new investors. It should be noted that each fund's performance is a reflection of current events and investor interests, and can rapidly change with any reversal of the market. -- Suleman Din

You can view this in a single-page version

here.

10. Direxion Daily Healthcare Bull 3X ETF

9. PowerShares DB 3X Long 25+ Year Treasury Bond ETN

8. Direxion Daily 20+ Year Treasury Bull 3X ETF

7. ProShares Ultra Semiconductors

6. Direxion Daily Semiconductor Bull 3X ETF

5. PowerShares DB Crude Oil Double Short ETN

4. Direxion Daily Real Estate Bull 3X ETF

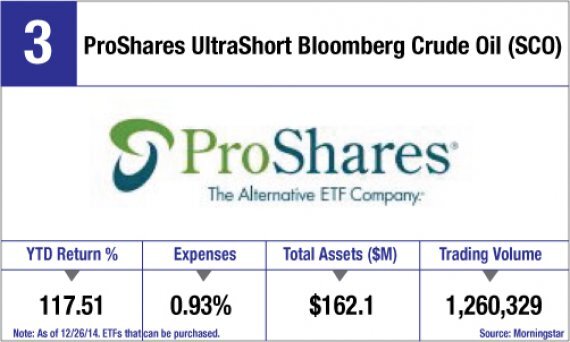

3. ProShrares UltraShort Bloomberg Crude Oil

2. Direxion Daily Russia Bear 3X ETF