Bonds: Top corporate funds of the past 3 years

We've ranked the following bond funds by three-year return figures. However, given the recent surge of foreign money, the one-year numbers are generally even higher. As usual, we also show the expense ratios for each fund. Since ETFs are part of our mix, expenses range from a few basis points (actually, one of them is zero) to about 1%.

Click through to see all the funds. All data are from Morningstar.

20. PIA BBB Bond

1-Yr. Return: 2.06%

3-Yr. Return: 2.44%

Expense Ratio: 0.15%

Fund assets (millions): $215

19. BMO TCH Corporate Income

1-Yr. Return: 1.52%

3-Yr. Return: 2.51%

Expense Ratio: 0.45%

Fund assets (millions): $200

18. Oppenheimer Corporate Bond

1-Yr. Return: 1.99%

3-Yr. Return: 2.58%

Expense Ratio: 1.00%

Fund assets (millions): $178

17. Thrivent Income

1-Yr. Return: 2.40%

3-Yr. Return: 2.61%

Expense Ratio: 0.77%

Fund assets (millions): $775

16. Calamos Total Return Bond

1-Yr. Return: 2.88%

3-Yr. Return: 2.63%

Expense Ratio: 0.90%

Fund assets (millions): $101

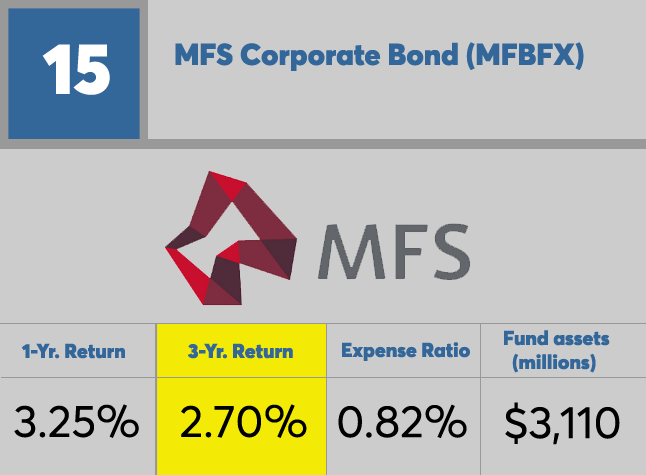

15. MFS Corporate Bond

1-Yr. Return: 3.25%

3-Yr. Return: 2.70%

Expense Ratio: 0.82%

Fund assets (millions): $3,110

14. JPMorgan Corporate Bond

1-Yr. Return: 3.78%

3-Yr. Return: 2.91%

Expense Ratio: 0.74%

Fund assets (millions): $1,993

13. PIMCO Investment Grade Corp Bd Instl

1-Yr. Return: 3.24%

3-Yr. Return: 2.96%

Expense Ratio: 0.50%

Fund assets (millions): $8,002

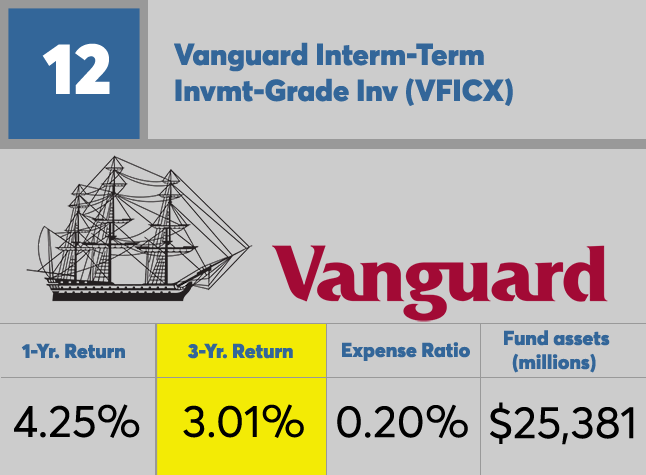

12. Vanguard Interm-Term Invmt-Grade Inv

1-Yr. Return: 4.25%

3-Yr. Return: 3.01%

Expense Ratio: 0.20%

Fund assets (millions): $25,381

11. T. Rowe Price Corporate Income

1-Yr. Return: 3.23%

3-Yr. Return: 3.06%

Expense Ratio: 0.62%

Fund assets (millions): $816

10. DFA Intermediate-Term Extnd Qlty

1-Yr. Return: 4.93%

3-Yr. Return: 3.18%

Expense Ratio: 0.22%

Fund assets (millions): $1,221

9. Invesco Corporate Bond

1-Yr. Return: 2.76%

3-Yr. Return: 3.28%

Expense Ratio: 0.90%

Fund assets (millions): $1,087

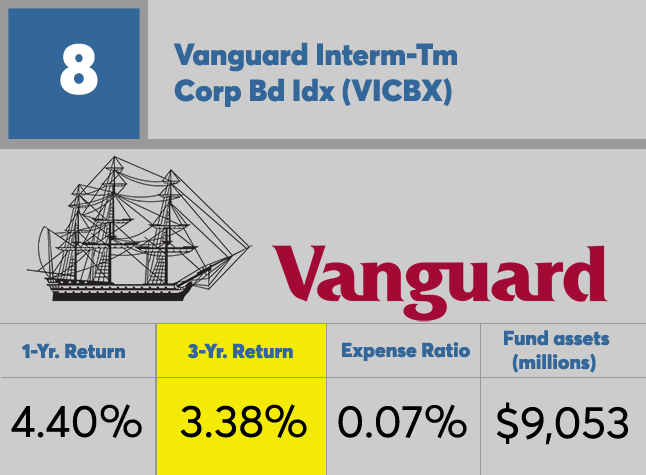

8. Vanguard Interm-Tm Corp Bd Idx

1-Yr. Return: 4.40%

3-Yr. Return: 3.38%

Expense Ratio: 0.07%

Fund assets (millions): $9,053

7. BlackRock Allocation Target Shrs

1-Yr. Return: 3.28%

3-Yr. Return: 3.39%

Expense Ratio: N/A

Fund assets (millions): $363

6. Western Asset Corporate Bond

1-Yr. Return: 2.64%

3-Yr. Return: 3.60%

Expense Ratio: 1.02%

Fund assets (millions): $361

5. Delaware Extended Duration Bond

1-Yr. Return: 4.04%

3-Yr. Return: 3.66%

Expense Ratio: 0.98%

Fund assets (millions): $620

4. Payden Corporate Bond

1-Yr. Return: 4.69%

3-Yr. Return: 3.98%

Expense Ratio: 0.65%

Fund assets (millions): $116

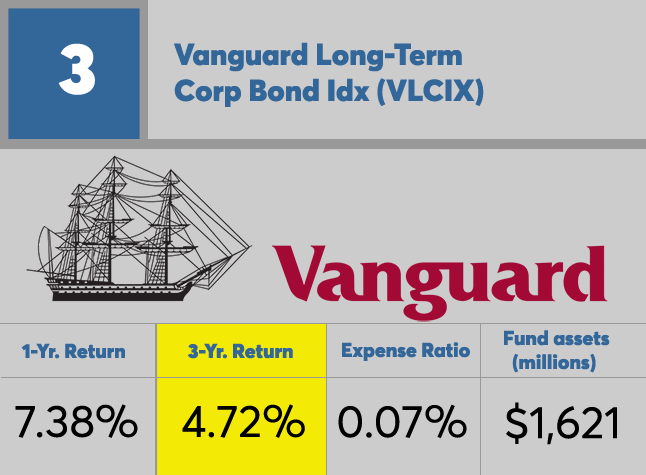

3. Vanguard Long-Term Corp Bond Idx

1-Yr. Return: 7.38%

3-Yr. Return: 4.72%

Expense Ratio: 0.07%

Fund assets (millions): $1,621

2. SEI Long Duration Credit

1-Yr. Return: 8.79%

3-Yr. Return: 5.29%

Expense Ratio: 0.15%

Fund assets (millions): $3,271

1. Vanguard Long-Term Investment-Grade Inv

1-Yr. Return: 9.79%

3-Yr. Return: 5.61%

Expense Ratio: 0.21%

Fund assets (millions): $14,894