Biggest RIA M&A Deals Set Stage for Active 2016

"Advisory firms, consolidators and affiliates of consolidators are likely to be the most aggressive acquirers," says David DeVoe, who heads DeVoe & Co., a San Francisco-based M&A consulting firm. "I expect to see more acquisitions like Aspirants' acquisition of Hokanson Associates, where a large RIA is merged into an even bigger multi-billion dollar firm."

Indeed, two large RIAs merged in the first week of 2016: Pathstone Family Office absorbed Federal Street Advisors to form a new wealth management powerhouse with nearly $6 billion in assets under management, Pathstone Federal Street.

Private equity firms are also expected to be active RIA buyers in 2016.

“They see the average RIA growing at 15% plus in a minimally capital intensive business," says investment banker Elizabeth Nesvold, managing partner at New York-based Silver Lane Advisors.

And look for tech expertise to also spur deals.

"A key driver for M&A deals, especially at a regional level, is a need for new technology by acquiring firms," according to David Selig, CEO of Advice Dynamic Partners, a San Francisco-based consulting firm specializing in mergers and acquisitions.

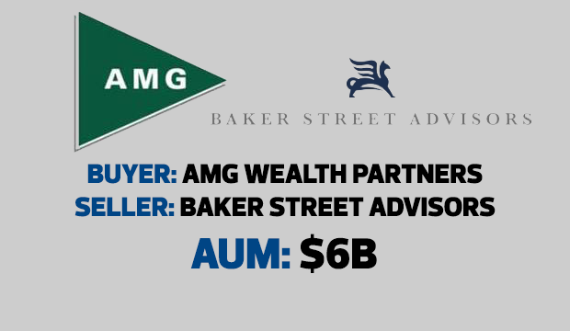

Please click on the arrow above to see the deals that topped the market in 2015. Rankings and data provided by DeVoe & Co. --Charles Paikert

Biggest RIA M&A Deals Set Stage for Active 2016

Biggest RIA M&A Deals Set Stage for Active 2016

Biggest RIA M&A Deals Set Stage for Active 2016

Biggest RIA M&A Deals Set Stage for Active 2016

Biggest RIA M&A Deals Set Stage for Active 2016

Biggest RIA M&A Deals Set Stage for Active 2016

Biggest RIA M&A Deals Set Stage for Active 2016

Biggest RIA M&A Deals Set Stage for Active 2016

Biggest RIA M&A Deals Set Stage for Active 2016