ETFs becoming the new default investment

Other dramatic wealth management shifts, from the reasons planners now give for rebalancing asset allocations, to the outlook on the U.S. economy, were revealed by the FPA’s Trends in Investing survey. Click through our slideshow to learn more about strategies advisers – or their competitors – are utilizing today.

FPA’s 10th annual study surveyed 283 advisers in April, 98% of whom are CFP practitioners and about half identify as independent IARs/RIAs.

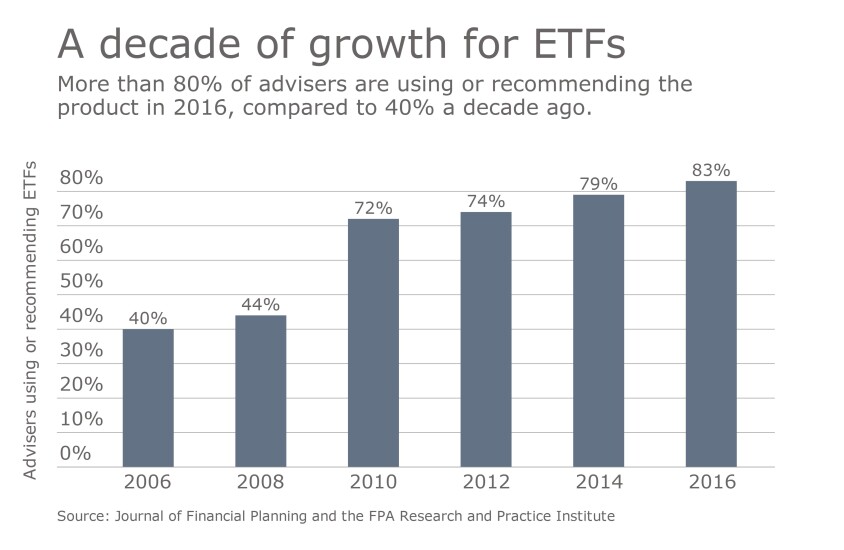

Rise of ETFs shows no signs of waning

ETFs show clear lead in future expected use

Mutual funds take a hit

Cheaper is better

Too expensive to sell

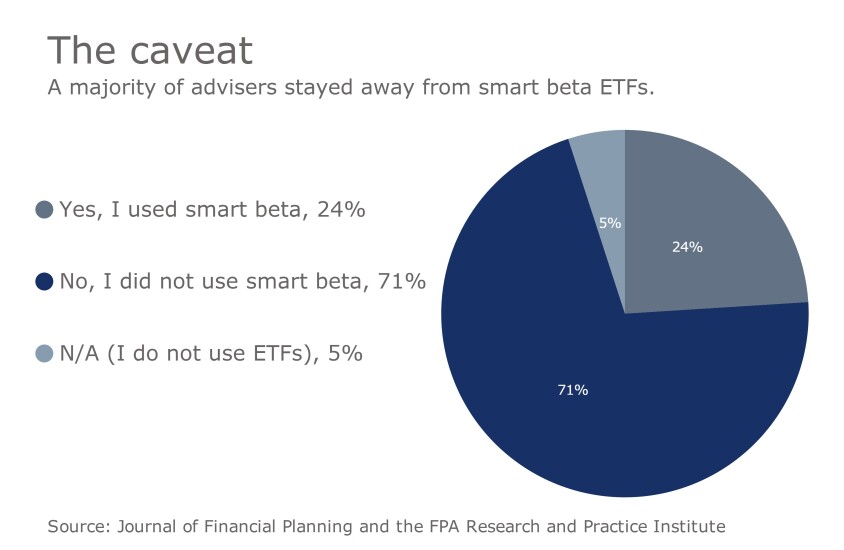

Dave Yeske, practitioner editor of the Journal of Financial Planning, attributes this to their more costly and risky nature, in addition to the fact that advisers recognize the strategies embedded in smart beta are nothing new.

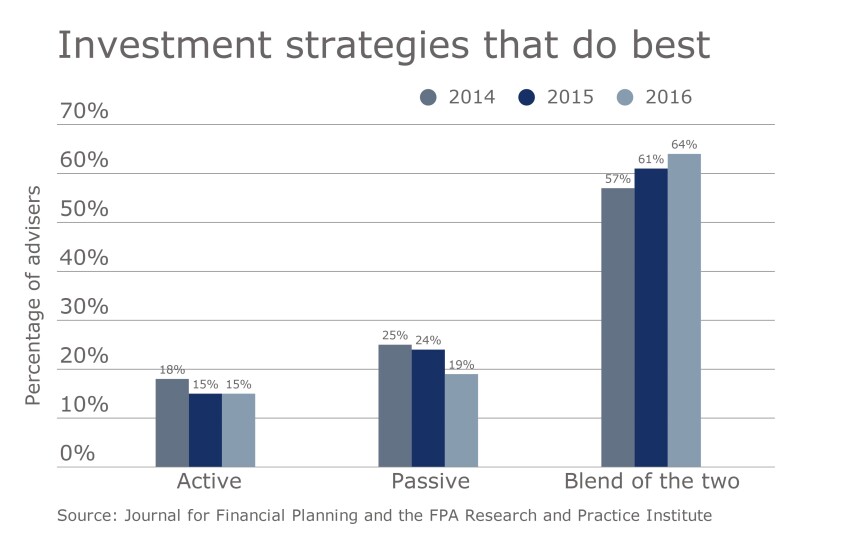

Striking the perfect balance

Economic factors drive asset rebalancing

Between last year and now, administrative factors such as costs saw the largest increase as a leading cause of portfolio reassessment.

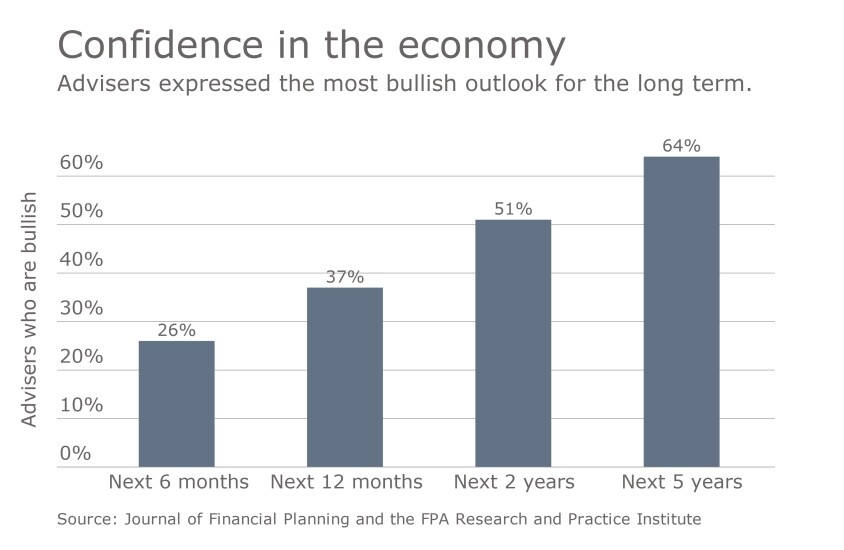

Uncertain now, hopeful for the future

For all timelines however, an average 41% of advisers are playing it safe by stating that they are neither bullish nor bearish.