By the Numbers: How the Big 10 Have Stumbled

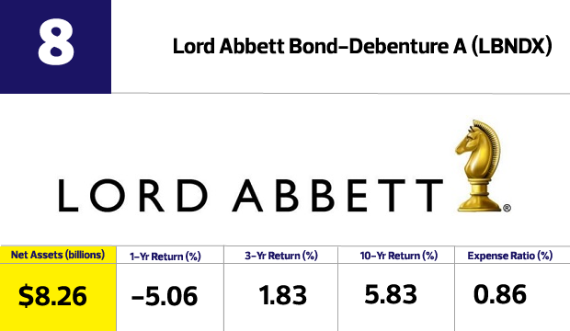

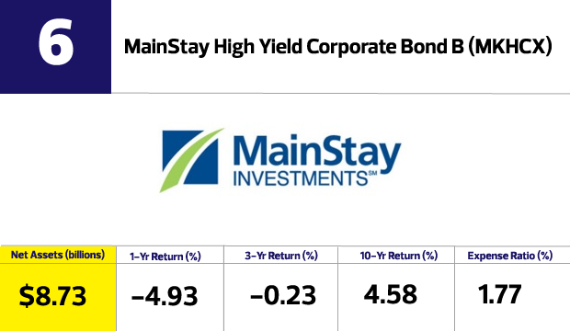

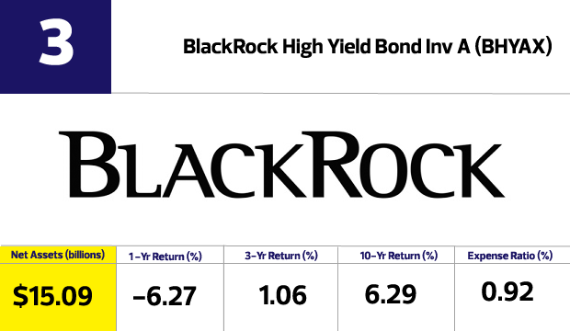

Once steadfast high-yield bond funds have stumbled the average 1-year return of the top 10 performers was -4.84%, Morningstar data shows. The same data shows that a decade ago, these funds had an average return of 5.95%.

Investors, though, can reap higher yields, as nearly 9% of the high-yield market now reports yields above 20% the most since the financial crisis, Bloomberg says. These high-yield percentages may not sustain themselves. Investment-grade bonds sold, meanwhile, soared to an "unprecedented" $1.3 trillion, according to Goldman Sachs.

Goldman analysts also note ETFs and mutual funds now own a record 25% of the corporate bond market, with ETFs comprising the minority at an estimated 3%.

"While the high-yield and investment-grade market has withstood significant mutual fund outflows (in 2014 for high-yield and in 2015 for investment grade) without directly causing sustained spread dislocation, redemption risk in the new bond architecture remains to be tested," according to a Goldman Sachs analyst.

Here, we have highlighted the largest 10 high-yield bond funds, which manage a combined $111 billion, by their year-to-date net assets.

Scroll through out slideshow or to view in a single-page version, click here.

By the Numbers: How the Big 10 Have Stumbled

By the Numbers: How the Big 10 Have Stumbled

By the Numbers: How the Big 10 Have Stumbled

By the Numbers: How the Big 10 Have Stumbled

By the Numbers: How the Big 10 Have Stumbled

By the Numbers: How the Big 10 Have Stumbled

By the Numbers: How the Big 10 Have Stumbled

By the Numbers: How the Big 10 Have Stumbled

By the Numbers: How the Big 10 Have Stumbled